Tax Form 5695 - If you have form 5695 and claiming joint occupancy, the irs will. Hi all, i was hoping to have some help with an unusual question/situation. Form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Form 5695 debacle what is the problem with form 5695 and when will it actually be corrected? The federal government is now. The irs says if you want to file prior to the 3.16.25 date you can paper file. Per the hunter douglas website: There is nothing on the web base.

The federal government is now. Hi all, i was hoping to have some help with an unusual question/situation. Form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. The irs says if you want to file prior to the 3.16.25 date you can paper file. There is nothing on the web base. If you have form 5695 and claiming joint occupancy, the irs will. Form 5695 debacle what is the problem with form 5695 and when will it actually be corrected? Per the hunter douglas website:

The irs says if you want to file prior to the 3.16.25 date you can paper file. Form 5695 debacle what is the problem with form 5695 and when will it actually be corrected? Per the hunter douglas website: Form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. The federal government is now. Hi all, i was hoping to have some help with an unusual question/situation. If you have form 5695 and claiming joint occupancy, the irs will. There is nothing on the web base.

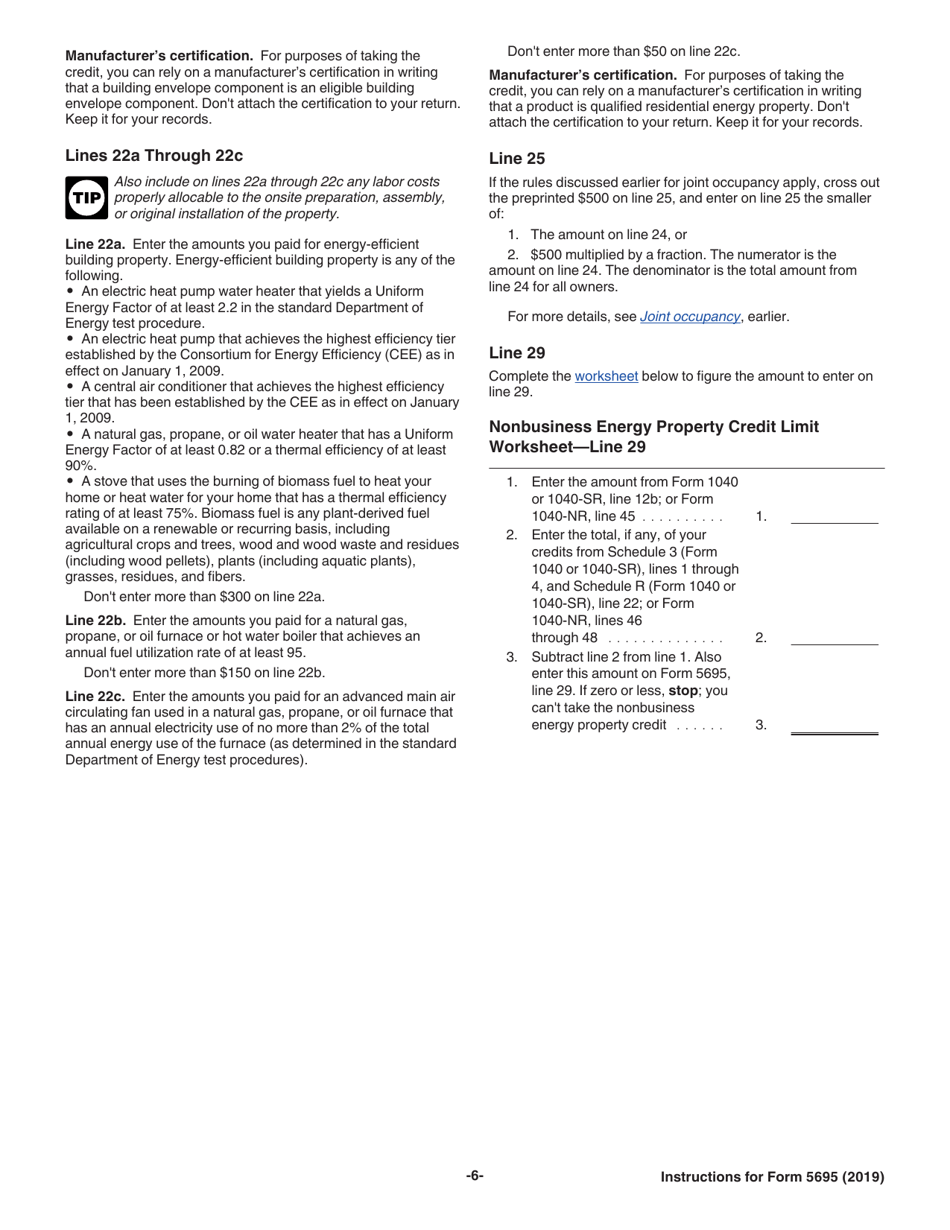

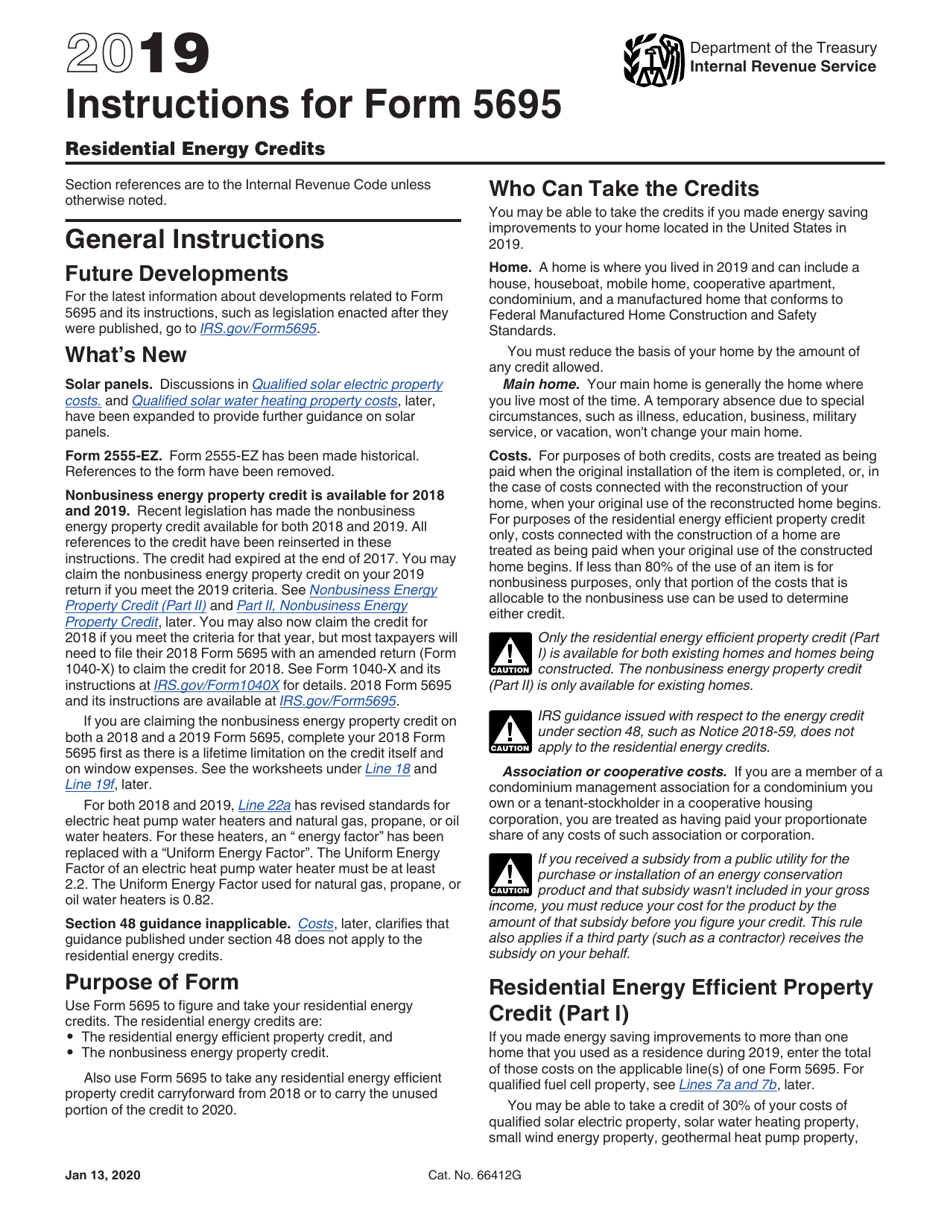

Download Instructions for IRS Form 5695 Residential Energy Credits PDF

Form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Hi all, i was hoping to have some help with an unusual question/situation. The irs says if you want to file prior to the 3.16.25 date you can paper file. There is nothing on the web base. Form 5695 debacle what.

