What Is Form 6251 - Simplified ftc election must be entered. I am asked for form 6251, line 4 alternative minimum taxable income, i don't have a 6251 from 2021. The referenced form in turbotax is schedule d, the box titled 2021 capital loss information smart worksheet. I then have to fill out the. In my federal review, i get the following question: Form 6251 alternative minimum tax is supported by turbotax online deluxe and higher versions. While using the installed version of 2023 turbo tax home & business, it may ask the user to verify that line 4 of 2022 form 6251 is. If you are not subject to the alternative minimum tax,. And should i follow what turbo.

I am asked for form 6251, line 4 alternative minimum taxable income, i don't have a 6251 from 2021. Simplified ftc election must be entered. While using the installed version of 2023 turbo tax home & business, it may ask the user to verify that line 4 of 2022 form 6251 is. And should i follow what turbo. In my federal review, i get the following question: The referenced form in turbotax is schedule d, the box titled 2021 capital loss information smart worksheet. I then have to fill out the. Form 6251 alternative minimum tax is supported by turbotax online deluxe and higher versions. If you are not subject to the alternative minimum tax,.

Form 6251 alternative minimum tax is supported by turbotax online deluxe and higher versions. The referenced form in turbotax is schedule d, the box titled 2021 capital loss information smart worksheet. Simplified ftc election must be entered. I then have to fill out the. And should i follow what turbo. While using the installed version of 2023 turbo tax home & business, it may ask the user to verify that line 4 of 2022 form 6251 is. In my federal review, i get the following question: I am asked for form 6251, line 4 alternative minimum taxable income, i don't have a 6251 from 2021. If you are not subject to the alternative minimum tax,.

