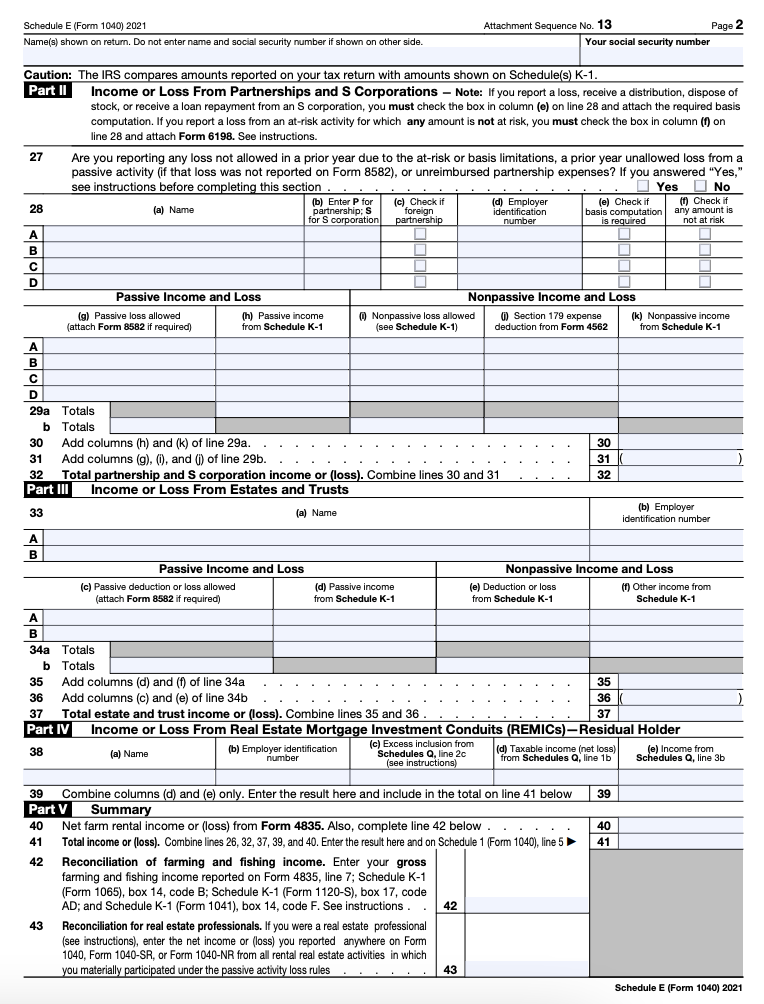

Schedule E Tax Form - Taxpayers need to complete a. Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Learn how schedule e on form 1040 reports supplemental income and. What is schedule e on form 1040 and how does it affect your taxes?

Taxpayers need to complete a. Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Learn how schedule e on form 1040 reports supplemental income and. What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s.

What is schedule e on form 1040 and how does it affect your taxes? Taxpayers need to complete a. Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Learn how schedule e on form 1040 reports supplemental income and.

Property Schedule Tax Benefits For Active And Passive Real

Taxpayers need to complete a. Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. What is schedule e on form 1040 and how does it affect your taxes? Learn how schedule e on form 1040 reports supplemental income and. Schedule e is a tax form that.

