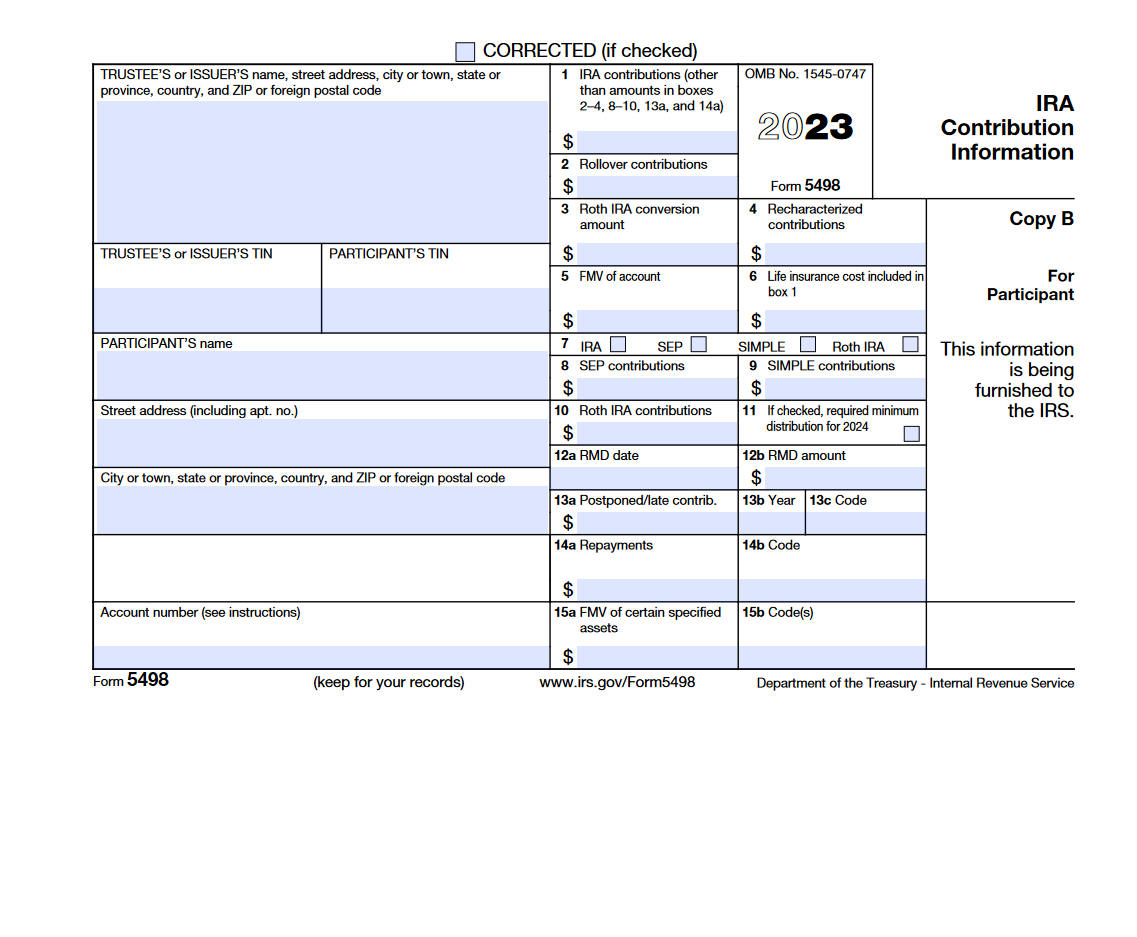

Roth Ira Tax Form 5498 - Roth contributions (and thus withdrawals) are taxed at. First, from regular contributions, not subject to tax or. Make non deductible contribution to traditional ira and do roth conversion) for previous year, you need to. If an employer offers 401k match for both traditional and roth, is it better to do roth, so the match grows tax free? If you are instead doing backdoor roth (i.e. The irs mandates that roth ira distributions be taken in this order: Roth accounts are a hedge against future tax hikes and tax rate insecurity. There’s a reason roth accounts are always subject to elimination every. Essentially you need to look at effective tax rates vs top marginal.

