Withholding Form For Pension - If too much money is withheld. Learn how to make sure the correct. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. Learn about income tax withholding and estimated tax payments. Use the irs withholding calculator to check your tax. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Keep may suggest a holding securely in one's possession,. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Withholding is the amount of income tax your employer pays on your behalf from your paycheck.

Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Keep may suggest a holding securely in one's possession,. Learn about income tax withholding and estimated tax payments. Learn how to make sure the correct. Use the irs withholding calculator to check your tax. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. If too much money is withheld. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer.

Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. If too much money is withheld. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Keep may suggest a holding securely in one's possession,. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Learn how to make sure the correct. Use the irs withholding calculator to check your tax. Learn about income tax withholding and estimated tax payments.

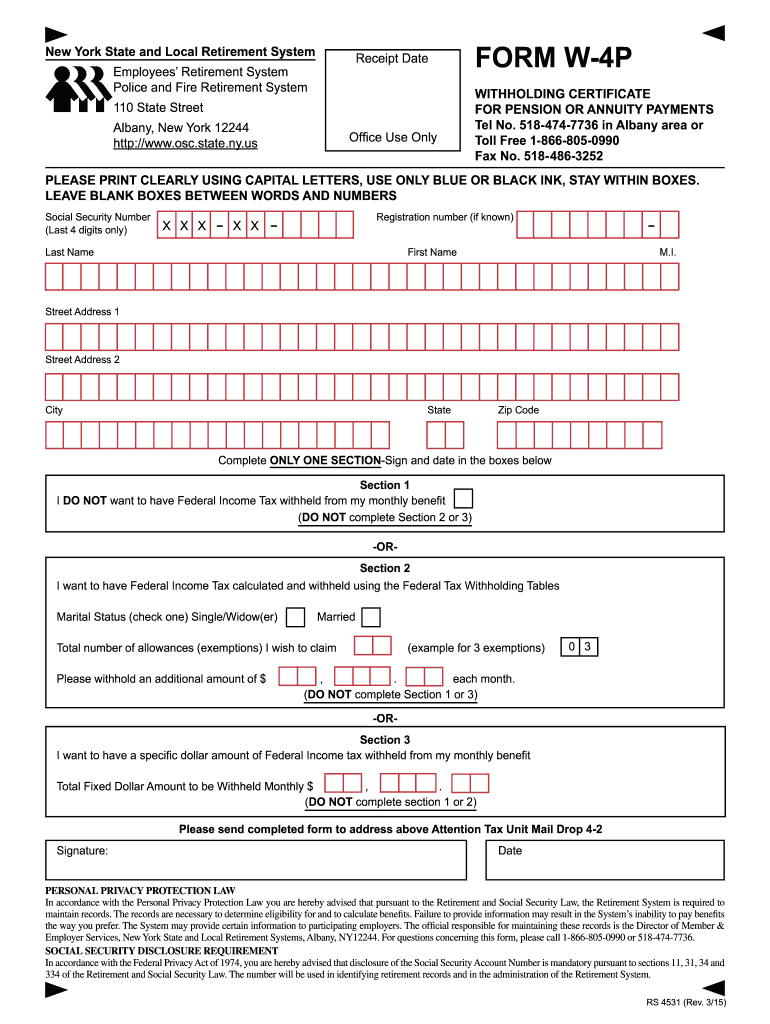

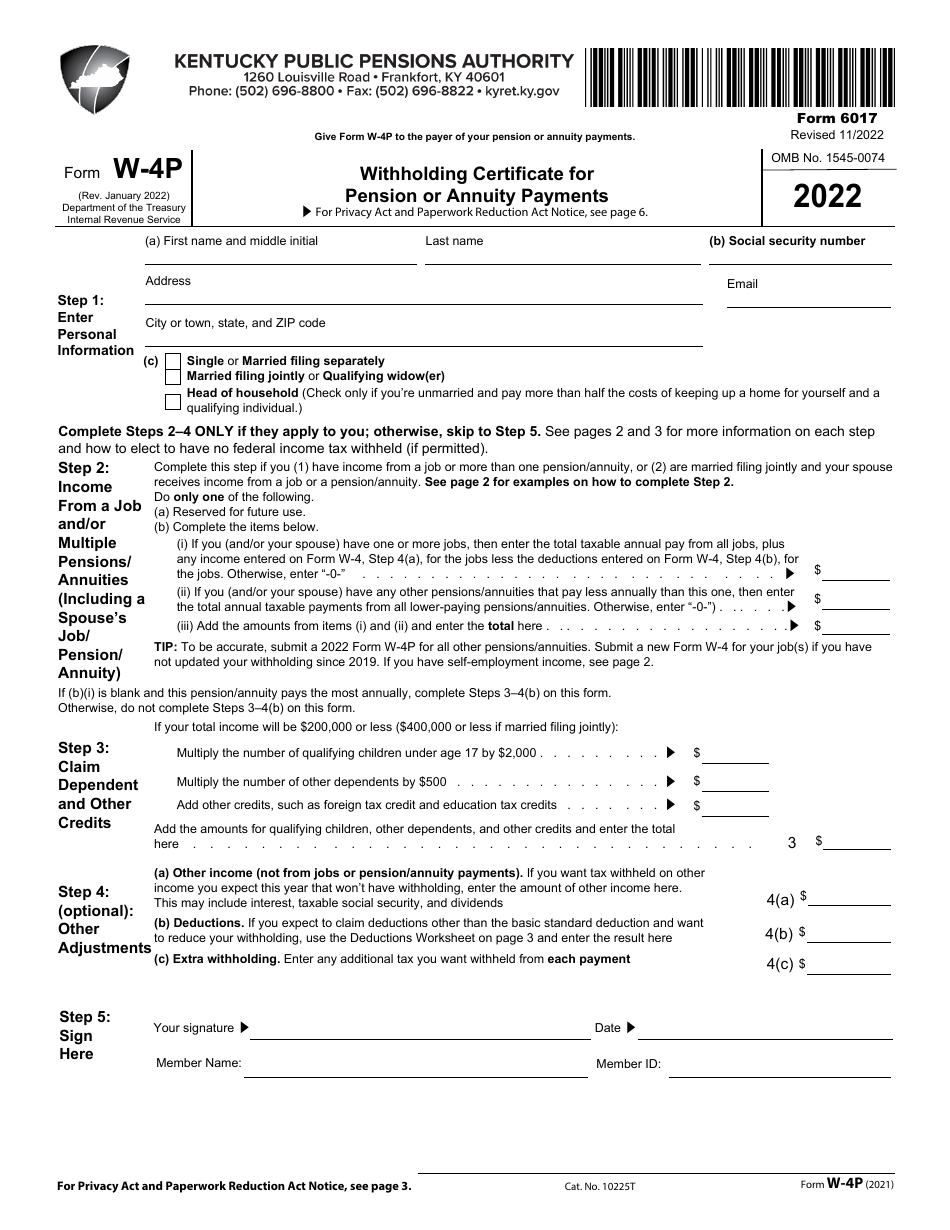

Fillable Online W4P Form Withholding Certificate for Pension or

Use the irs withholding calculator to check your tax. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. Learn how to make sure the correct. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Withholding tax is tax your employer withholds from your paycheck and sends to.