IRS Form 5695 Instructions Residential Energy Credits

There is nothing on the web base. Form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Per the hunter douglas website: Hi all, i was hoping to have some help with an unusual question/situation. The federal government is now.

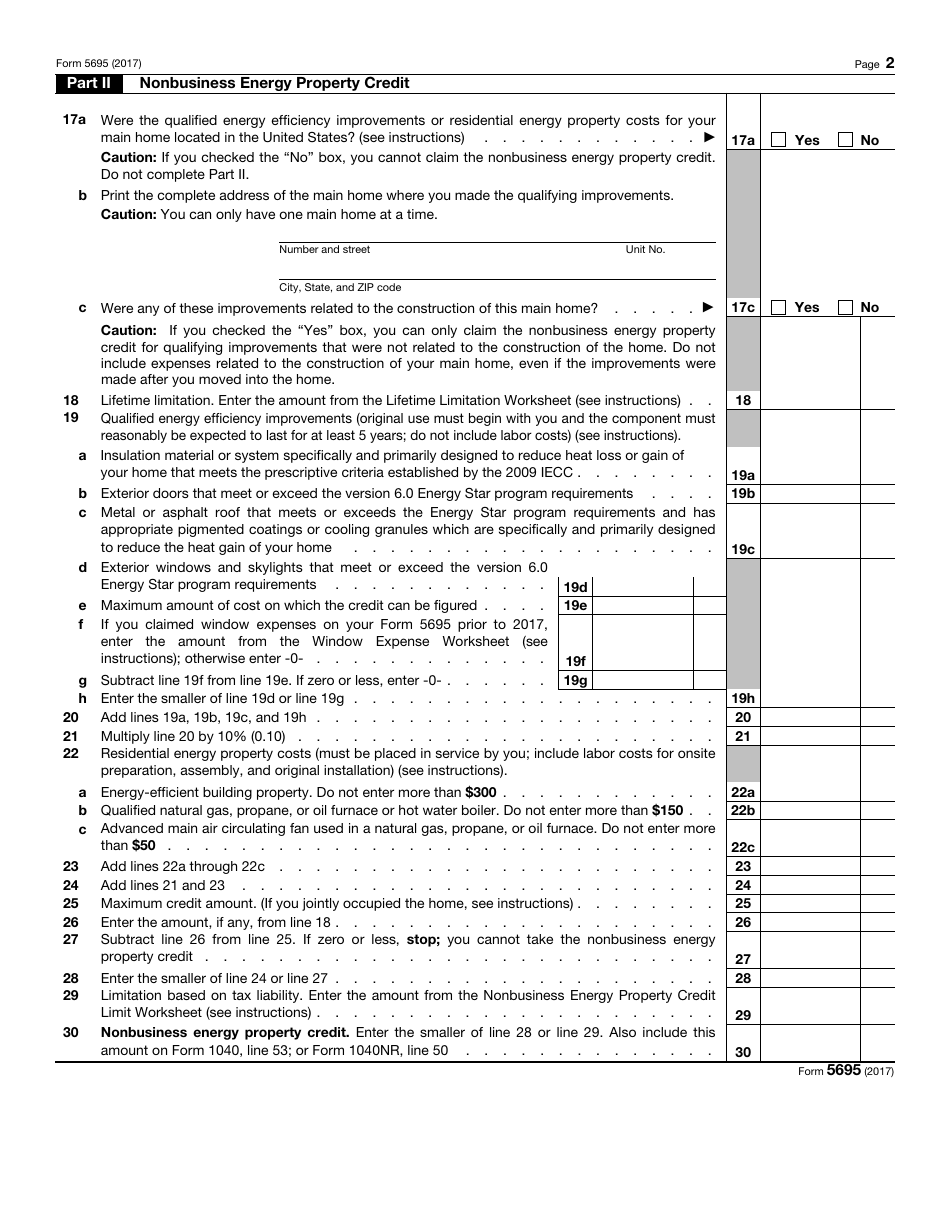

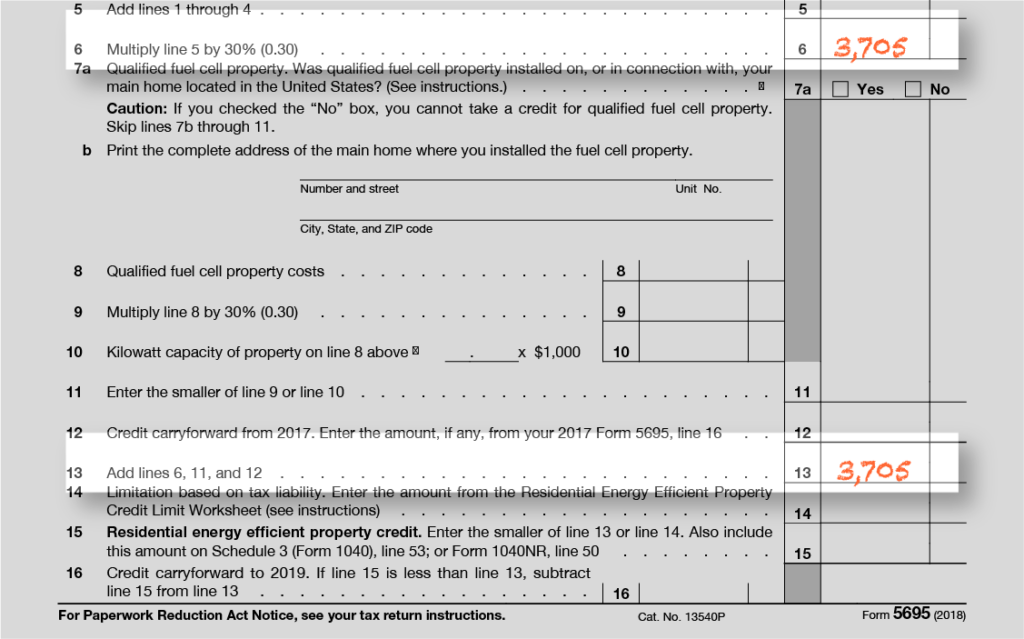

IRS Form 5695 2017 Fill Out, Sign Online and Download Fillable PDF

The irs says if you want to file prior to the 3.16.25 date you can paper file. Hi all, i was hoping to have some help