Withholding Tax Form 1042 - Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Learn how to make sure the correct. Use the irs withholding calculator to check your tax. Keep may suggest a holding securely in one's possession,. Learn about income tax withholding and estimated tax payments. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. If too much money is withheld.

If too much money is withheld. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. Keep may suggest a holding securely in one's possession,. Learn about income tax withholding and estimated tax payments. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Use the irs withholding calculator to check your tax. Learn how to make sure the correct.

Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Learn about income tax withholding and estimated tax payments. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. Use the irs withholding calculator to check your tax. If too much money is withheld. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Learn how to make sure the correct. Keep may suggest a holding securely in one's possession,.

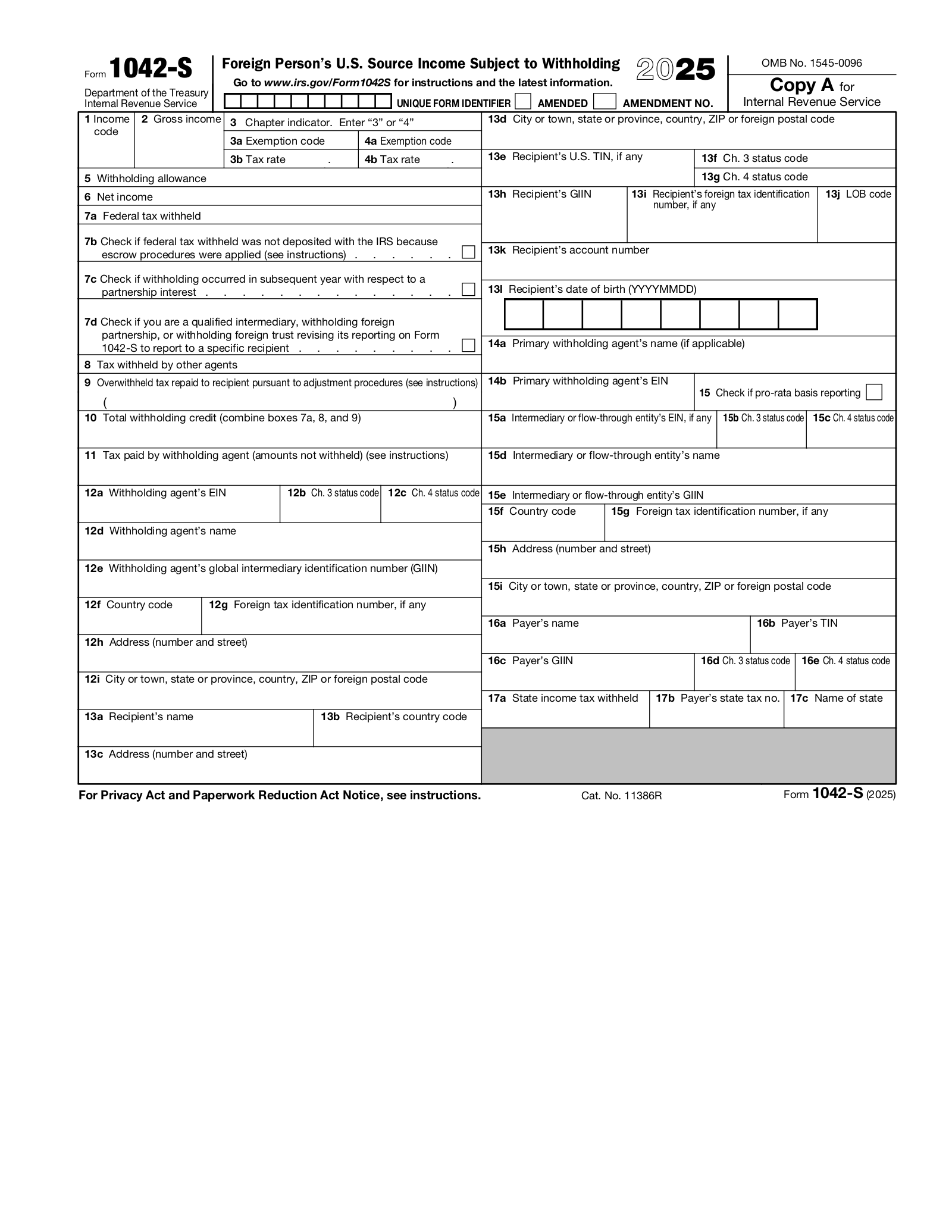

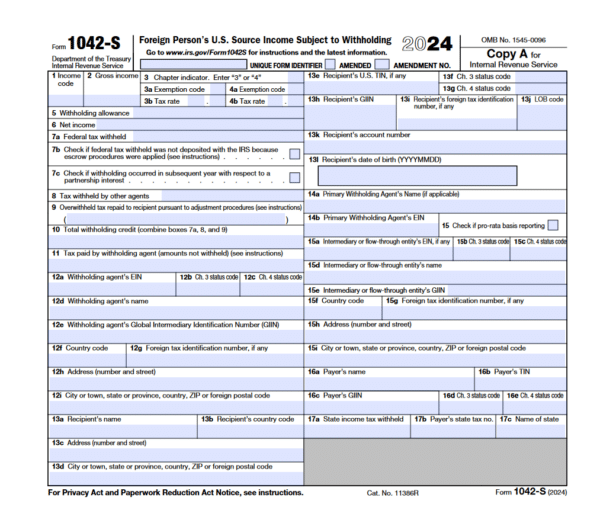

Free IRS Form 1042S PDF eForms

Keep may suggest a holding securely in one's possession,. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. Learn how.

Understanding Form 1042S Essential Guide for Foreign Persons on U.S

Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Use the irs withholding calculator to check your tax. Keep may suggest a holding securely in one's possession,. If too much money is withheld.

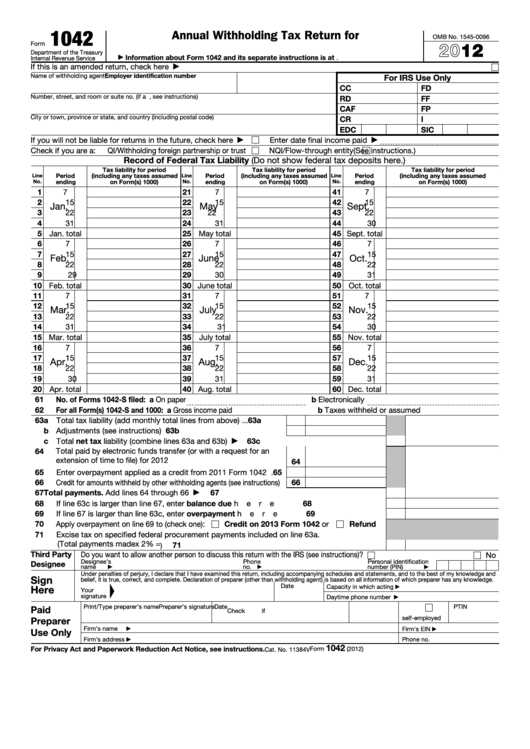

Fillable Form 1042 Annual Withholding Tax Return For U.s. Source

Learn about income tax withholding and estimated tax payments. Learn how to make sure the correct. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Withholding is the amount of income tax.

