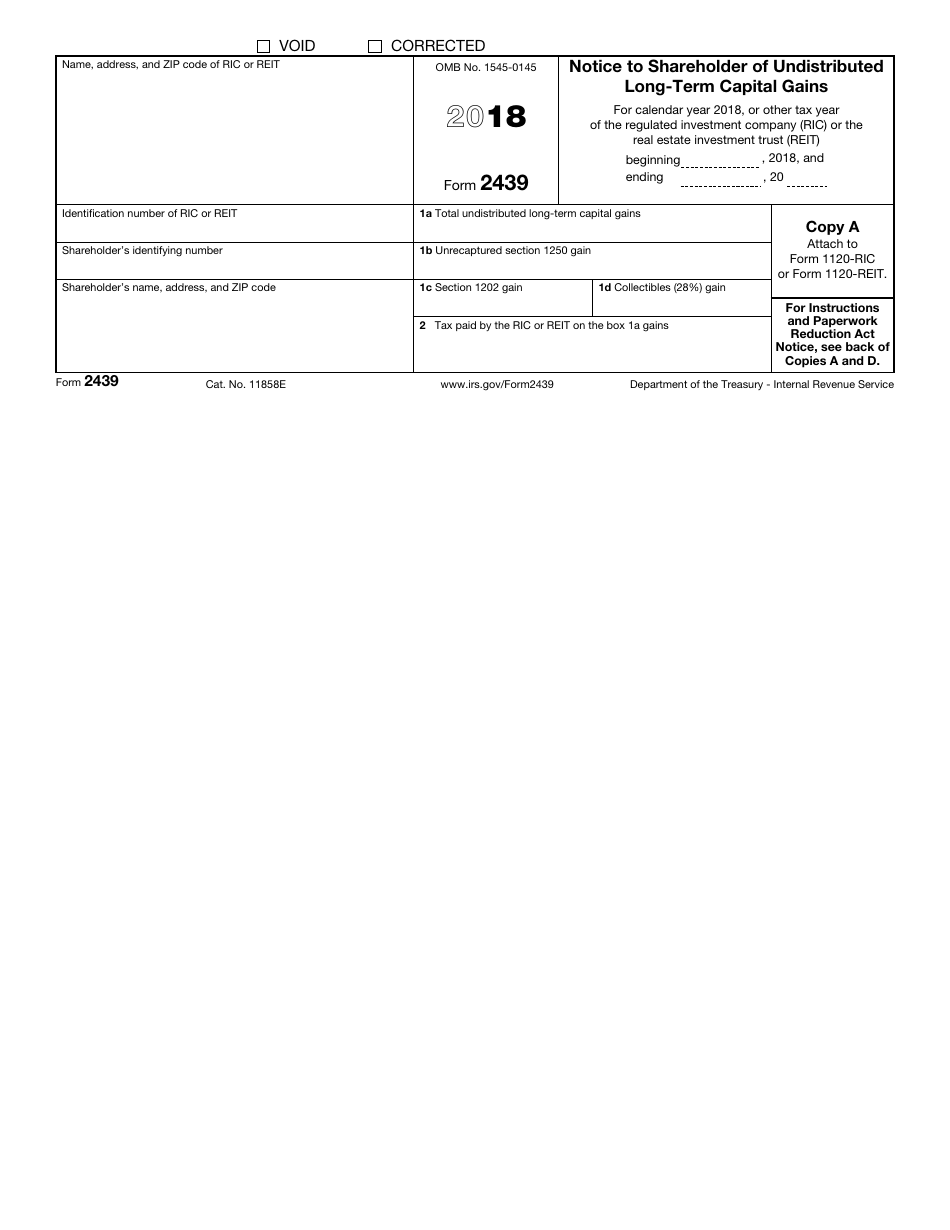

Tax Form 2439 - File at an irs partner site with the irs free file program or use free file. Prepare and file your federal income tax return online for free. Access irs forms, instructions and publications in electronic and print media. We help you understand and meet your federal tax. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Review the amount you owe, balance for each tax year, payment history, tax records and more. Sign in or create an online account. As your income goes up, the. Find irs forms and answers to tax questions.

Prepare and file your federal income tax return online for free. As your income goes up, the. Find irs forms and answers to tax questions. Sign in or create an online account. File at an irs partner site with the irs free file program or use free file. Access irs forms, instructions and publications in electronic and print media. We help you understand and meet your federal tax. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Review the amount you owe, balance for each tax year, payment history, tax records and more.