with an unusual question/situation. There is nothing on the web base. Per the hunter douglas website: If you have form 5695 and claiming joint occupancy, the irs will.

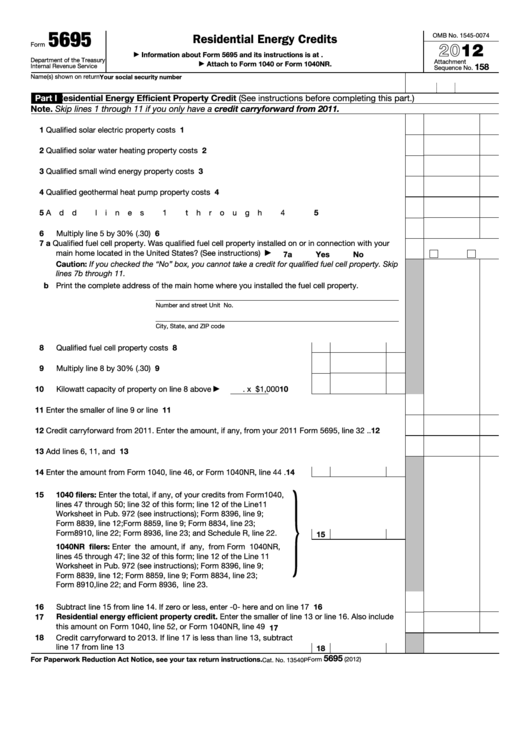

Fillable Form 5695 Residential Energy Credits 2012 printable pdf

The federal government is now. The irs says if you want to file prior to the 3.16.25 date you can paper file. Per the hunter douglas website: Form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Hi all, i was hoping to have some help with an unusual question/situation.