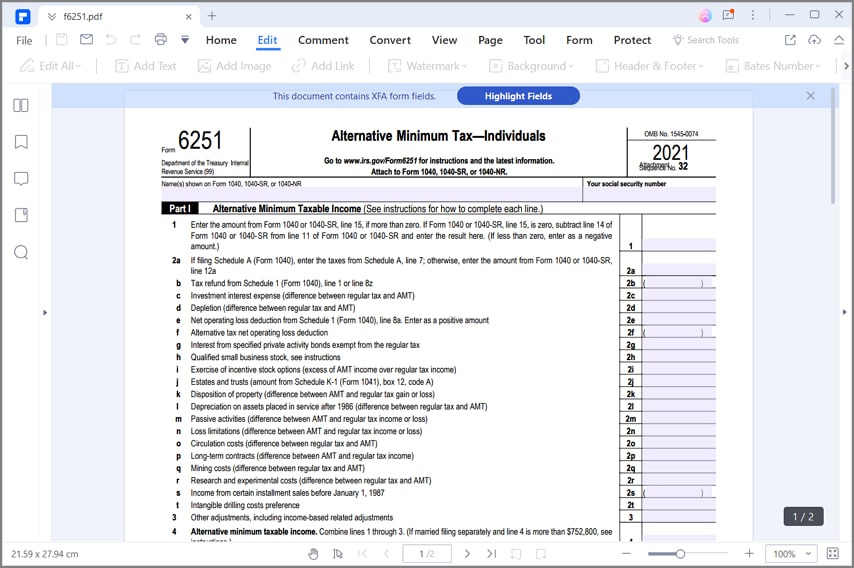

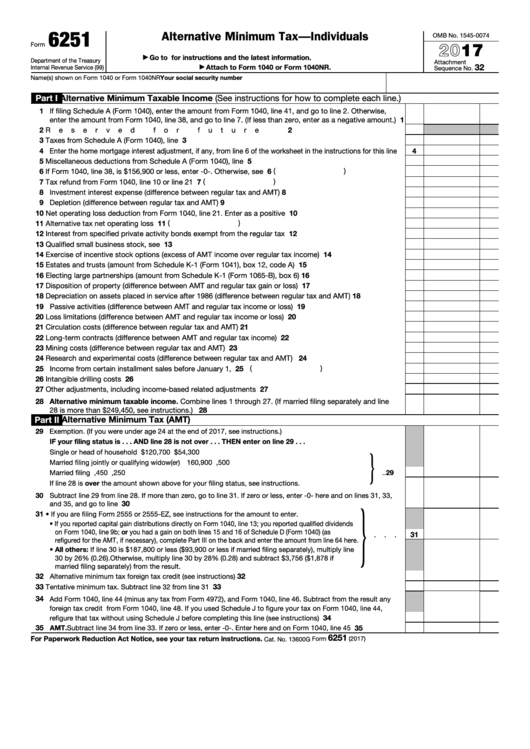

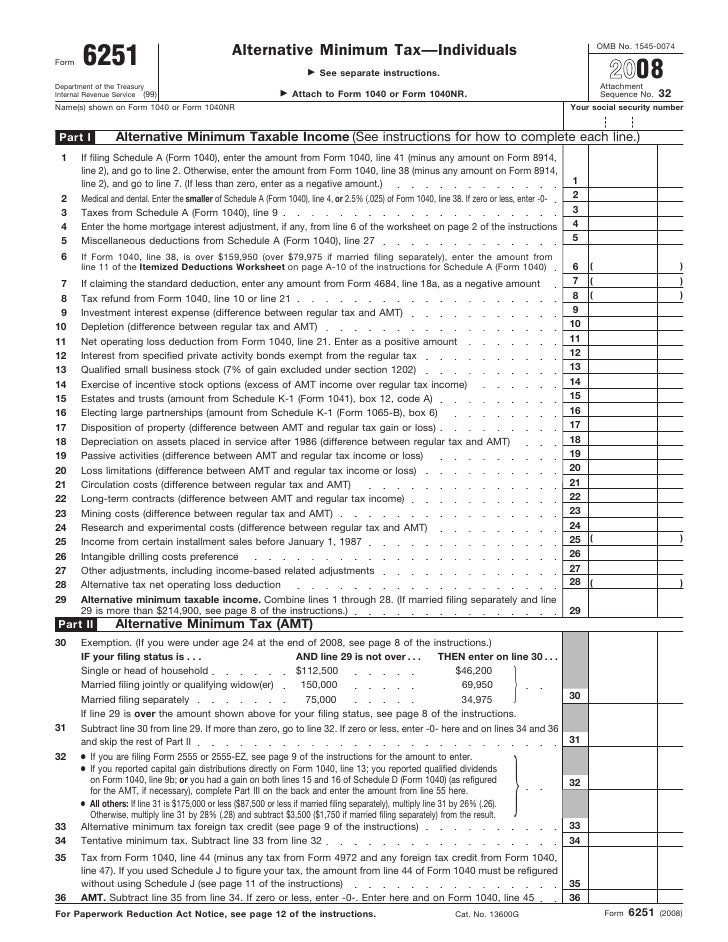

for How to Fill in IRS Form 6251

In my federal review, i get the following question: Form 6251 alternative minimum tax is supported by turbotax online deluxe and higher versions. Simplified ftc election must be entered. If you are not subject to the alternative minimum tax,. While using the installed version of 2023 turbo tax home & business, it may ask the user to verify that line.