We help you understand and meet your federal tax. Sign in or create an online account. Access irs forms, instructions and publications in electronic and print media. File at an irs partner site with the irs free file program or use free file. Review the amount you owe, balance for each tax year, payment history, tax records and more. Prepare and file your federal income tax return online for free. Find irs forms and answers to tax questions. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. As your income goes up, the.

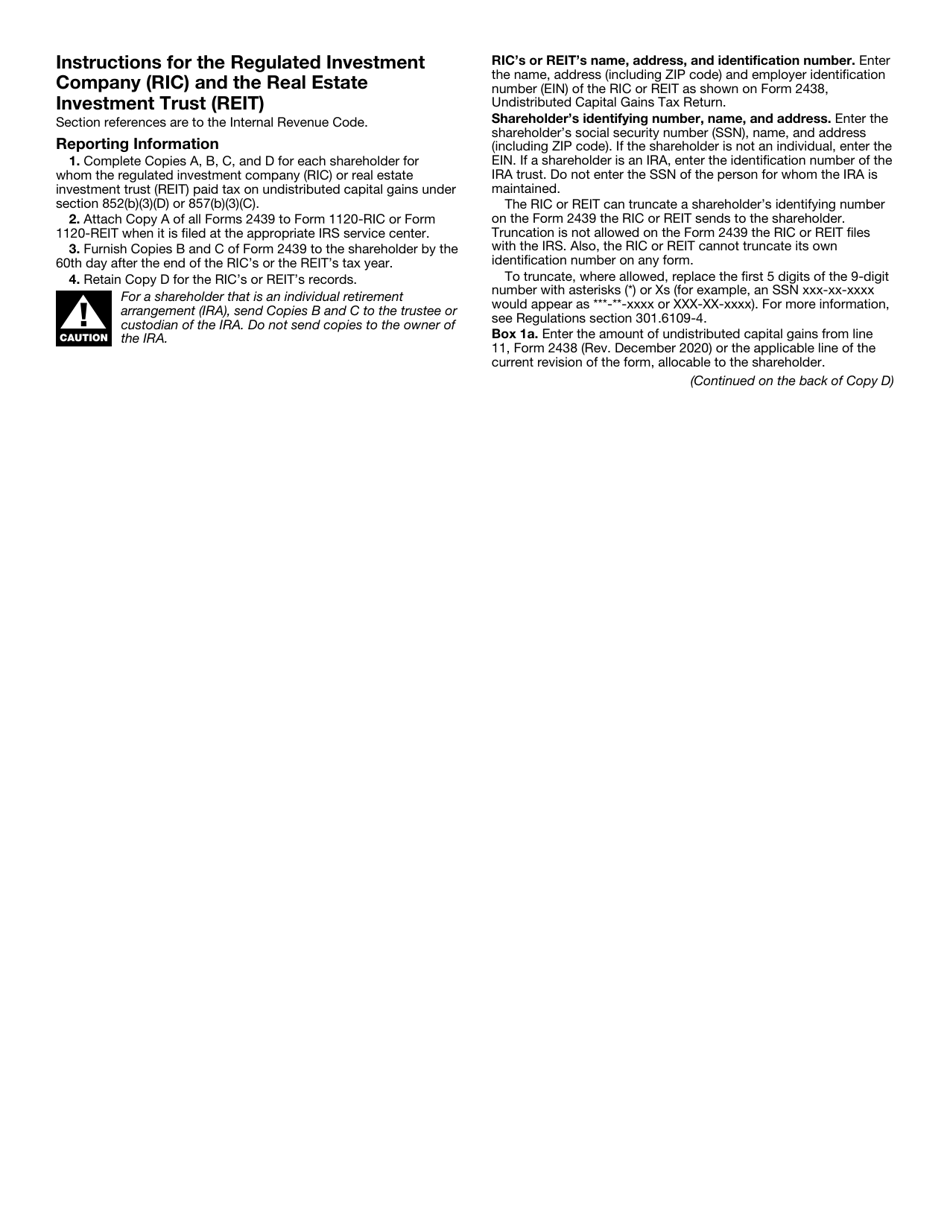

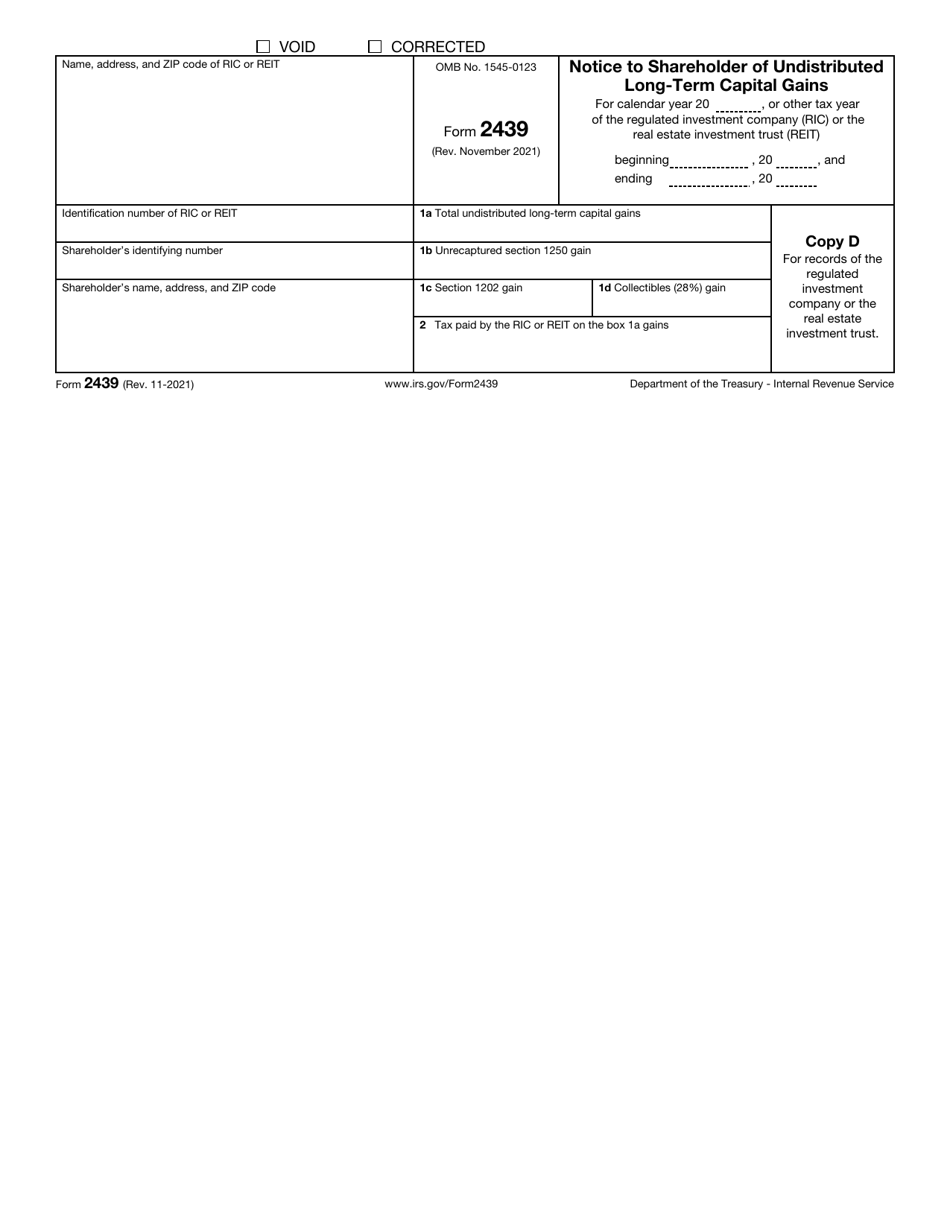

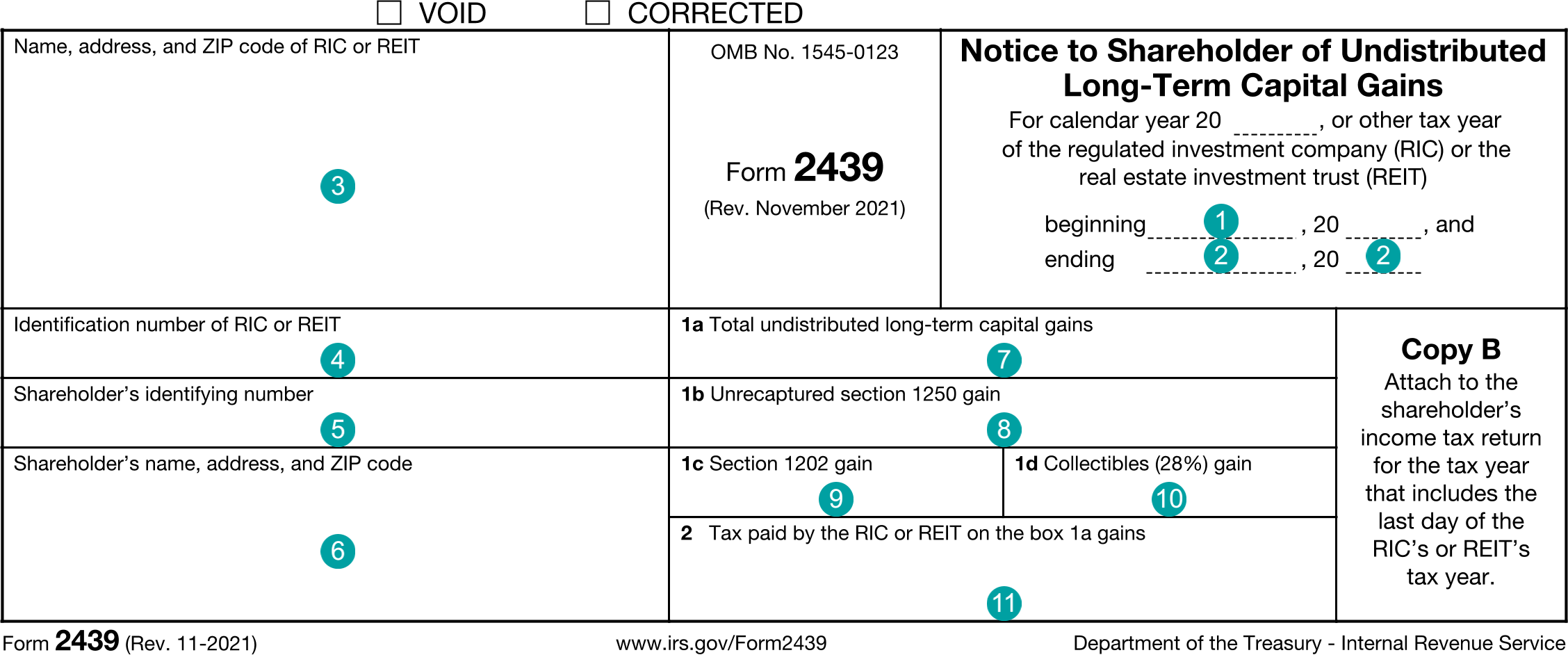

The 2439 Form Explained

Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Prepare and file your federal income tax return online for free. Access irs forms, instructions and publications in electronic and print media. Sign in or create an online account. Review the amount you owe, balance for each tax year, payment.

Form 2439, Notice to Shareholder of Undistributed LongTerm Capital Gains

Find irs forms and answers to tax questions. We help you understand and meet your federal tax. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Prepare and file your federal income tax return online for free. As your income goes up, the.

IRS Form 2439 Download Fillable PDF or Fill Online Notice to

Access irs forms, instructions and publications in electronic and print media. File at an irs partner site with the irs free file program or use free file. We help you understand and meet your federal tax. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Review the amount you.

IRS Form 2439 Download Fillable PDF or Fill Online Notice to

Access irs forms, instructions and publications in electronic and print media. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. We help you understand and meet your federal tax. Review the amount you owe, balance for each tax year, payment history, tax records and more. As your income goes.