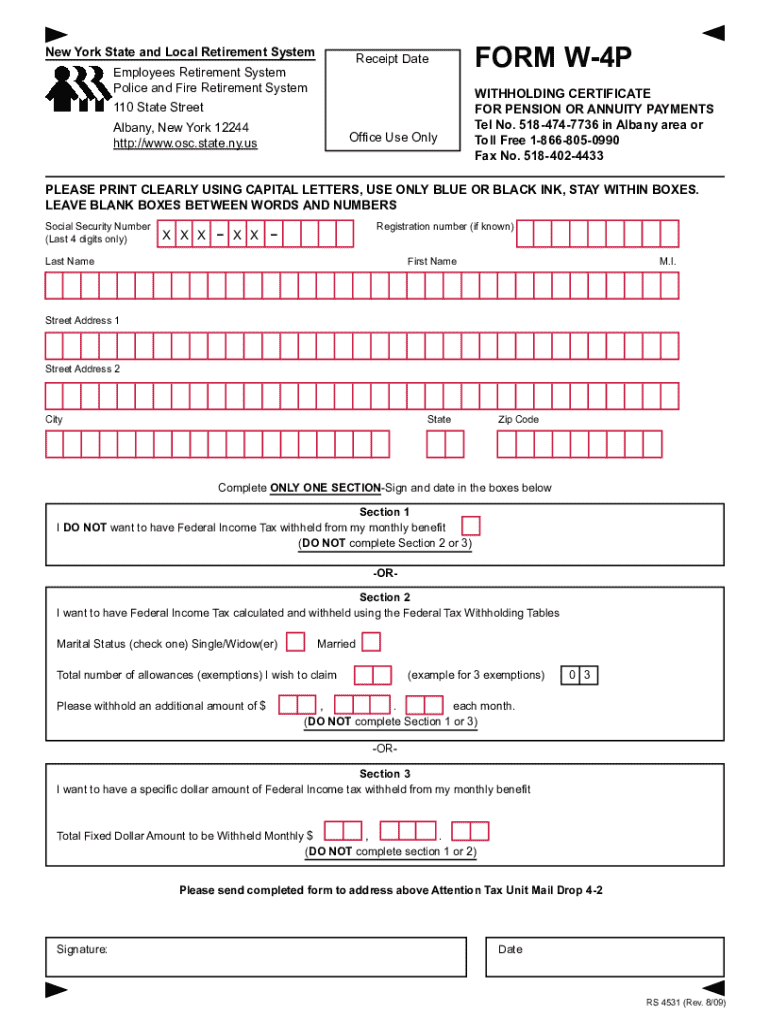

Fillable Online Form W4P, Withholding Certificate for Pension or

If too much money is withheld. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. Use the irs withholding calculator to check your tax. Withholding tax is tax your employer withholds from your paycheck and.

State Tax Withholding Form Pension Fund

Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Learn about income tax withholding and estimated tax payments. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Keep may suggest a holding securely in one's possession,. Withholding is the amount of.