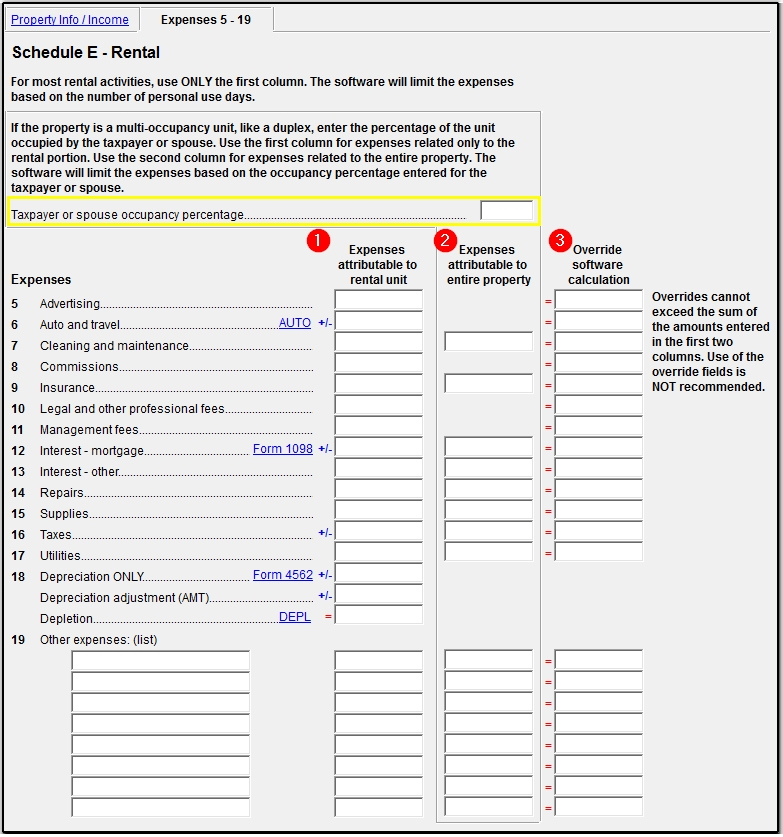

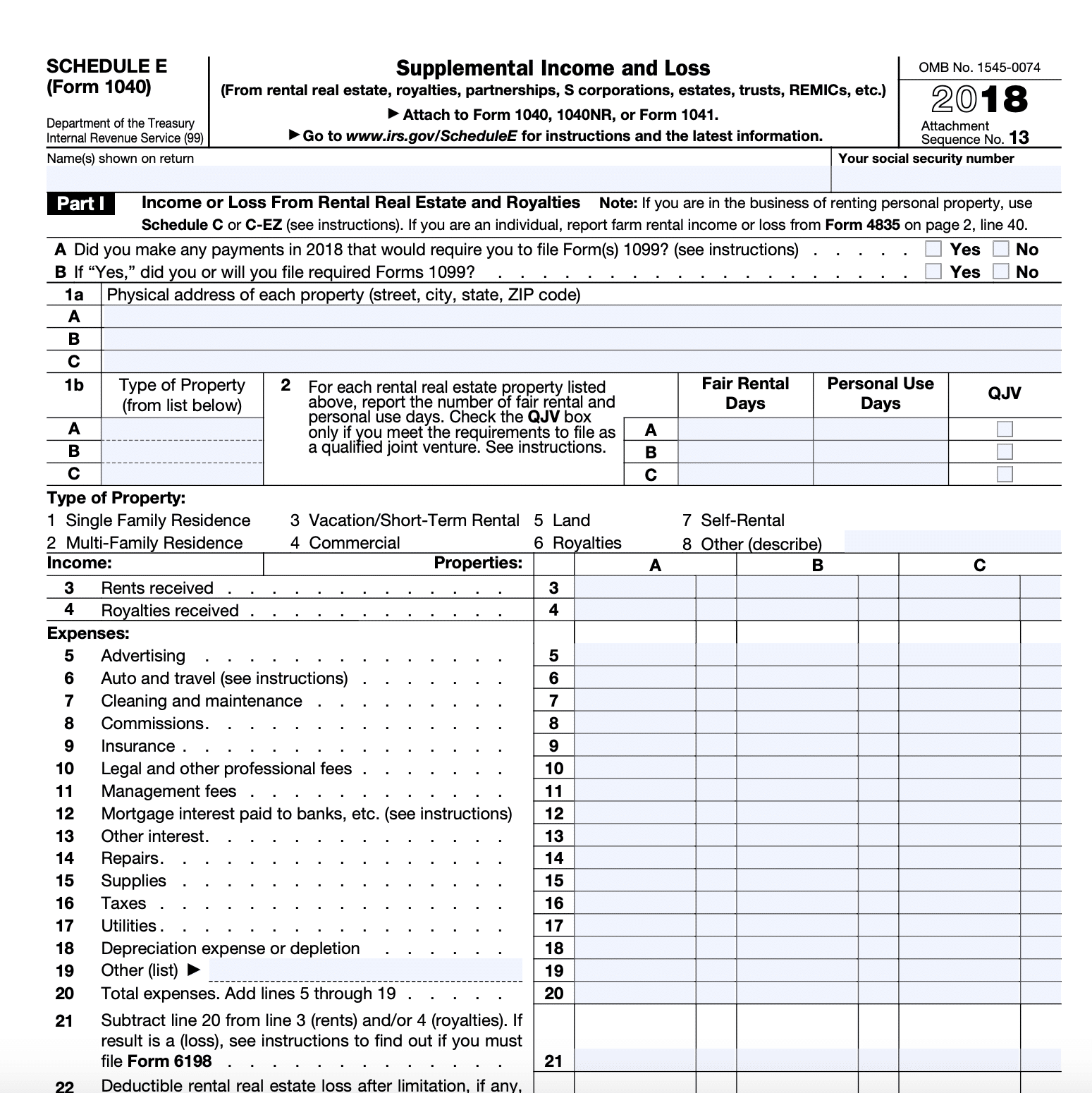

A Breakdown of your Schedule E Expense Categories

Learn how schedule e on form 1040 reports supplemental income and. What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Schedule e is a tax form that individual taxpayers must file to.