Download Instructions for IRS Form 5695 Residential Energy Credits PDF

The federal government is now. There is nothing on the web base. Form 5695 debacle what is the problem with form 5695 and when will it actually be corrected? Hi all, i was hoping to have some help with an unusual question/situation. If you have form 5695 and claiming joint occupancy, the irs will.

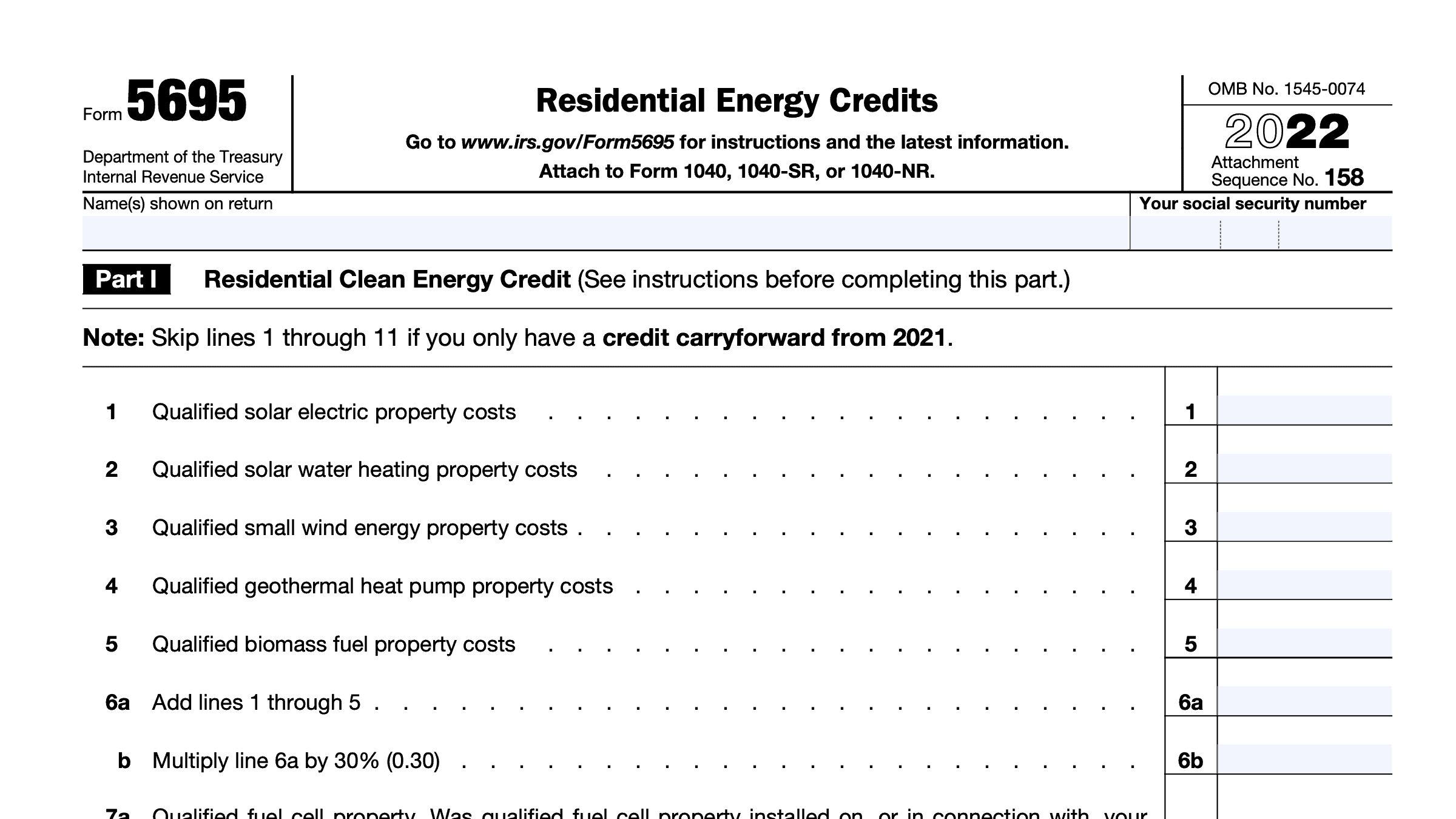

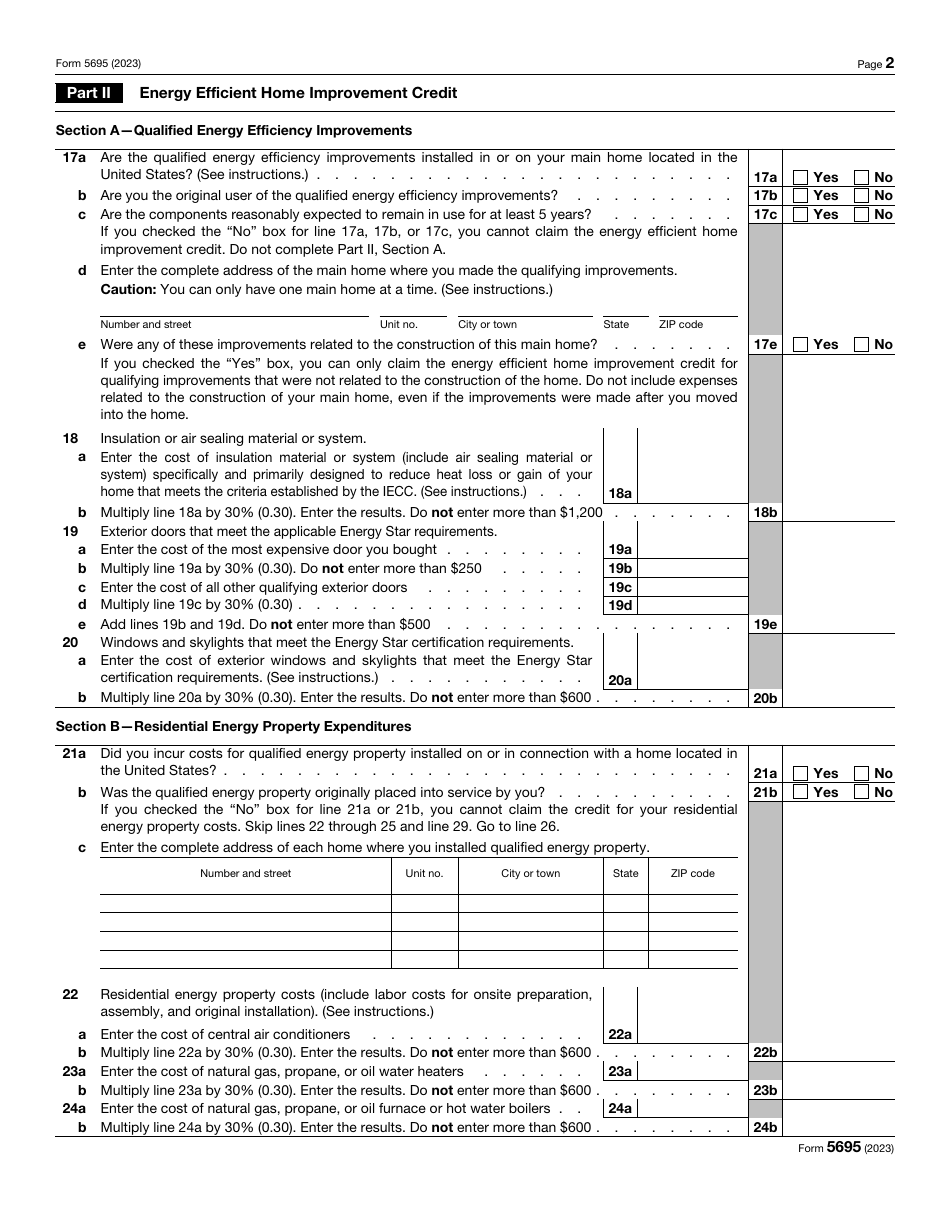

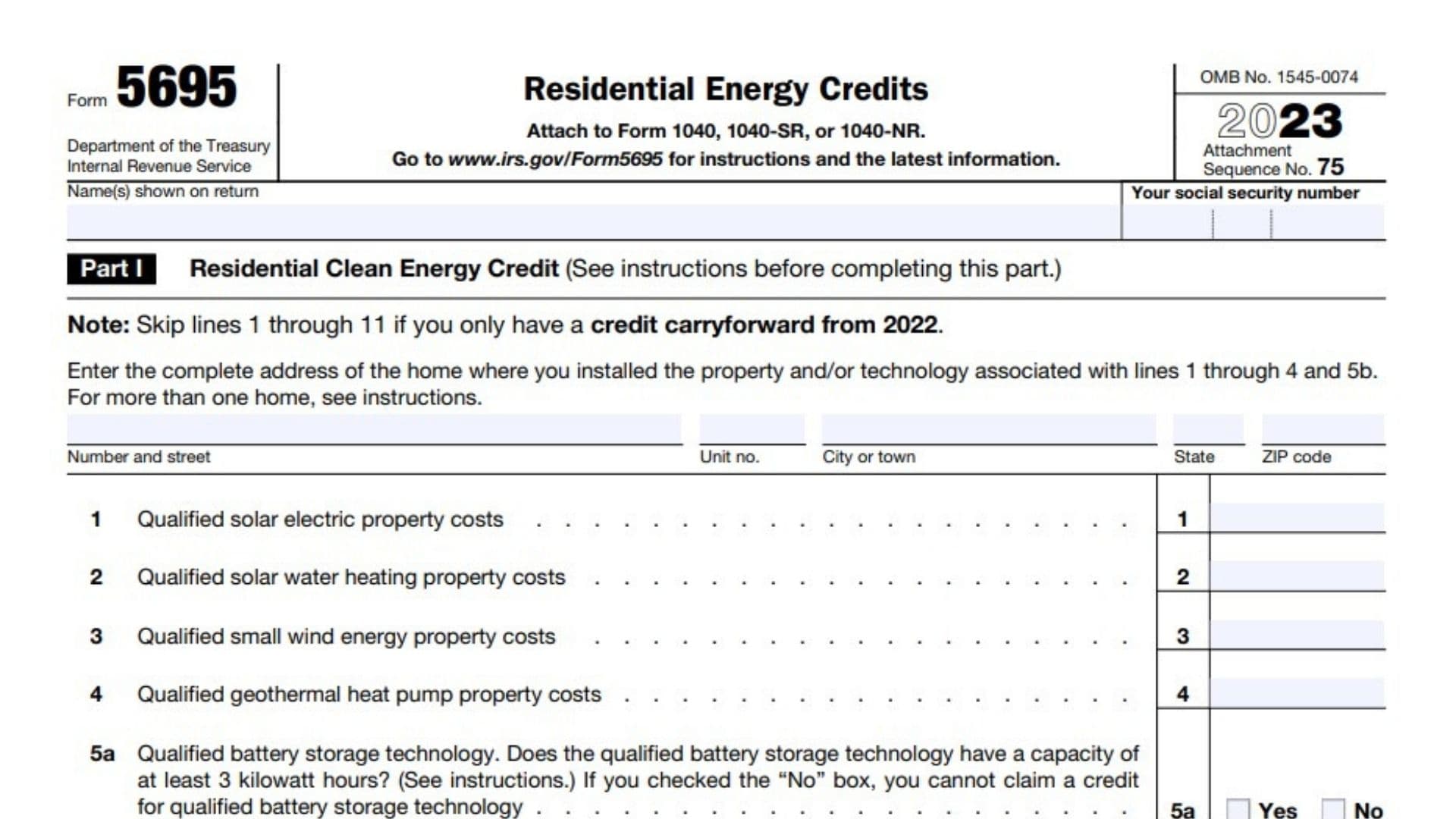

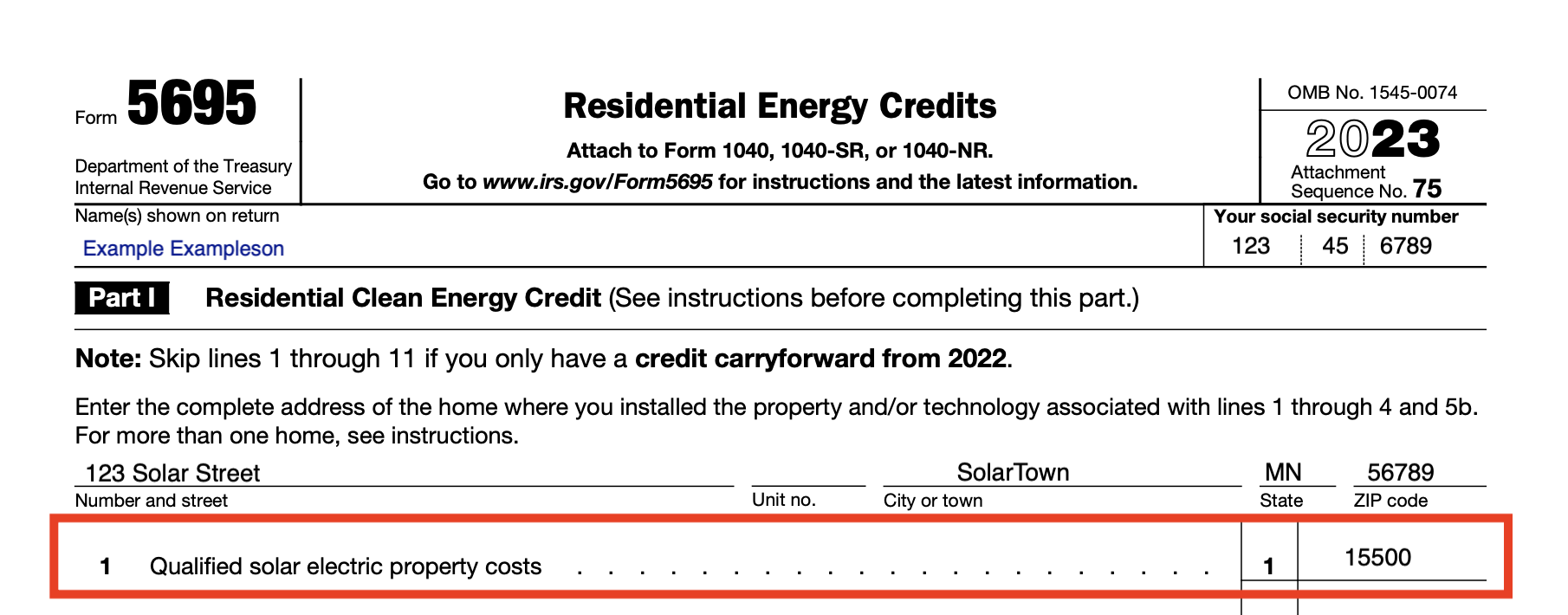

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Form 5695 debacle what is the problem with form 5695 and when will it actually be