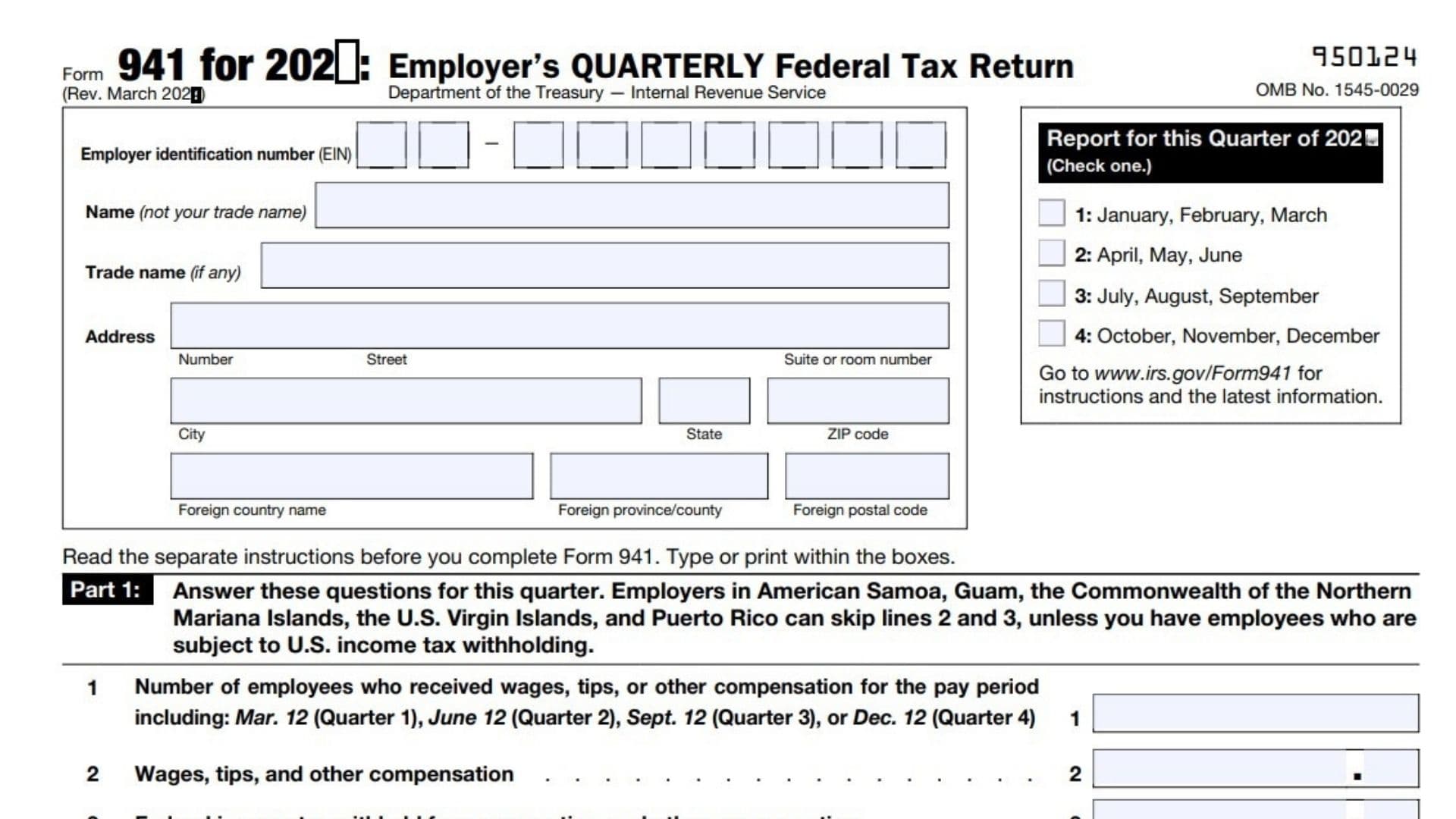

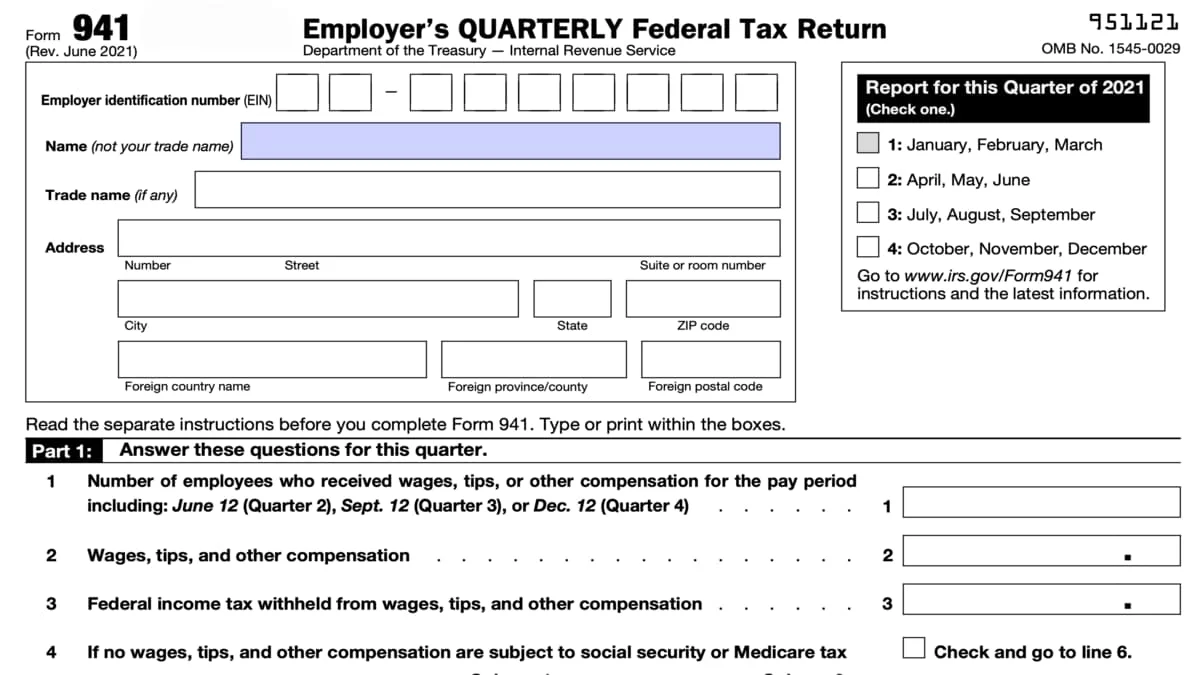

Form 941 Tax Form - Answer these questions for this quarter. Tax year 2024 guide to the employer's quarterly federal tax form 941. Read the separate instructions before you complete form 941. Learn filing essentials, get instructions, deadlines, mailing. If you have employees, you. You'll file form 941 quarterly to report employee federal withholdings. 🔥 nearly 40% of small businesses pay ~$845 in payroll tax penalties each year due to mistakes. Irs form 941, also known as the employer’s quarterly federal tax return, is used when businesses report the income taxes, payroll. Type or print within the boxes. To fill out irs form 941, you’ll report.