Roth contributions (and thus withdrawals) are taxed at. If an employer offers 401k match for both traditional and roth, is it better to do roth, so the match grows tax free? Essentially you need to look at effective tax rates vs top marginal. There’s a reason roth accounts are always subject to elimination every. First, from regular contributions, not subject to tax or. Make non deductible contribution to traditional ira and do roth conversion) for previous year, you need to. If you are instead doing backdoor roth (i.e. The irs mandates that roth ira distributions be taken in this order: Roth accounts are a hedge against future tax hikes and tax rate insecurity.

Roth contributions (and thus withdrawals) are taxed at. Essentially you need to look at effective tax rates vs top marginal. The irs mandates that roth ira distributions be taken in this order: There’s a reason roth accounts are always subject to elimination every. Roth accounts are a hedge against future tax hikes and tax rate insecurity. Make non deductible contribution to traditional ira and do roth conversion) for previous year, you need to. If an employer offers 401k match for both traditional and roth, is it better to do roth, so the match grows tax free? First, from regular contributions, not subject to tax or. If you are instead doing backdoor roth (i.e.

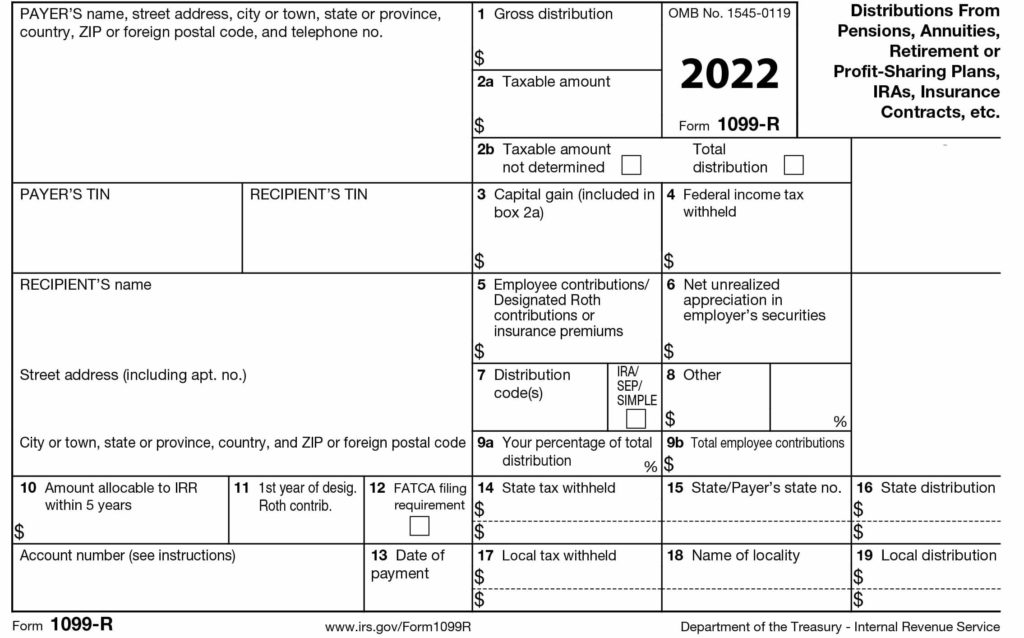

Fillable Online Re Form 5498 not given in time for roth IRA to do 2007

Essentially you need to look at effective tax rates vs top marginal. Make non deductible contribution to traditional ira and do roth conversion) for previous year, you need to. Roth contributions (and thus withdrawals) are taxed at. If an employer offers 401k match for both traditional and roth, is it better to do roth, so the match grows tax free?.

FDX

Make non deductible contribution to traditional ira and do roth conversion) for previous year, you need to. Roth contributions (and thus withdrawals) are taxed at. If you are instead doing backdoor roth (i.e. Essentially you need to look at effective tax rates vs top marginal. The irs mandates that roth ira distributions be taken in this order:

The Purpose of IRS Form 5498

Roth contributions (and thus withdrawals) are taxed at. The irs mandates that roth ira distributions be taken in this order: First, from regular contributions, not subject to tax or. If you are instead doing backdoor roth (i.e. Essentially you need to look at effective tax rates vs top marginal.

What is IRS Form 5498 IRA Contributions Information? Tax1099 Blog

If an employer offers 401k match for both traditional and roth, is it better to do roth, so the match grows tax free? Roth accounts are a hedge against future tax hikes and tax rate insecurity. There’s a reason roth accounts are always subject to elimination every. Make non deductible contribution to traditional ira and do roth conversion) for previous.

