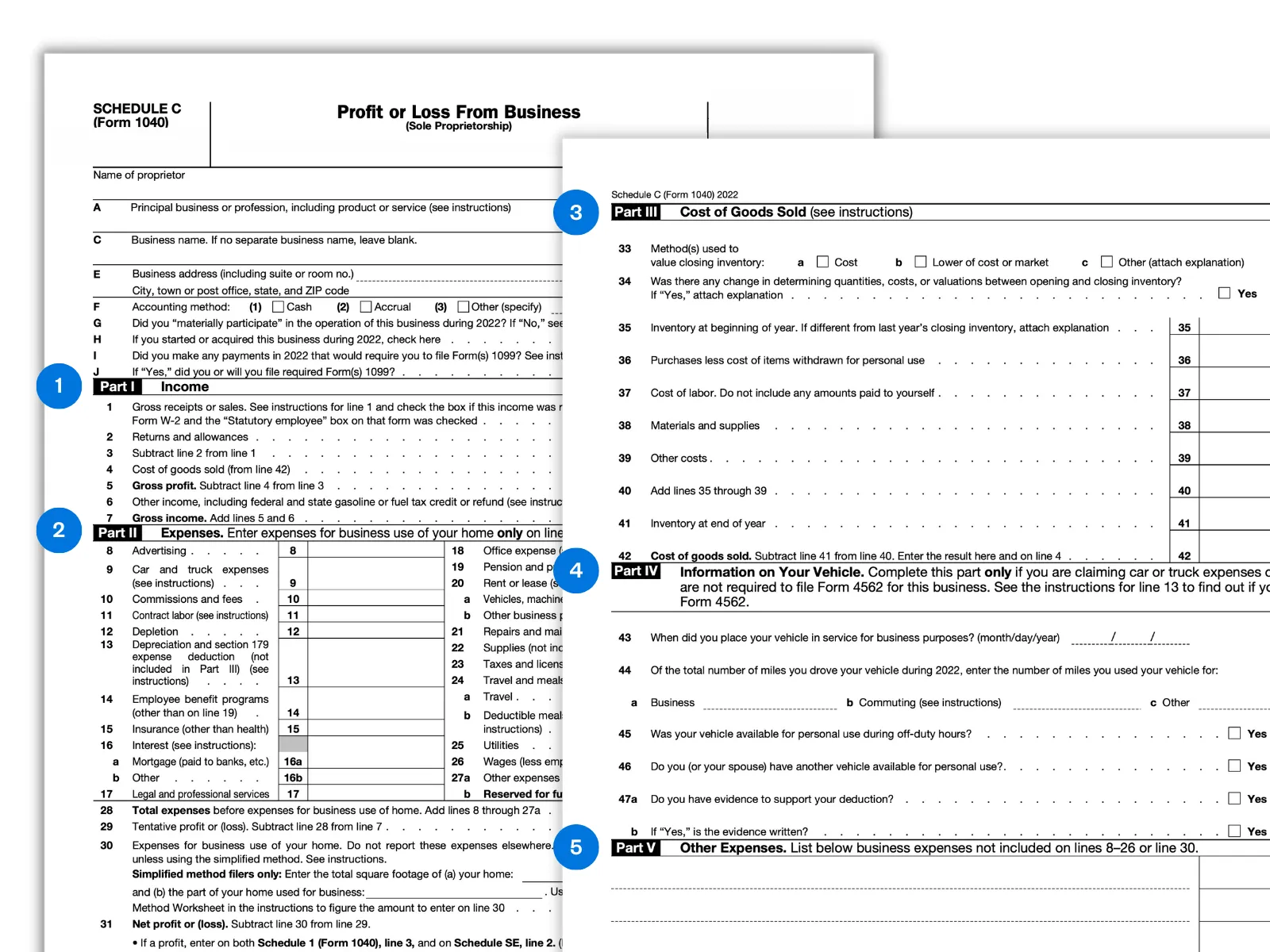

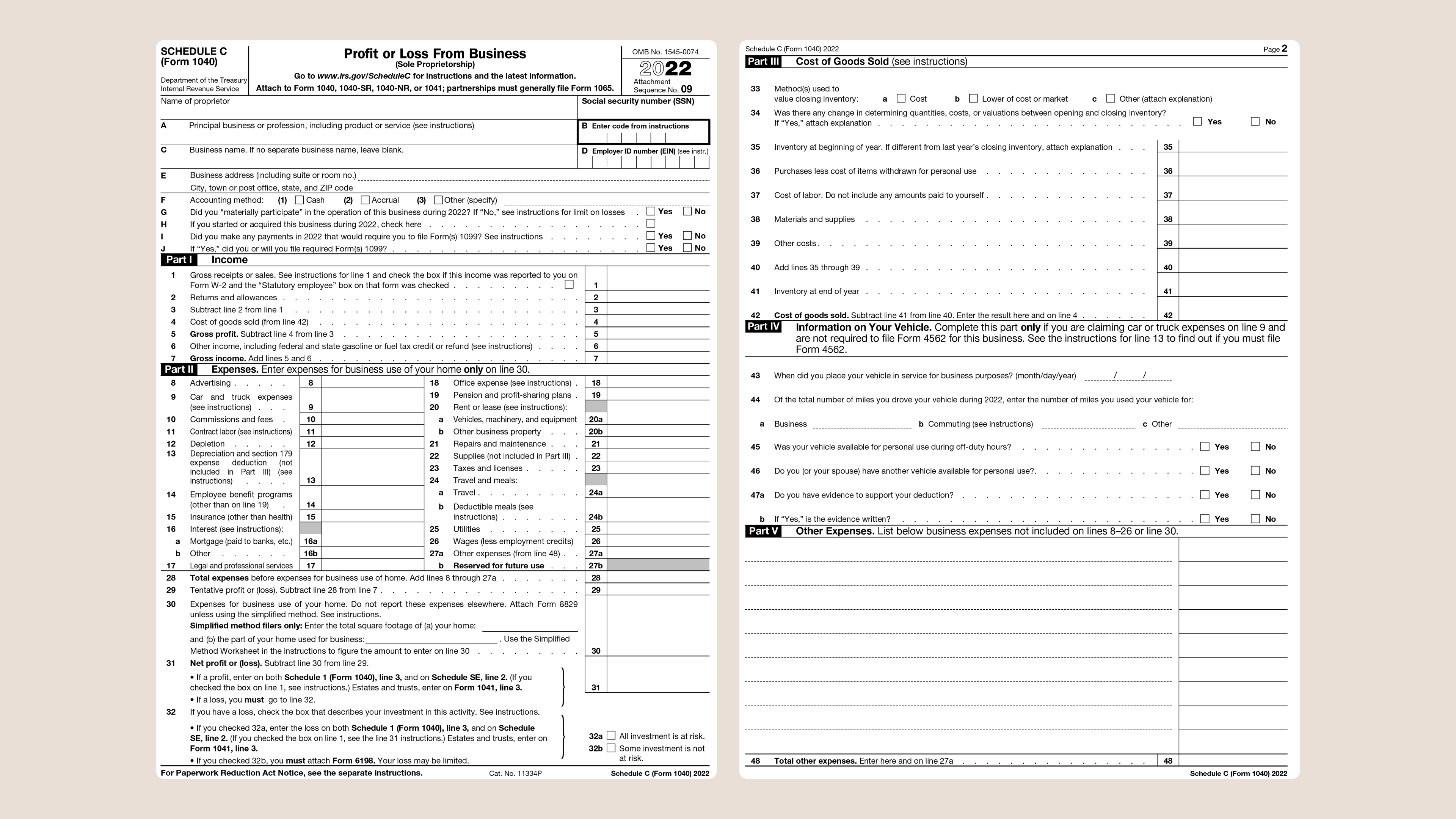

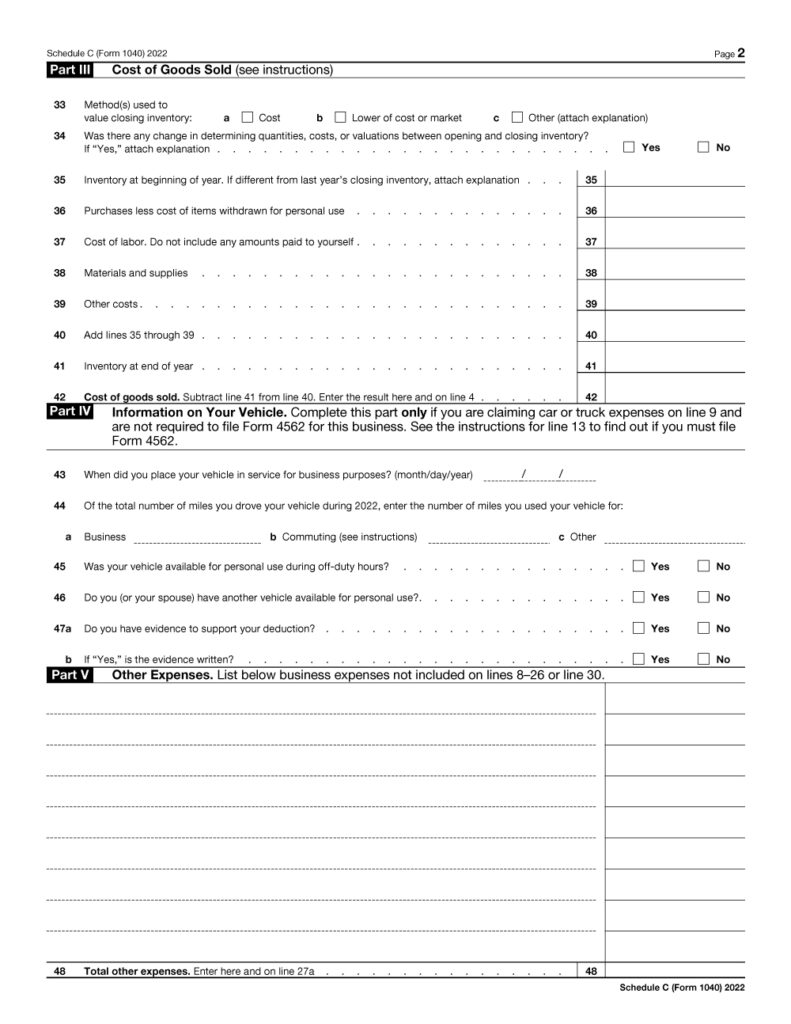

What Is Schedule C Tax Form - Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker,. Schedule c (form 1040), profit or loss from business, is the irs tax form used by sole proprietors and certain single. You fill out schedule c at tax time and attach it to. Irs schedule c is a tax form for reporting profit or loss from a business.

Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Irs schedule c is a tax form for reporting profit or loss from a business. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker,. Schedule c (form 1040), profit or loss from business, is the irs tax form used by sole proprietors and certain single. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. You fill out schedule c at tax time and attach it to.

Irs schedule c is a tax form for reporting profit or loss from a business. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker,. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. You fill out schedule c at tax time and attach it to. Schedule c (form 1040), profit or loss from business, is the irs tax form used by sole proprietors and certain single.

What is an IRS Schedule C Form? What is 1040 Schedule C? (Everything

You fill out schedule c at tax time and attach it to. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. Irs schedule c is a tax form for reporting profit or loss from a business. Irs schedule c, profit or loss from business, is.