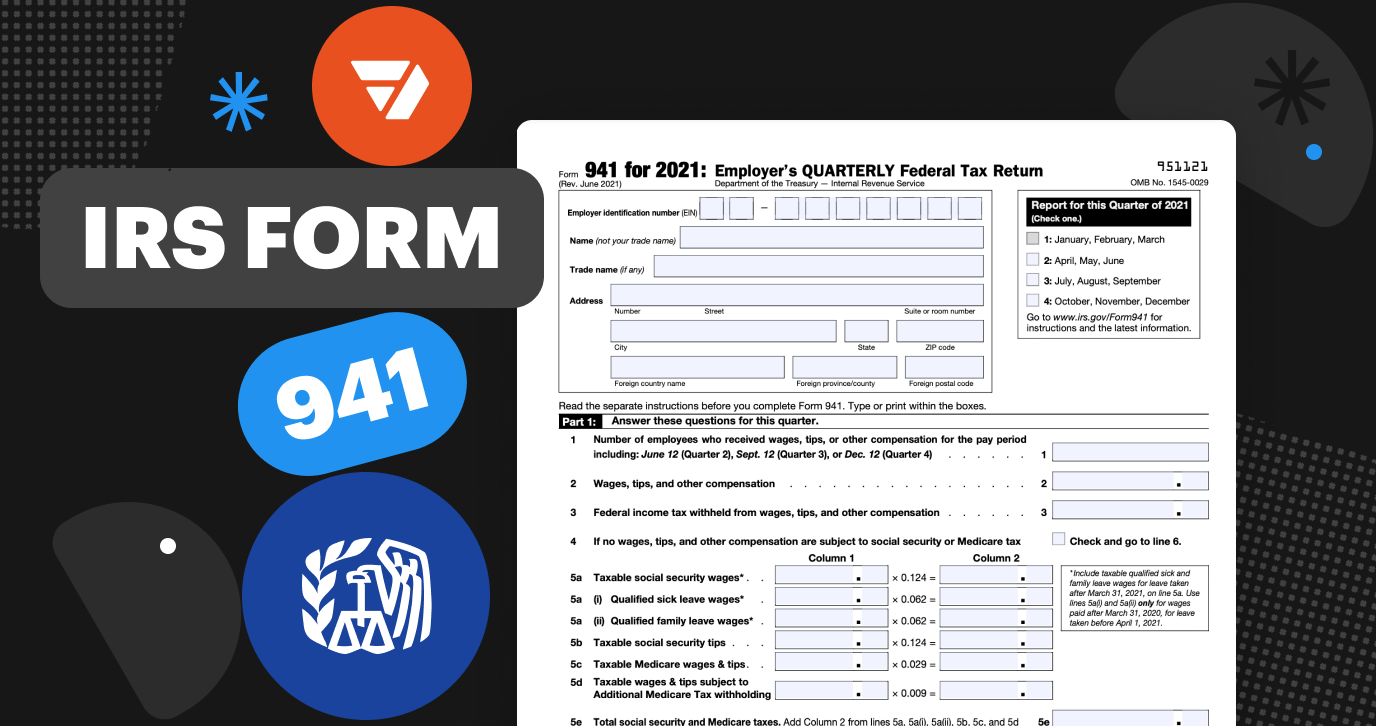

What is tax form 941, and who needs to file it? 🔥 nearly 40% of small businesses pay ~$845 in payroll tax penalties each year due to mistakes. Irs form 941, also known as the employer’s quarterly federal tax return, is used when businesses report the income taxes, payroll. If you have employees, you. Tax year 2024 guide to the employer's quarterly federal tax form 941. Read the separate instructions before you complete form 941. Type or print within the boxes. Learn filing essentials, get instructions, deadlines, mailing. You'll file form 941 quarterly to report employee federal withholdings. To fill out irs form 941, you’ll report.

Learn filing essentials, get instructions, deadlines, mailing. What is tax form 941, and who needs to file it? 🔥 nearly 40% of small businesses pay ~$845 in payroll tax penalties each year due to mistakes. You'll file form 941 quarterly to report employee federal withholdings. Read the separate instructions before you complete form 941. Tax year 2024 guide to the employer's quarterly federal tax form 941. Type or print within the boxes. Answer these questions for this quarter. To fill out irs form 941, you’ll report. Irs form 941, also known as the employer’s quarterly federal tax return, is used when businesses report the income taxes, payroll.

Form 941 Instructions 2024 2025

🔥 nearly 40% of small businesses pay ~$845 in payroll tax penalties each year due to mistakes. What is tax form 941, and who needs to file it? You'll file form 941 quarterly to report employee federal withholdings. If you have employees, you. Answer these questions for this quarter.

Form 941 template ONLYOFFICE

Irs form 941, also known as the employer’s quarterly federal tax return, is used when businesses report the income taxes, payroll. Read the separate instructions before you complete form 941. 🔥 nearly 40% of small businesses pay ~$845 in payroll tax penalties each year due to mistakes. If you have employees, you. What is tax form 941, and who needs.