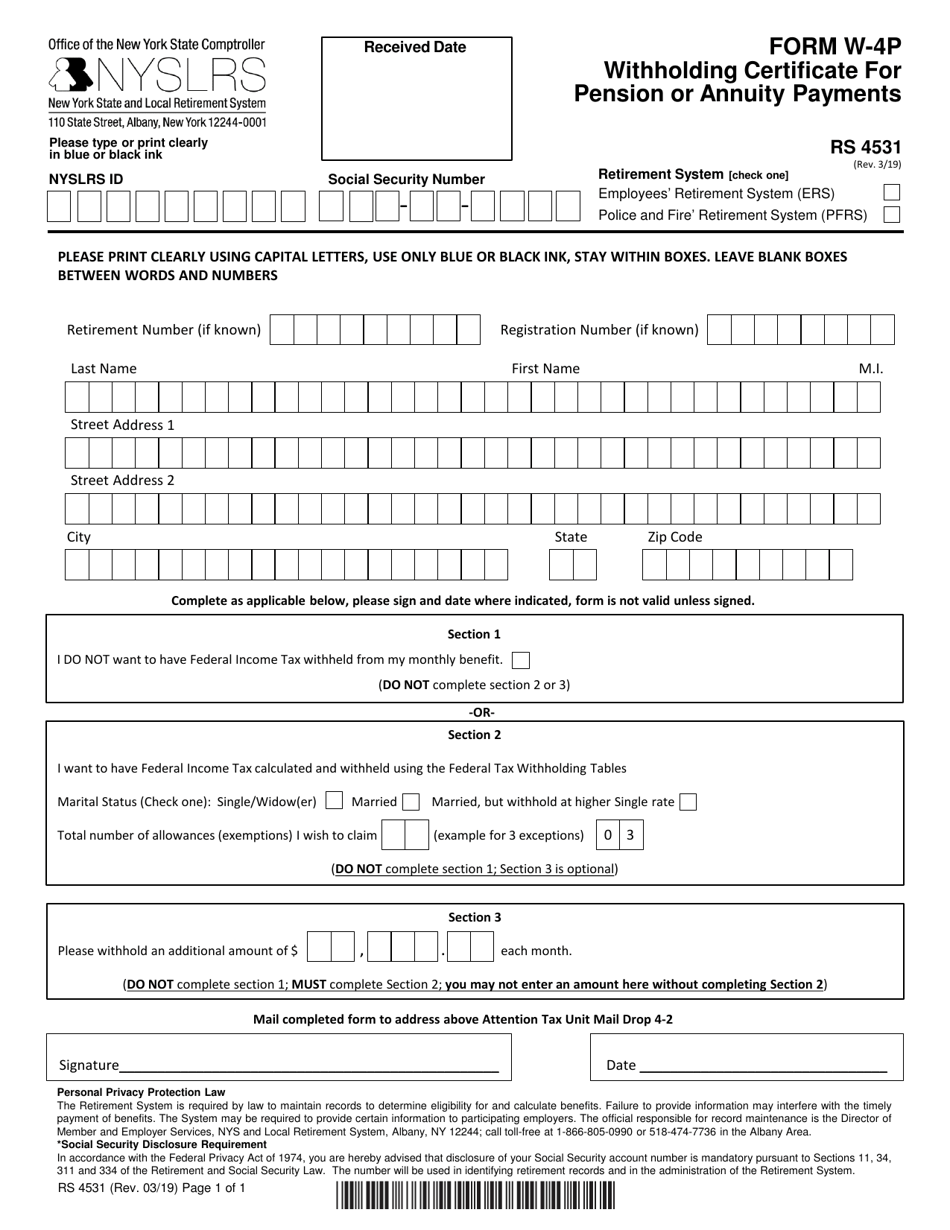

Fillable Online FORM W4P Withholding Certificate For Pension or

Learn about income tax withholding and estimated tax payments. If too much money is withheld. Use the irs withholding calculator to check your tax. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Keep may suggest a holding securely in one's possession,.

Withholding Certificate for Pension or Annuity Payments Free Download

Use the irs withholding calculator to check your tax. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. If too much money is withheld. Learn about income tax withholding and estimated tax payments. Withholding is the amount of income tax your employer pays on your behalf from your paycheck.

2020 Form W4P. Withholding Certificate For Pension Or Annuity Payments

Learn how to make sure the correct. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Keep may suggest a holding securely in one's possession,. If too much money is withheld. Use the irs withholding calculator to check your tax.

Fillable Online Form W4P Withholding Certificate for Pension or

Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Use the irs withholding calculator to check your tax. If too.