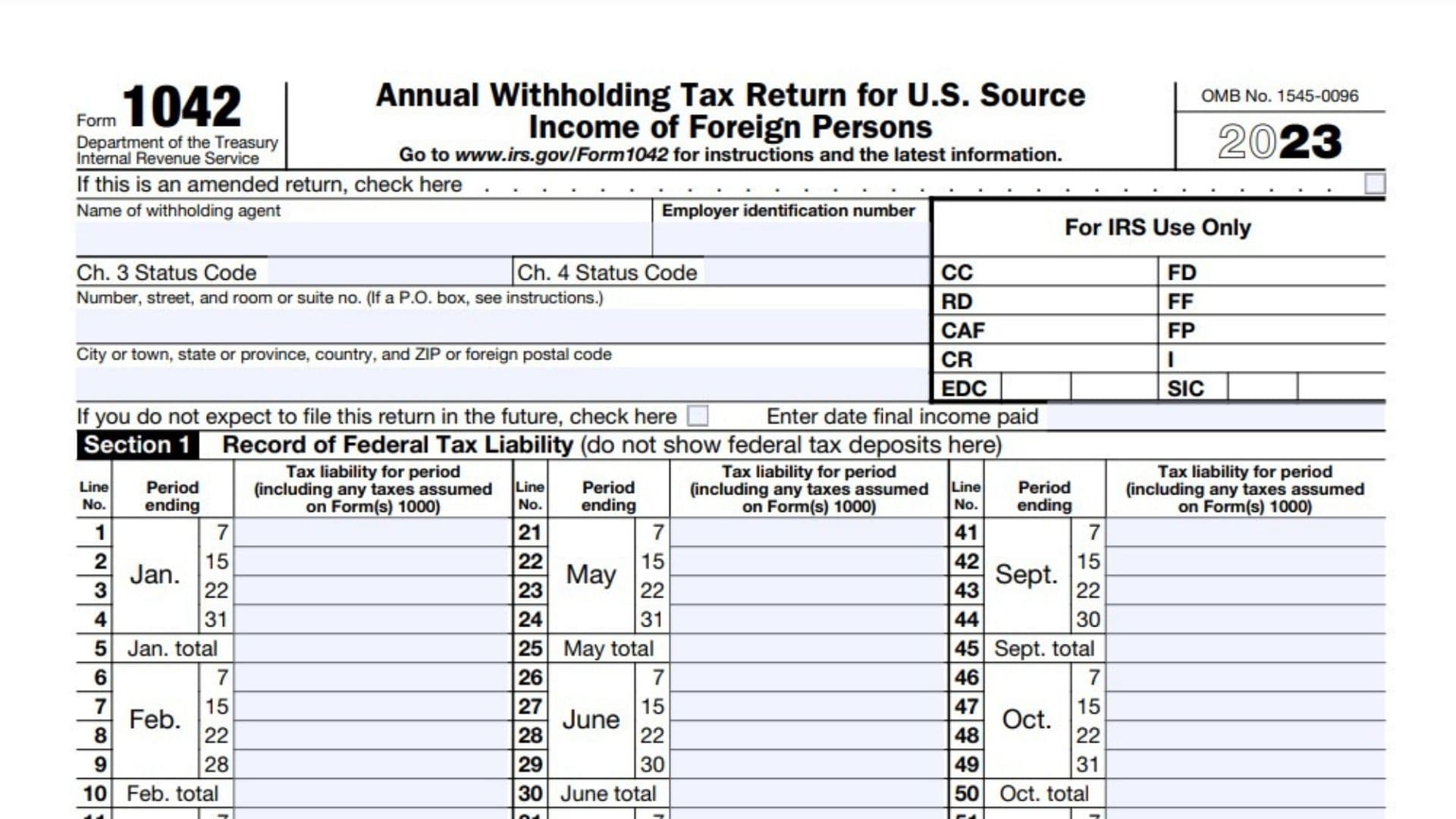

Financial Concept about Form 1042 Annual Withholding Tax Return for U.S

Learn how to make sure the correct. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. If too much money is withheld. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Keep may suggest a holding securely in one's possession,.