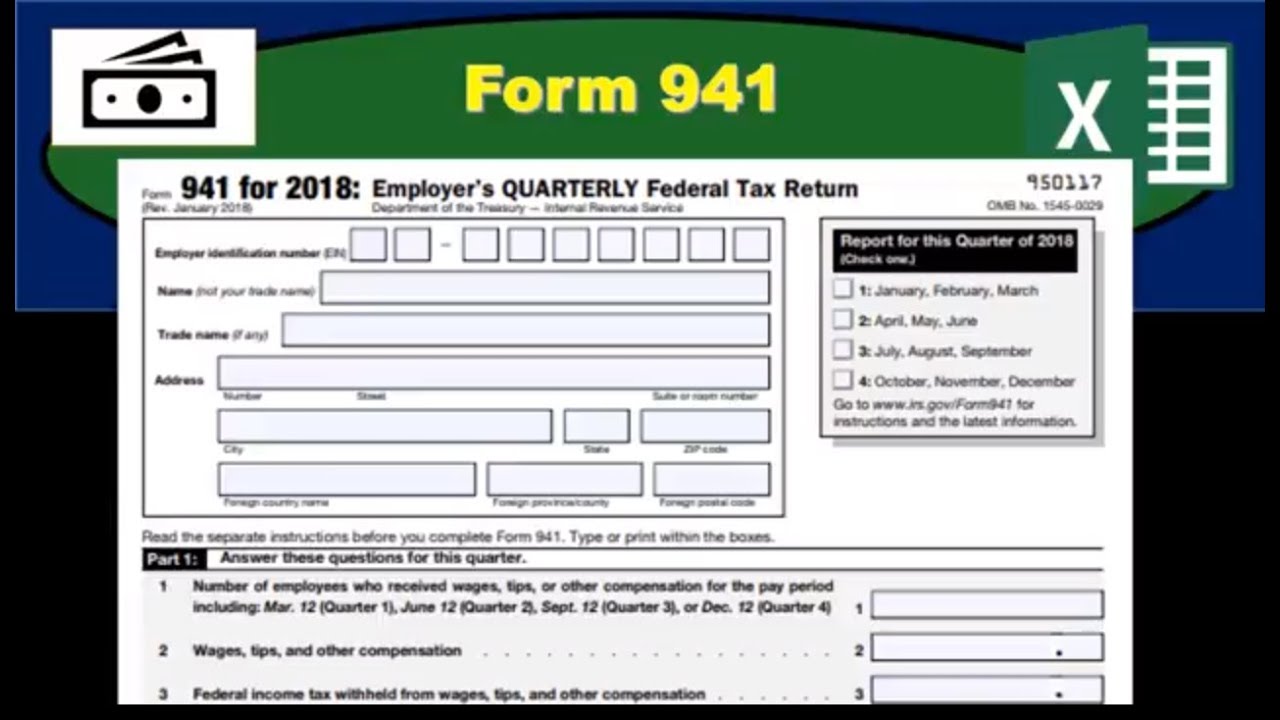

Form 941 Instructions Where to Mail Employer’s Quarterly Federal Tax

Read the separate instructions before you complete form 941. Type or print within the boxes. Answer these questions for this quarter. Irs form 941, also known as the employer’s quarterly federal tax return, is used when businesses report the income taxes, payroll. If you have employees, you.

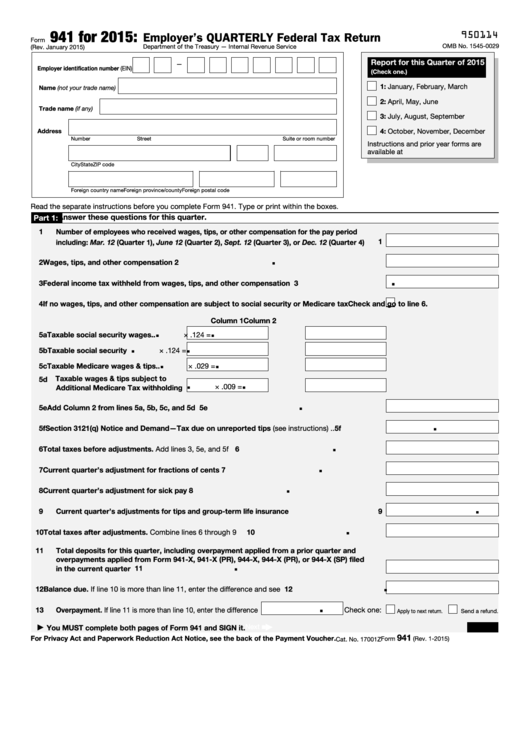

Form 941 Employer's Quarterly Federal Tax Return (2015) Free Download

Answer these questions for this quarter. Type or print within the boxes. Learn filing essentials, get instructions, deadlines, mailing. You'll file form 941 quarterly to report employee federal withholdings. What is tax form 941, and who needs to file it?