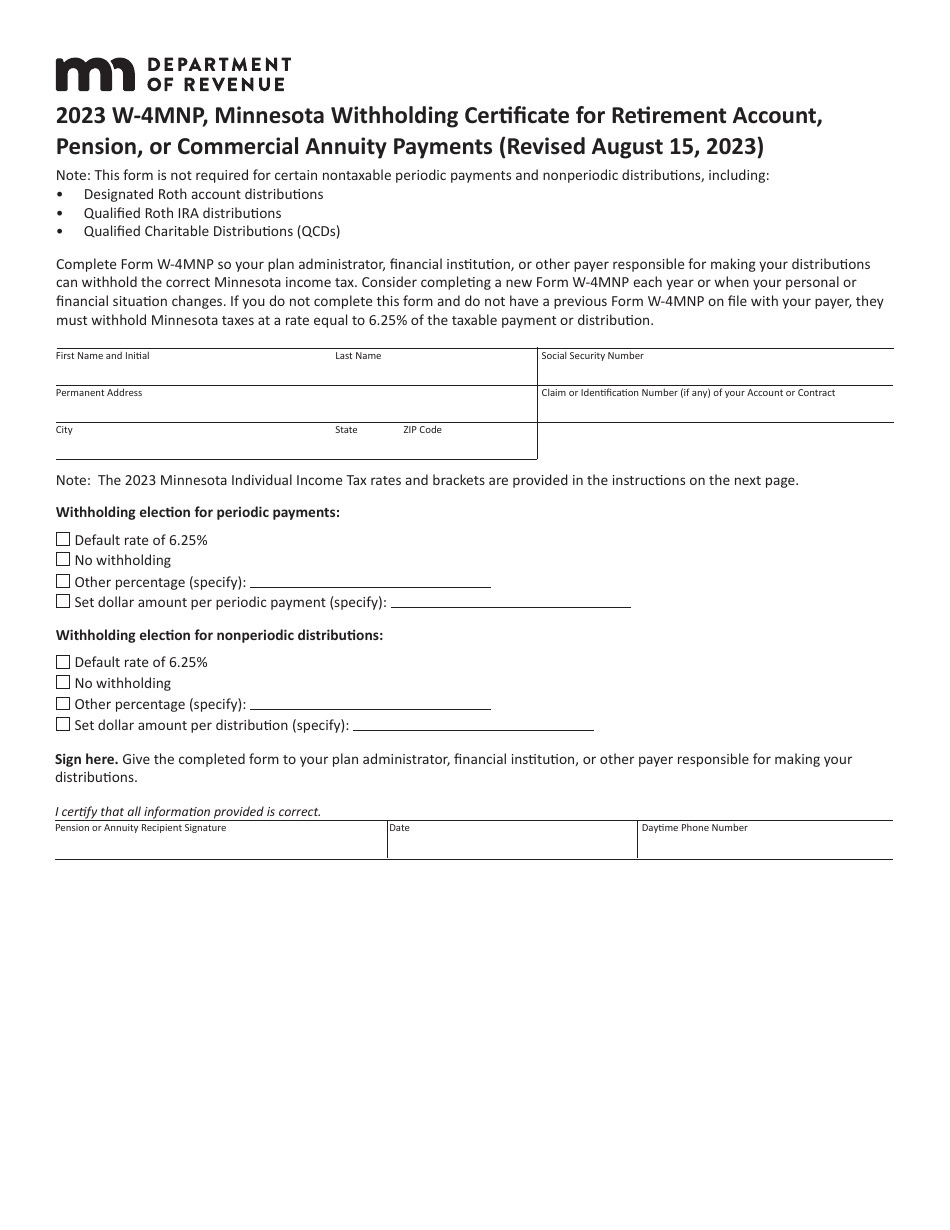

Form W4MNP Download Fillable PDF or Fill Online Minnesota Withholding

Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Keep may suggest a holding securely in one's possession,. Use the irs withholding calculator to check your tax. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Keep, retain, detain, withhold, reserve mean to.

Fillable W 4p Form Printable Printable Forms Free Online

Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Learn about income tax withholding and estimated tax payments. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. Learn how to make sure the correct. Withholding tax is income tax withheld from an employee's wages and paid directly.

Form 6017 (IRS Form W4P) 2022 Fill Out, Sign Online and Download

Keep may suggest a holding securely in one's possession,. Learn how to make sure the correct. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. If too much money is withheld. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control.

Use The Irs Withholding Calculator To Check Your Tax.

Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer. Keep, retain, detain, withhold, reserve mean to hold in one's possession or under one's control. If too much money is withheld. Withholding is the amount of income tax your employer pays on your behalf from your paycheck.

Withholding Tax Is Tax Your Employer Withholds From Your Paycheck And Sends To The Irs On Your Behalf.

Learn how to make sure the correct. Keep may suggest a holding securely in one's possession,. Learn about income tax withholding and estimated tax payments.