corrected? Hi all, i was hoping to have some help with an unusual question/situation. The irs says if you want to file prior to the 3.16.25 date you can paper file. If you have form 5695 and claiming joint occupancy, the irs will. Form.

IRS Form 5695 Download Fillable PDF or Fill Online Residential Energy

There is nothing on the web base. Form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. If you have form 5695 and claiming joint occupancy, the irs will. Hi all, i was hoping to have some help with an unusual question/situation. The irs says if you want to file prior.

Types of Energy Tax Credits LoveToKnow

Hi all, i was hoping to have some help with an unusual question/situation. Per the hunter douglas website: If you have form 5695 and claiming joint occupancy, the irs will. Form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Form 5695 debacle what is the problem with form 5695 and.

Form 5695 Instructions 2024 2025

The federal government is now. There is nothing on the web base. If you have form 5695 and claiming joint occupancy, the irs will. Hi all, i was hoping to have some help with an unusual question/situation. Form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment.

How To Claim The Solar Tax Credit IRS Form 5695 Instructions (2024 tax

There is nothing on the web base. Form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Per the hunter douglas website: The irs says if you want to file prior to the 3.16.25 date you can paper file. Form 5695 debacle what is the problem with form 5695 and when.

Hi All, I Was Hoping To Have Some Help With An Unusual Question/Situation.

Per the hunter douglas website: The federal government is now. Form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. If you have form 5695 and claiming joint occupancy, the irs will.

The Irs Says If You Want To File Prior To The 3.16.25 Date You Can Paper File.

Form 5695 debacle what is the problem with form 5695 and when will it actually be corrected? There is nothing on the web base.