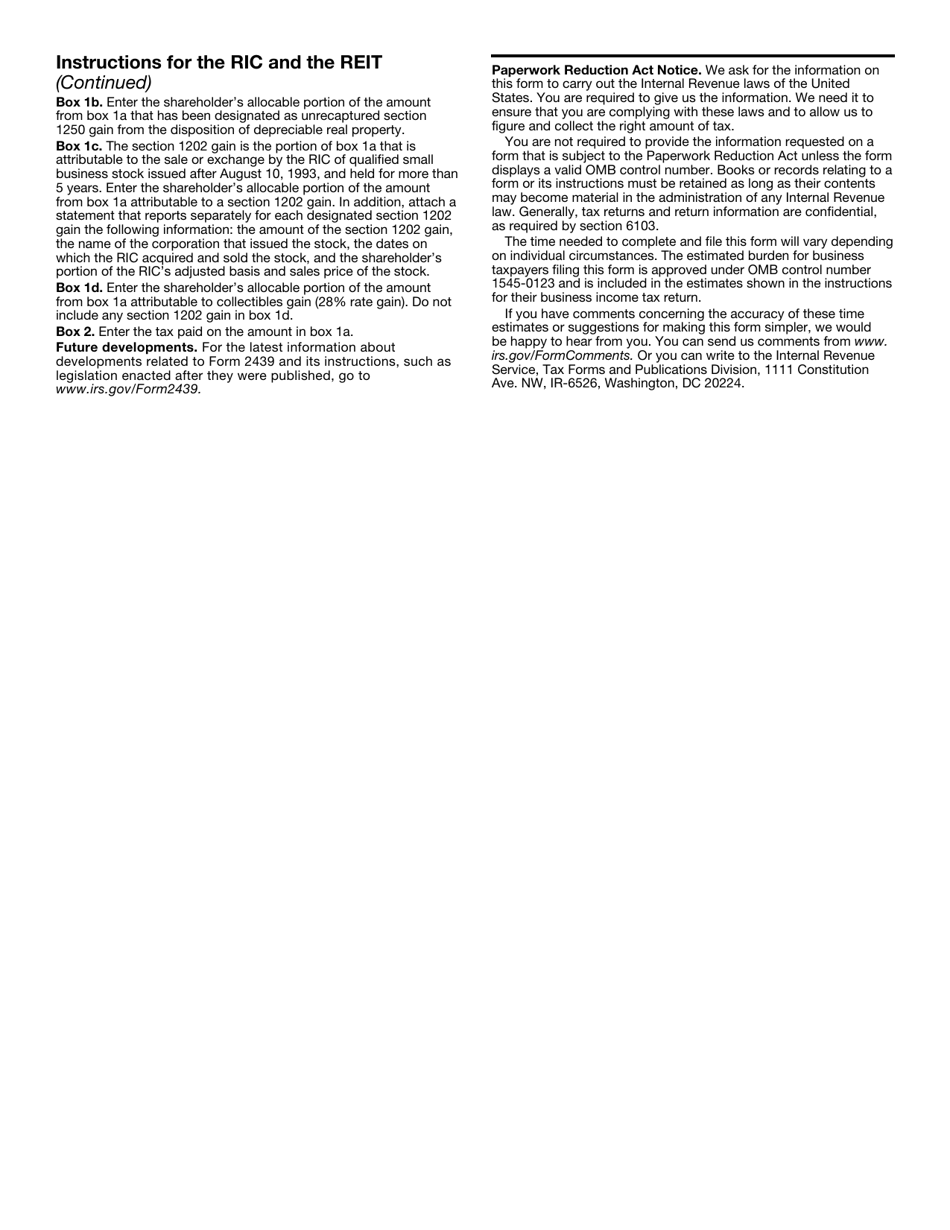

IRS Form 2439 Instructions Undistributed LongTerm Capital Gains

We help you understand and meet your federal tax. File at an irs partner site with the irs free file program or use free file. Find irs forms and answers to tax questions. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Prepare and file your federal income tax.

FDX

Access irs forms, instructions and publications in electronic and print media. Review the amount you owe, balance for each tax year, payment history, tax records and more. Prepare and file your federal income tax return online for free. Find irs forms and answers to tax questions. As your income goes up, the.

IRS Form 2439 2018 Fill Out, Sign Online and Download Fillable PDF

Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Find irs forms and answers to tax questions. Sign in or create an online account. Access irs forms, instructions and publications in electronic and print media. File at an irs partner site with the irs free file program or use.

IRS Form 2439 Instructions Undistributed LongTerm Capital Gains

We help you understand and meet your federal tax. Review the amount you owe, balance for each tax year, payment history, tax records and more. File at an irs partner site with the irs free file program or use free file. Sign in or create an online account. Federal income tax rates and brackets you pay tax as a percentage.

Form 2439 Instructions 2024 2025

We help you understand and meet your federal tax. Access irs forms, instructions and publications in electronic and print media. Prepare and file your federal income tax return online for free. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Find irs forms and answers to tax questions.

IRS Form 2439 Download Fillable PDF or Fill Online Notice to

Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Sign in or create an online account. Find irs forms and answers to tax questions. As your income goes up, the. Access irs forms, instructions and publications in electronic and print media.

Federal Income Tax Rates And Brackets You Pay Tax As A Percentage Of Your Income In Layers Called Tax Brackets.

As your income goes up, the. Sign in or create an online account. Review the amount you owe, balance for each tax year, payment history, tax records and more. We help you understand and meet your federal tax.

Find Irs Forms And Answers To Tax Questions.

Prepare and file your federal income tax return online for free. Access irs forms, instructions and publications in electronic and print media. File at an irs partner site with the irs free file program or use free file.