Schedule C Instructions How to Fill Out Form 1040 Excel Capital

Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker,. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. Irs schedule c is a tax form for reporting profit or loss from a.

What is an IRS Schedule C Form? What is 1040 Schedule C? (Everything

Schedule c (form 1040), profit or loss from business, is the irs tax form used by sole proprietors and certain single. Irs schedule c is a tax form for reporting profit or loss from a business. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker,. Information about.

Schedule C Tax Form Who Needs To File & How To Do It

Schedule c (form 1040), profit or loss from business, is the irs tax form used by sole proprietors and certain single. Irs schedule c is a tax form for reporting profit or loss from a business. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for.

Who's required to fill out a Schedule C IRS form?

You fill out schedule c at tax time and attach it to. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or.

Understanding the Schedule C Tax Form

Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker,. You fill out schedule c at tax time and attach it to. Schedule c (form 1040), profit or loss from business, is the irs tax form used by sole proprietors and certain single. Irs schedule c is a.

A Friendly Guide to Schedule C Tax Forms (U.S.) FreshBooks Blog

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. Irs schedule c is a tax form for reporting profit or loss from a business. You fill out schedule c at tax time and attach it to. Profit or loss from business reports how much money.

Schedule C (Form 1040) 2023 Instructions

You fill out schedule c at tax time and attach it to. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Schedule c (form 1040), profit or loss from business, is the irs tax form used by sole proprietors and certain single. Information.

What Is Schedule C of Form 1040?

Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Schedule c (form 1040), profit or loss from business, is the irs tax form used by sole proprietors and certain single. Information about schedule c (form 1040), profit or loss from business, used to.

FREE 9+ Sample Schedule C Forms in PDF MS Word

You fill out schedule c at tax time and attach it to. Schedule c (form 1040), profit or loss from business, is the irs tax form used by sole proprietors and certain single. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker,. Information about schedule c (form.

You Fill Out Schedule C At Tax Time And Attach It To.

Schedule c (form 1040), profit or loss from business, is the irs tax form used by sole proprietors and certain single. Irs schedule c is a tax form for reporting profit or loss from a business. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker,. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)