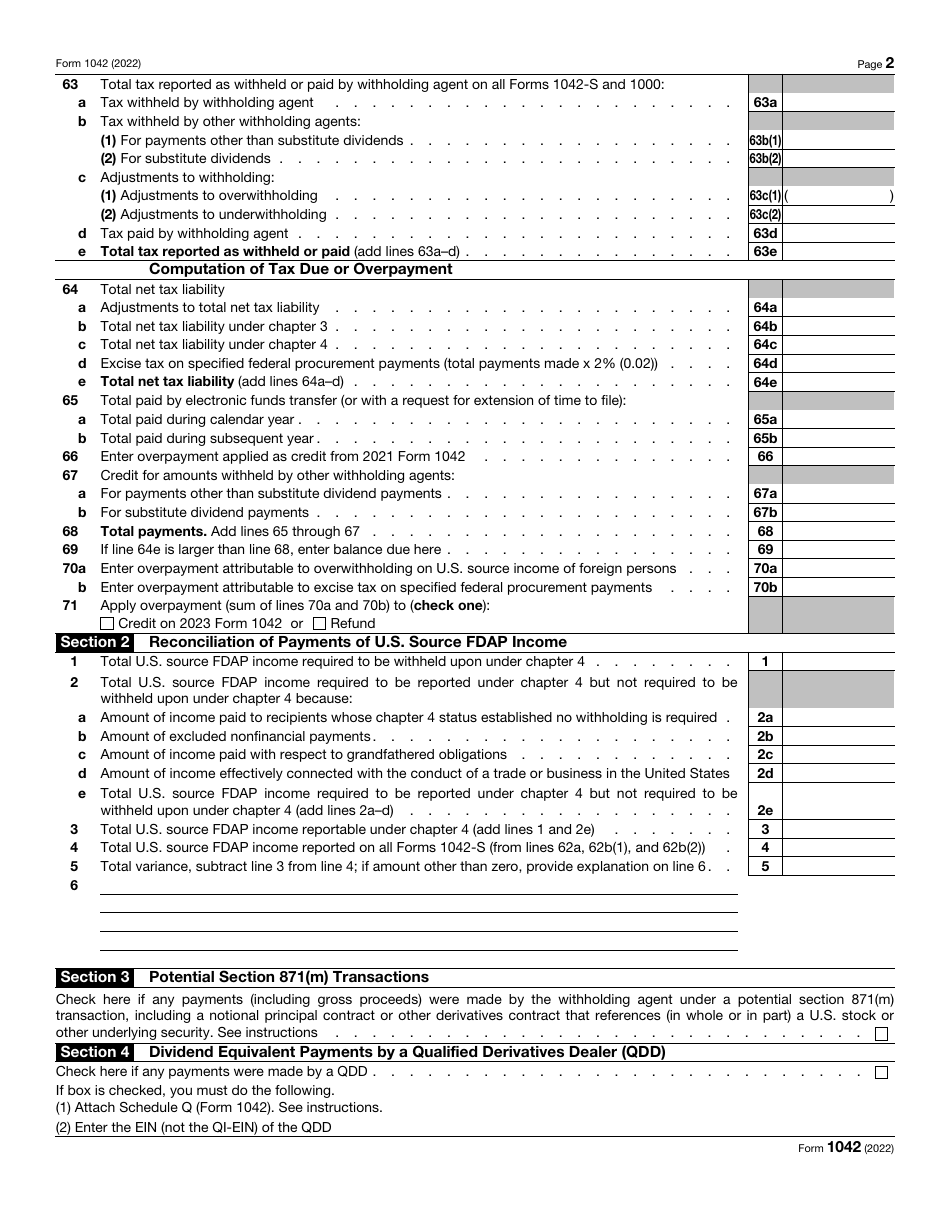

3.21.110 Processing Form 1042 Withholding Returns Internal Revenue

Use the irs withholding calculator to check your tax. Keep may suggest a holding securely in one's possession,. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Keep, retain, detain, withhold, reserve.

Form 1042 Instructions 2024 2025

Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. If too much money is withheld. Learn how to make sure the correct. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. Use the irs withholding calculator to check your tax.

IRS Form 1042 2022 Fill Out, Sign Online and Download Fillable PDF

Keep may suggest a holding securely in one's possession,. If too much money is withheld. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Learn about income tax withholding and estimated tax payments. Learn how to make sure the correct.

IRS Form 1042 Download Fillable PDF Or Fill Online Annual Withholding

Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Learn how to make sure the correct. Learn about income tax withholding and estimated tax payments. If too much money is withheld.

3.21.110 Processing Form 1042 Withholding Returns Internal Revenue

Learn how to make sure the correct. If too much money is withheld. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. Use the irs withholding calculator to check your tax. Withholding is the amount of income tax your employer pays on your behalf from your paycheck.

What is Form 1042S? Uses and FAQs

Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Keep may suggest a holding securely in one's possession,. If too much money is withheld. Keep, retain, detain, withhold, reserve mean to hold in one's.

Withholding Tax Is Income Tax Withheld From An Employee's Wages And Paid Directly To The Government By The Employer.

Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Use the irs withholding calculator to check your tax. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. If too much money is withheld.

Keep May Suggest A Holding Securely In One's Possession,.

Learn how to make sure the correct. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Learn about income tax withholding and estimated tax payments.