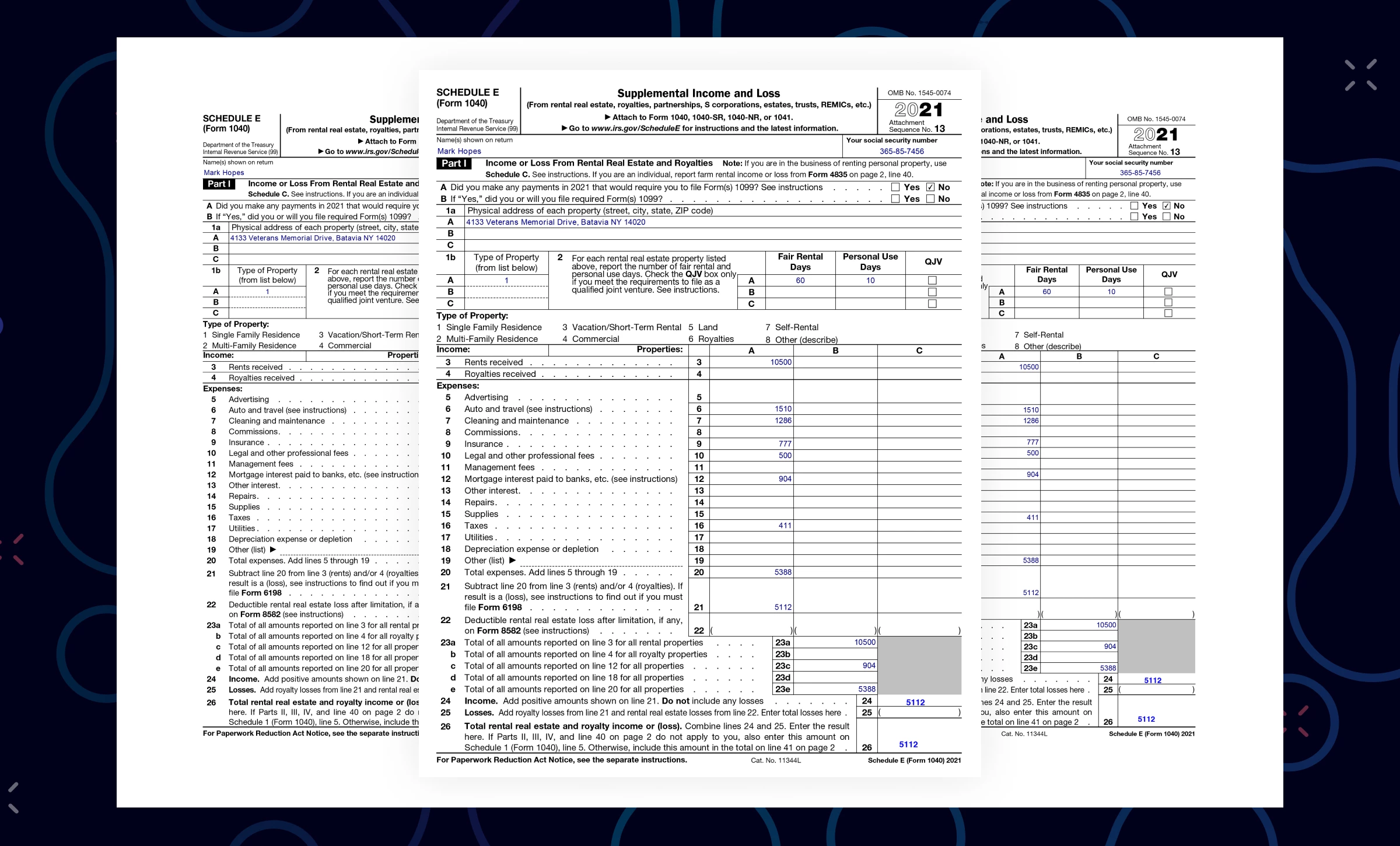

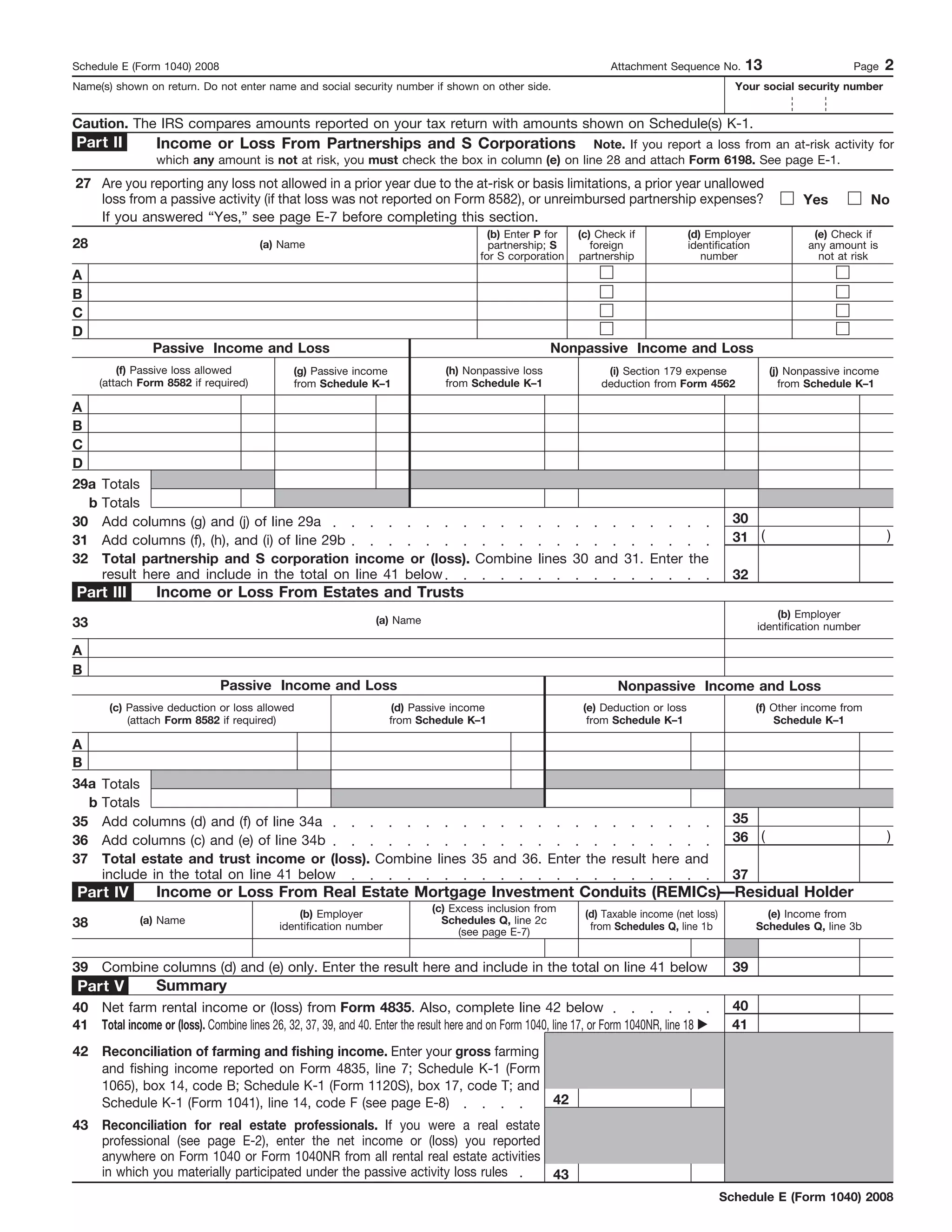

IRS Schedule E Instructions Supplemental and Loss

What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Taxpayers need to complete a. Learn how schedule e on form 1040 reports supplemental income and. Schedule e is a tax form used to report income or.

What Is A Schedule E For at John Rosado blog

Taxpayers need to complete a. Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. What is schedule e on form 1040 and how does it affect your.