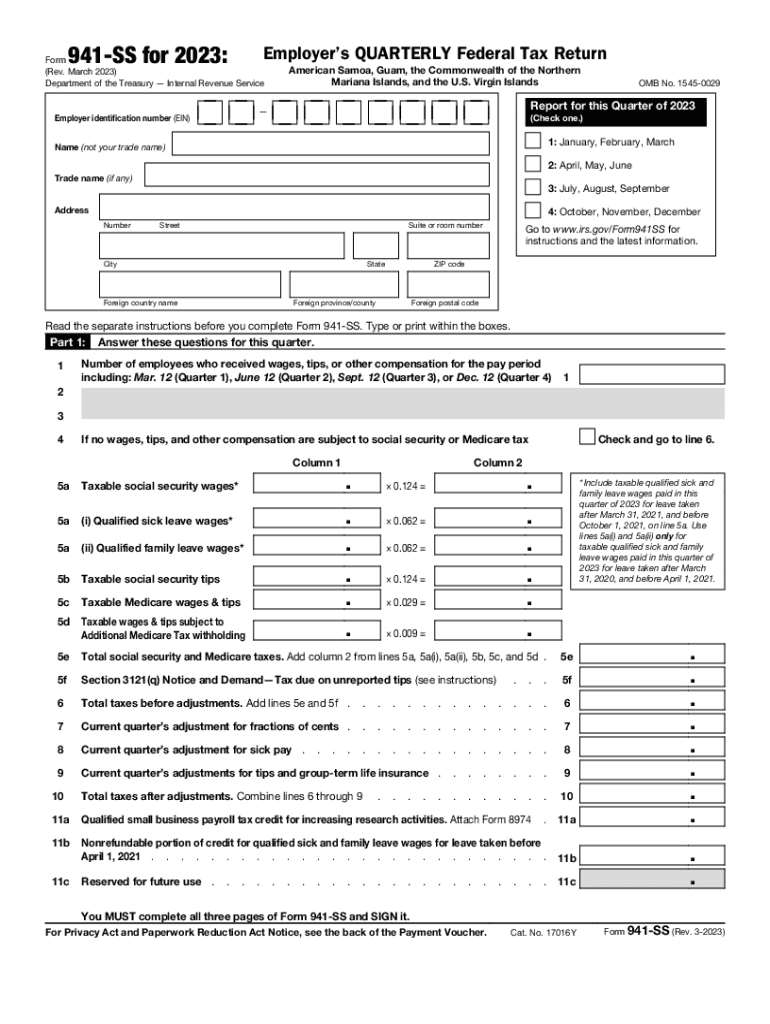

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

Learn filing essentials, get instructions, deadlines, mailing. You'll file form 941 quarterly to report employee federal withholdings. To fill out irs form 941, you’ll report. What is tax form 941, and who needs to file it? Irs form 941, also known as the employer’s quarterly federal tax return, is used when businesses report the income taxes, payroll.

Form 941 Quarterly Payroll Tax Form How Fill Out YouTube

🔥 nearly 40% of small businesses pay ~$845 in payroll tax penalties each year due to mistakes. Learn filing essentials, get instructions, deadlines, mailing. Tax year 2024 guide to the employer's quarterly federal tax form 941. You'll file form 941 quarterly to report employee federal withholdings. Type or print within the boxes.

Irs 941 quarterly form Fill out & sign online DocHub

If you have employees, you. Type or print within the boxes. Learn filing essentials, get instructions, deadlines, mailing. Tax year 2024 guide to the employer's quarterly federal tax form 941. To fill out irs form 941, you’ll report.

What Employers Need to Know about 941 Quarterly Tax Return?

Read the separate instructions before you complete form 941. If you have employees, you. Type or print within the boxes. Learn filing essentials, get instructions, deadlines, mailing. Irs form 941, also known as the employer’s quarterly federal tax return, is used when businesses report the income taxes, payroll.

941 Forms TaxUni

Answer these questions for this quarter. You'll file form 941 quarterly to report employee federal withholdings. What is tax form 941, and who needs to file it? Irs form 941, also known as the employer’s quarterly federal tax return, is used when businesses report the income taxes, payroll. If you have employees, you.

Fillable Form 941 Employer S Quarterly Federal Tax Printable Form 2022

To fill out irs form 941, you’ll report. Irs form 941, also known as the employer’s quarterly federal tax return, is used when businesses report the income taxes, payroll. Learn filing essentials, get instructions, deadlines, mailing. If you have employees, you. You'll file form 941 quarterly to report employee federal withholdings.

Tax Year 2024 Guide To The Employer's Quarterly Federal Tax Form 941.

Type or print within the boxes. You'll file form 941 quarterly to report employee federal withholdings. Read the separate instructions before you complete form 941. Learn filing essentials, get instructions, deadlines, mailing.

What Is Tax Form 941, And Who Needs To File It?

Irs form 941, also known as the employer’s quarterly federal tax return, is used when businesses report the income taxes, payroll. Answer these questions for this quarter. 🔥 nearly 40% of small businesses pay ~$845 in payroll tax penalties each year due to mistakes. To fill out irs form 941, you’ll report.