All About IRS Tax Form 5498 for 2020 IRA for individuals

Roth contributions (and thus withdrawals) are taxed at. First, from regular contributions, not subject to tax or. The irs mandates that roth ira distributions be taken in this order: Essentially you need to look at effective tax rates vs top marginal. Roth accounts are a hedge against future tax hikes and tax rate insecurity.

Form 5498 Your Complete Guide to IRA Contribution Information REI Prime

Make non deductible contribution to traditional ira and do roth conversion) for previous year, you need to. The irs mandates that roth ira distributions be taken in this order: First, from regular contributions, not subject to tax or. If an employer offers 401k match for both traditional and roth, is it better to do roth, so the match grows tax.

Backdoor IRA Gillingham CPA

If you are instead doing backdoor roth (i.e. Roth accounts are a hedge against future tax hikes and tax rate insecurity. There’s a reason roth accounts are always subject to elimination every. First, from regular contributions, not subject to tax or. Roth contributions (and thus withdrawals) are taxed at.

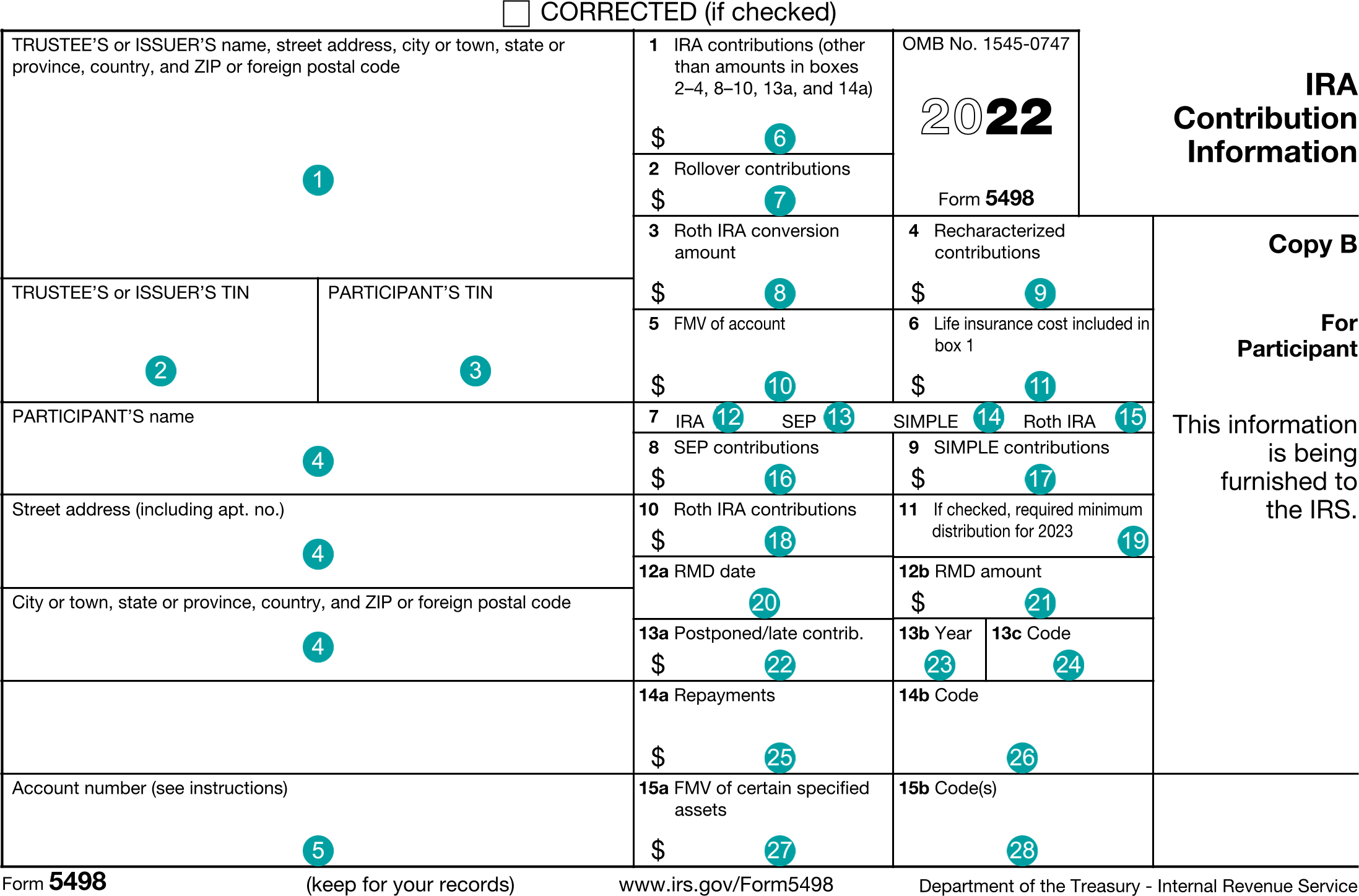

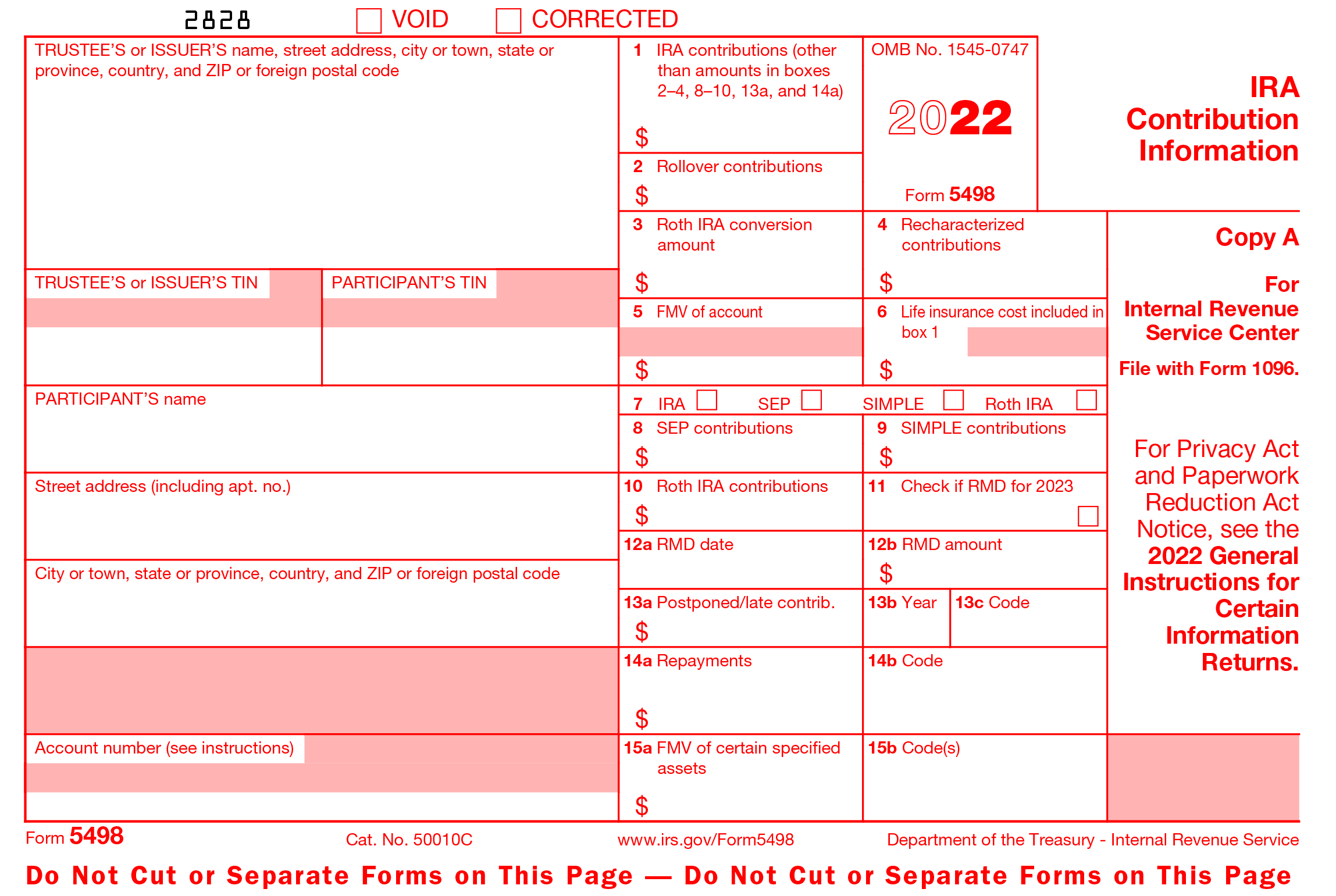

IRS Form 5498. IRA Contribution Information Forms Docs 2023

If you are instead doing backdoor roth (i.e. Roth accounts are a hedge against future tax hikes and tax rate insecurity. The irs mandates that roth ira distributions be taken in this order: First, from regular contributions, not subject to tax or. Roth contributions (and thus withdrawals) are taxed at.

