Trust Itr Form - A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a. Living or testamentary, funded or unfunded, revocable or irrevocable. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. A trust is a legal vehicle that allows a third party — a trustee — to hold and direct assets in a trust fund on behalf of a beneficiary. Each trust falls into six broad categories: A trust, sometimes called a trust fund or trust account, is a legal arrangement to ensure a person’s assets go to specific beneficiaries.

A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a. A trust is a legal vehicle that allows a third party — a trustee — to hold and direct assets in a trust fund on behalf of a beneficiary. A trust, sometimes called a trust fund or trust account, is a legal arrangement to ensure a person’s assets go to specific beneficiaries. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Living or testamentary, funded or unfunded, revocable or irrevocable. Each trust falls into six broad categories:

A trust is a legal vehicle that allows a third party — a trustee — to hold and direct assets in a trust fund on behalf of a beneficiary. A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Living or testamentary, funded or unfunded, revocable or irrevocable. A trust, sometimes called a trust fund or trust account, is a legal arrangement to ensure a person’s assets go to specific beneficiaries. Each trust falls into six broad categories:

What is ITR7 and How to File It?

A trust is a legal vehicle that allows a third party — a trustee — to hold and direct assets in a trust fund on behalf of a beneficiary. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. A trust, sometimes called a trust fund or.

Trust Tax Return Taxation for Trust ITR7 Tax Craft Hub

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Living or testamentary, funded or unfunded, revocable or irrevocable. Each trust falls into six broad categories: A trust is a legal vehicle that allows a third party — a trustee — to hold and direct assets in.

Download Tax Return Acknowledgement Form ITRV Site Maintenance

A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a. Living or testamentary, funded or unfunded, revocable or irrevocable. A trust, sometimes called a trust fund or trust account, is a legal arrangement to ensure a person’s assets go to.

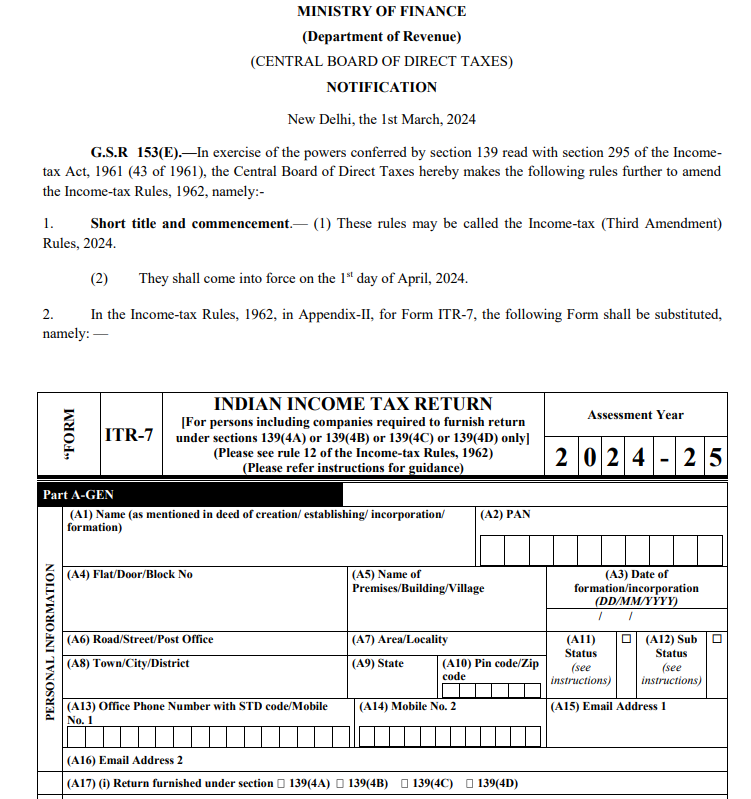

CBDT Notifies ITR7 Form for AY 202425

Each trust falls into six broad categories: A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries..

Tax Return (ITR) Forms AY 202526 Complete Guide from ITR1 to

A trust, sometimes called a trust fund or trust account, is a legal arrangement to ensure a person’s assets go to specific beneficiaries. A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a. Each trust falls into six broad categories:.

How to file ITR7 for Trust or NGO for AY 202324 and FY 202223 How

A trust, sometimes called a trust fund or trust account, is a legal arrangement to ensure a person’s assets go to specific beneficiaries. Living or testamentary, funded or unfunded, revocable or irrevocable. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. A trust is a legal.

Trust Tax Return Taxation for Trust ITR7 Tax Craft Hub

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. A trust is a legal vehicle that allows a third party — a trustee — to hold and direct assets in a trust fund on behalf of a beneficiary. A trust, sometimes called a trust fund or.

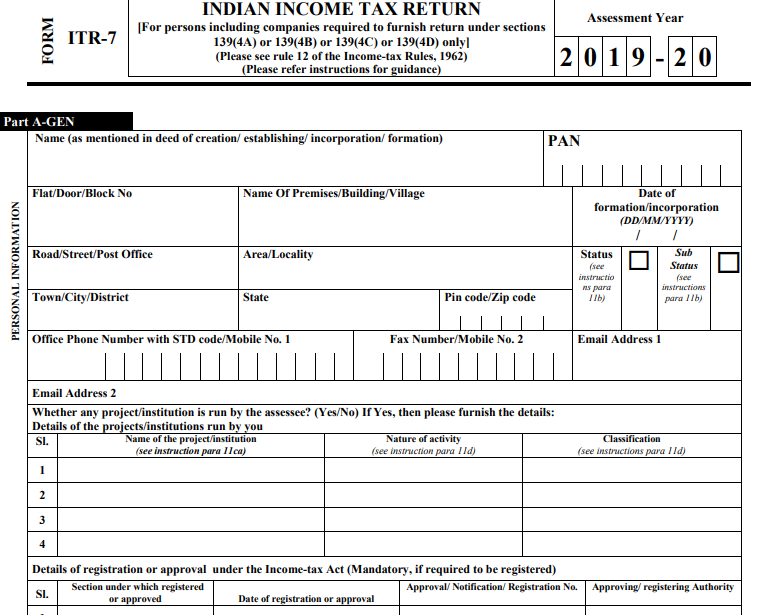

ITR Form PDF Insurance Pension

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Living or testamentary, funded or unfunded, revocable or irrevocable. Each trust falls into six broad categories: A trust, sometimes called a trust fund or trust account, is a legal arrangement to ensure a person’s assets go to.

What is Tax Return (ITR)? Simplified Guide for Taxpayers

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a. A trust, sometimes called a trust fund.

How to Choose the Right ITR Form for Your Tax Filing in India?

Living or testamentary, funded or unfunded, revocable or irrevocable. Each trust falls into six broad categories: A trust is a legal vehicle that allows a third party — a trustee — to hold and direct assets in a trust fund on behalf of a beneficiary. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold.

A Trust Is A Fiduciary Arrangement That Allows A Third Party, Or Trustee, To Hold Assets On Behalf Of A Beneficiary Or Beneficiaries.

A trust is a legal vehicle that allows a third party — a trustee — to hold and direct assets in a trust fund on behalf of a beneficiary. A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a. Each trust falls into six broad categories: A trust, sometimes called a trust fund or trust account, is a legal arrangement to ensure a person’s assets go to specific beneficiaries.