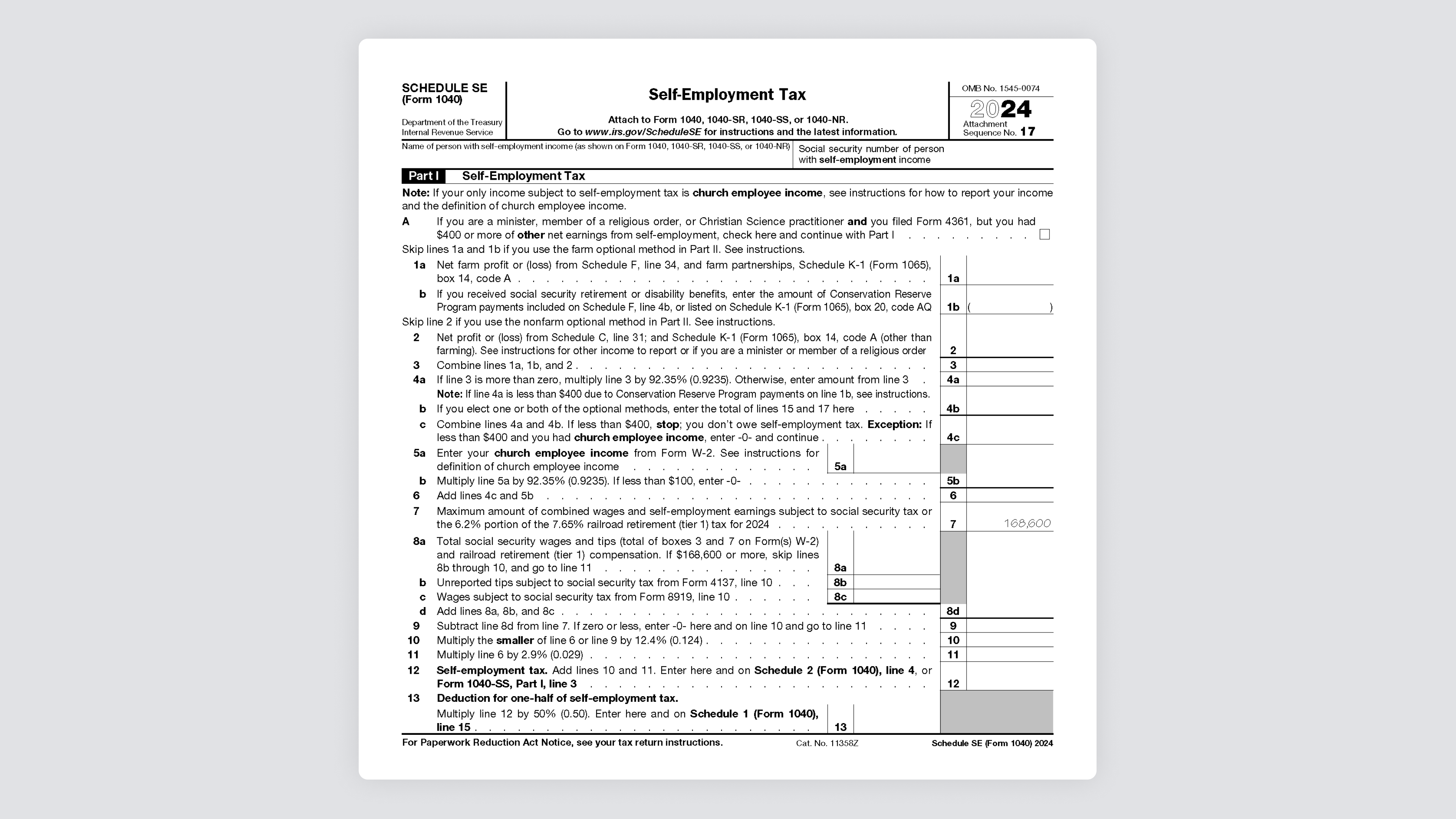

A StepbyStep Guide to the Schedule SE Tax Form

Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Taxpayers need to complete a. What is schedule e on form 1040 and how does it affect your.

Printable Schedule E Tax Form Printable Forms Free Online

Learn how schedule e on form 1040 reports supplemental income and. Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Taxpayers need to complete a. Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. What is.

What Is 1040 Schedule 3 datadome

Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Learn how schedule e on form 1040 reports supplemental income and. Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Taxpayers need to complete a. What is.

Form 1040, Schedule ESupplemental and Loss PDF

Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Learn how schedule e on form 1040 reports supplemental income and. Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Taxpayers need to complete a. What is.

What Is Schedule E? Here’s an Overview and Summary!

Taxpayers need to complete a. What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Schedule e is a tax form that individual taxpayers must file to the irs along with their form.

IRS Schedule E The Ultimate Guide for Real Estate Investors

Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Learn how schedule e on form 1040 reports supplemental income and. Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. What is schedule e on form 1040.

Schedule E Is A Tax Form Used To Report Income Or Loss From Less Common Sources Including Rental Real Estate, Royalties, Partnerships, S.

Learn how schedule e on form 1040 reports supplemental income and. What is schedule e on form 1040 and how does it affect your taxes? Taxpayers need to complete a. Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040.