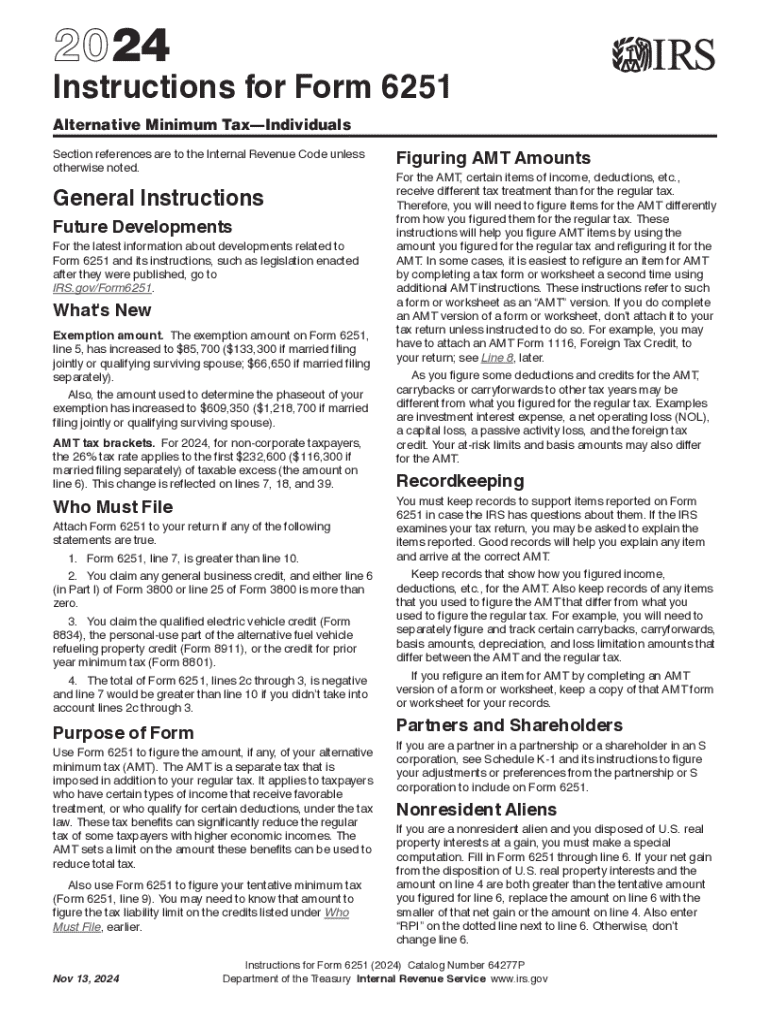

Form 6251 2024 2025

If you are not subject to the alternative minimum tax,. And should i follow what turbo. Form 6251 alternative minimum tax is supported by turbotax online deluxe and higher versions. Simplified ftc election must be entered. The referenced form in turbotax is schedule d, the box titled 2021 capital loss information smart worksheet.

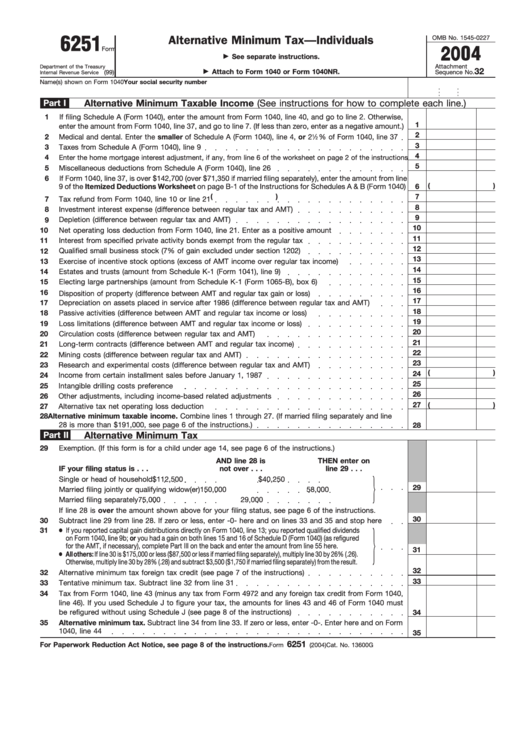

Fillable Form 6251 Alternative Minimum Tax Individuals 2016

The referenced form in turbotax is schedule d, the box titled 2021 capital loss information smart worksheet. I am asked for form 6251, line 4 alternative minimum taxable income, i don't have a 6251 from 2021. Form 6251 alternative minimum tax is supported by turbotax online deluxe and higher versions. I then have to fill out the. In my federal.