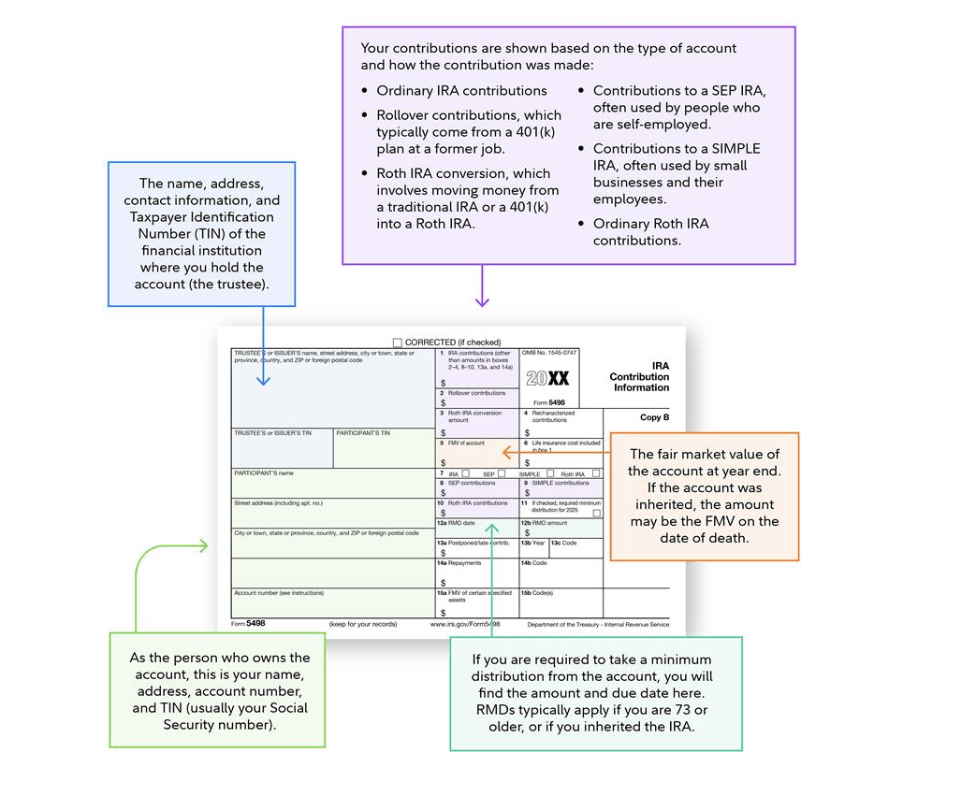

What is Form 5498? IRA Reporting Explained [2025]

There’s a reason roth accounts are always subject to elimination every. Roth contributions (and thus withdrawals) are taxed at. If you are instead doing backdoor roth (i.e. Essentially you need to look at effective tax rates vs top marginal. First, from regular contributions, not subject to tax or.

What is IRS Form 5498? A Complete Guide

Make non deductible contribution to traditional ira and do roth conversion) for previous year, you need to. Roth contributions (and thus withdrawals) are taxed at. The irs mandates that roth ira distributions be taken in this order: Essentially you need to look at effective tax rates vs top marginal. If an employer offers 401k match for both traditional and roth,.

Roth Accounts Are A Hedge Against Future Tax Hikes And Tax Rate Insecurity.

The irs mandates that roth ira distributions be taken in this order: First, from regular contributions, not subject to tax or. If an employer offers 401k match for both traditional and roth, is it better to do roth, so the match grows tax free? There’s a reason roth accounts are always subject to elimination every.

If You Are Instead Doing Backdoor Roth (I.e.

Make non deductible contribution to traditional ira and do roth conversion) for previous year, you need to. Roth contributions (and thus withdrawals) are taxed at. Essentially you need to look at effective tax rates vs top marginal.

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)

![What is Form 5498? IRA Reporting Explained [2025]](https://www.keka.com/us/wp-content/uploads/2025/04/sample-form-5498-1024x873.jpg)