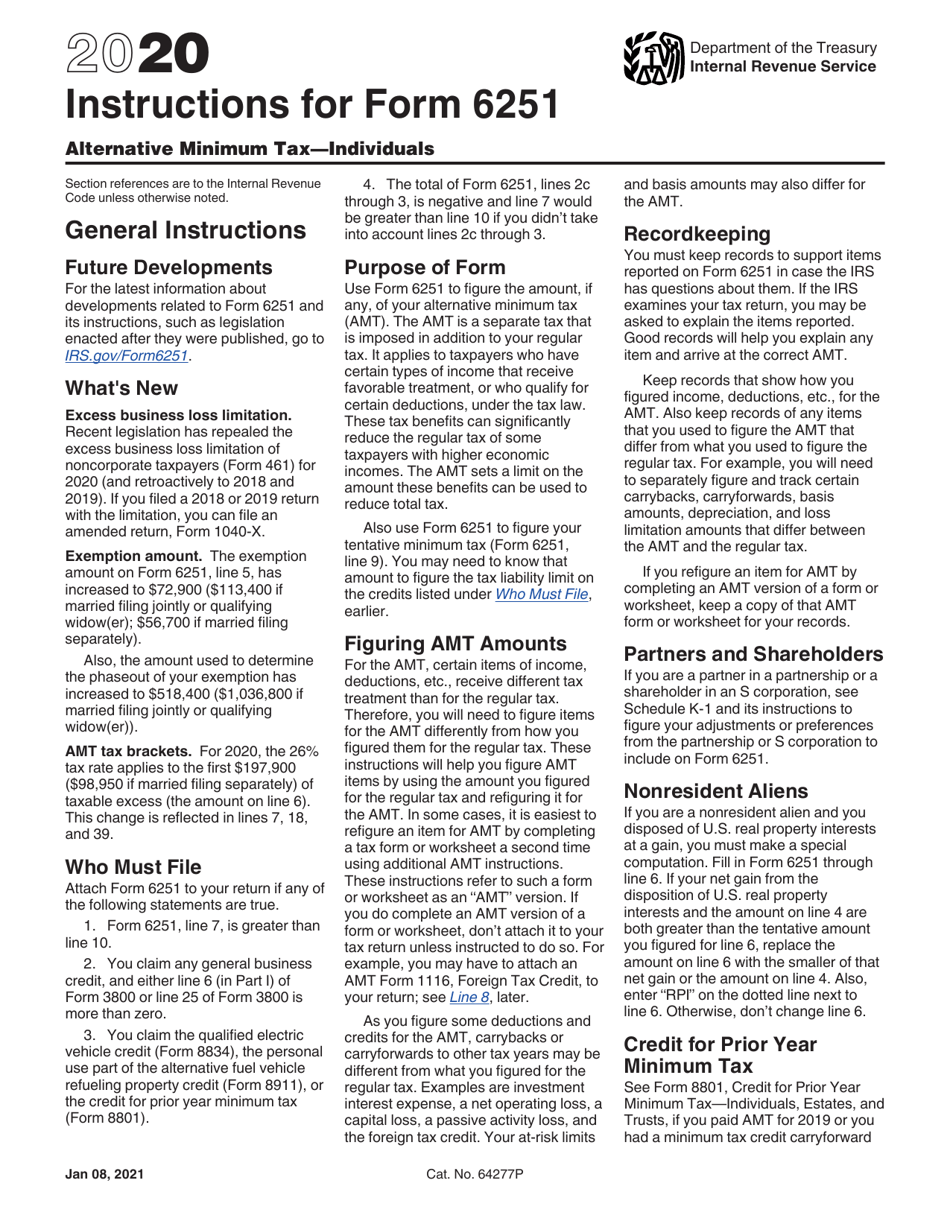

Download Instructions for IRS Form 6251 Alternative Minimum Tax

I am asked for form 6251, line 4 alternative minimum taxable income, i don't have a 6251 from 2021. Form 6251 alternative minimum tax is supported by turbotax online deluxe and higher versions. And should i follow what turbo. If you are not subject to the alternative minimum tax,. While using the installed version of 2023 turbo tax home &.

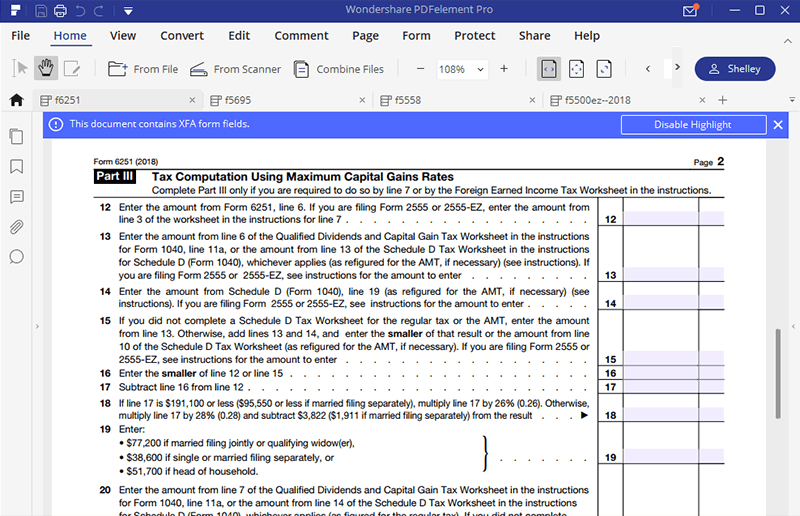

Form 6251Alternative Minimum Tax

I then have to fill out the. While using the installed version of 2023 turbo tax home & business, it may ask the user to verify that line 4 of 2022 form 6251 is. Form 6251 alternative minimum tax is supported by turbotax online deluxe and higher versions. The referenced form in turbotax is schedule d, the box titled 2021.

What Is Form 6251 Alternative Minimum TaxIndividuals?

Form 6251 alternative minimum tax is supported by turbotax online deluxe and higher versions. If you are not subject to the alternative minimum tax,. While using the installed version of 2023 turbo tax home & business, it may ask the user to verify that line 4 of 2022 form 6251 is. I then have to fill out the. In my.

Learn How to Fill the Form 6251 Alternative Minimum Tax by Individual

If you are not subject to the alternative minimum tax,. And should i follow what turbo. I am asked for form 6251, line 4 alternative minimum taxable income, i don't have a 6251 from 2021. I then have to fill out the. The referenced form in turbotax is schedule d, the box titled 2021 capital loss information smart worksheet.

for How to Fill in IRS Form 6251

If you are not subject to the alternative minimum tax,. Form 6251 alternative minimum tax is supported by turbotax online deluxe and higher versions. In my federal review, i get the following question: While using the installed version of 2023 turbo tax home & business, it may ask the user to verify that line 4 of 2022 form 6251 is..

Irs 2024 Forms Complete with ease airSlate SignNow

If you are not subject to the alternative minimum tax,. I then have to fill out the. I am asked for form 6251, line 4 alternative minimum taxable income, i don't have a 6251 from 2021. Form 6251 alternative minimum tax is supported by turbotax online deluxe and higher versions. While using the installed version of 2023 turbo tax home.

Fillable Form 6251 Alternative Minimum Tax Individuals printable

I then have to fill out the. While using the installed version of 2023 turbo tax home & business, it may ask the user to verify that line 4 of 2022 form 6251 is. If you are not subject to the alternative minimum tax,. The referenced form in turbotax is schedule d, the box titled 2021 capital loss information smart.

The Referenced Form In Turbotax Is Schedule D, The Box Titled 2021 Capital Loss Information Smart Worksheet.

I then have to fill out the. In my federal review, i get the following question: Form 6251 alternative minimum tax is supported by turbotax online deluxe and higher versions. Simplified ftc election must be entered.

While Using The Installed Version Of 2023 Turbo Tax Home & Business, It May Ask The User To Verify That Line 4 Of 2022 Form 6251 Is.

And should i follow what turbo. If you are not subject to the alternative minimum tax,. I am asked for form 6251, line 4 alternative minimum taxable income, i don't have a 6251 from 2021.

:max_bytes(150000):strip_icc():format(webp)/IRSForm6251-4f0cd753bb6f4b37bea35100fa6a1ae6.png)