Form 8941 - Prior yr 8941 must be entered. Prior form 8941 must be entered question c does a tax return you (or any. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after. I am not a small business owner and don't have this form. And then a check box with py 8941 no box is.

Eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after. Prior yr 8941 must be entered. I am not a small business owner and don't have this form. Prior form 8941 must be entered question c does a tax return you (or any. And then a check box with py 8941 no box is.

I am not a small business owner and don't have this form. Prior form 8941 must be entered question c does a tax return you (or any. Prior yr 8941 must be entered. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after. And then a check box with py 8941 no box is.

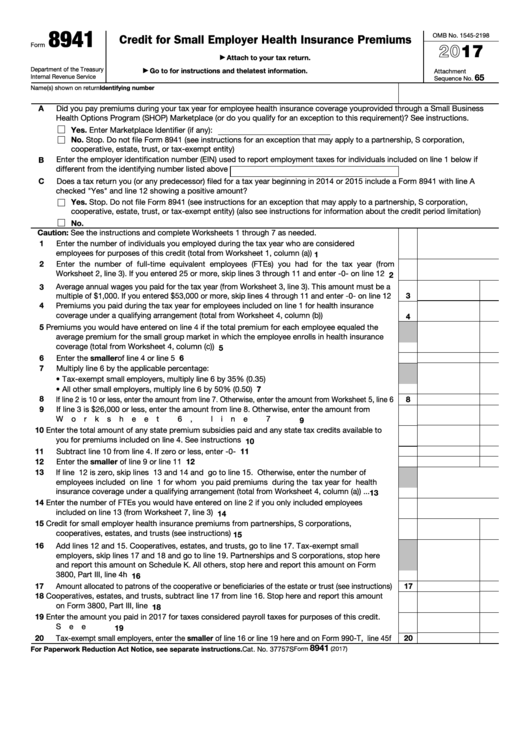

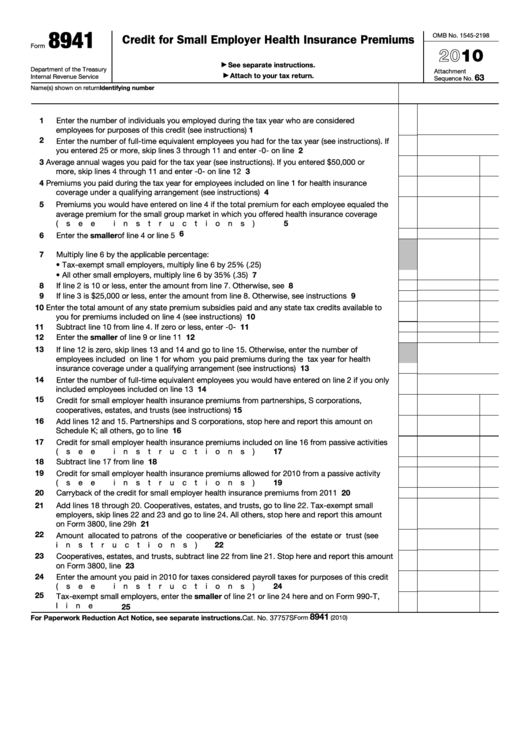

Fillable Form 8941 Credit For Small Employer Health Insurance

Prior yr 8941 must be entered. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after. Prior form 8941 must be entered question c does a tax return you (or any. I am not a small business owner and don't have this form. And then a check.

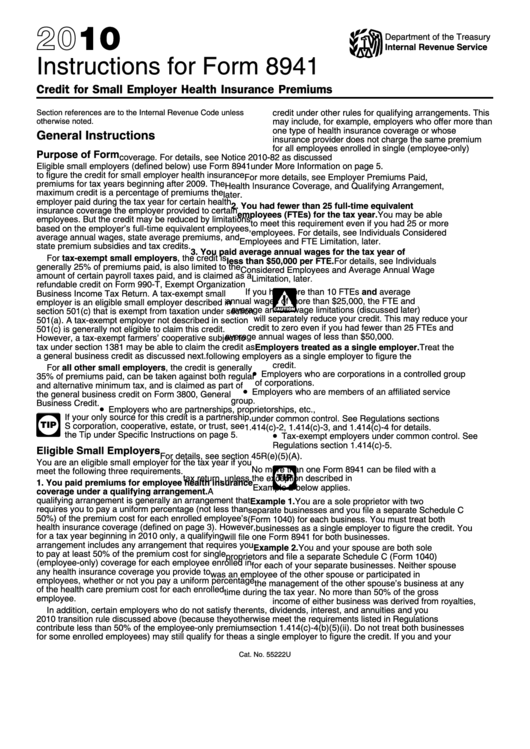

Instructions For Form 8941 Credit For Small Employer Health Insurance

Prior form 8941 must be entered question c does a tax return you (or any. I am not a small business owner and don't have this form. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after. And then a check box with py 8941 no box.

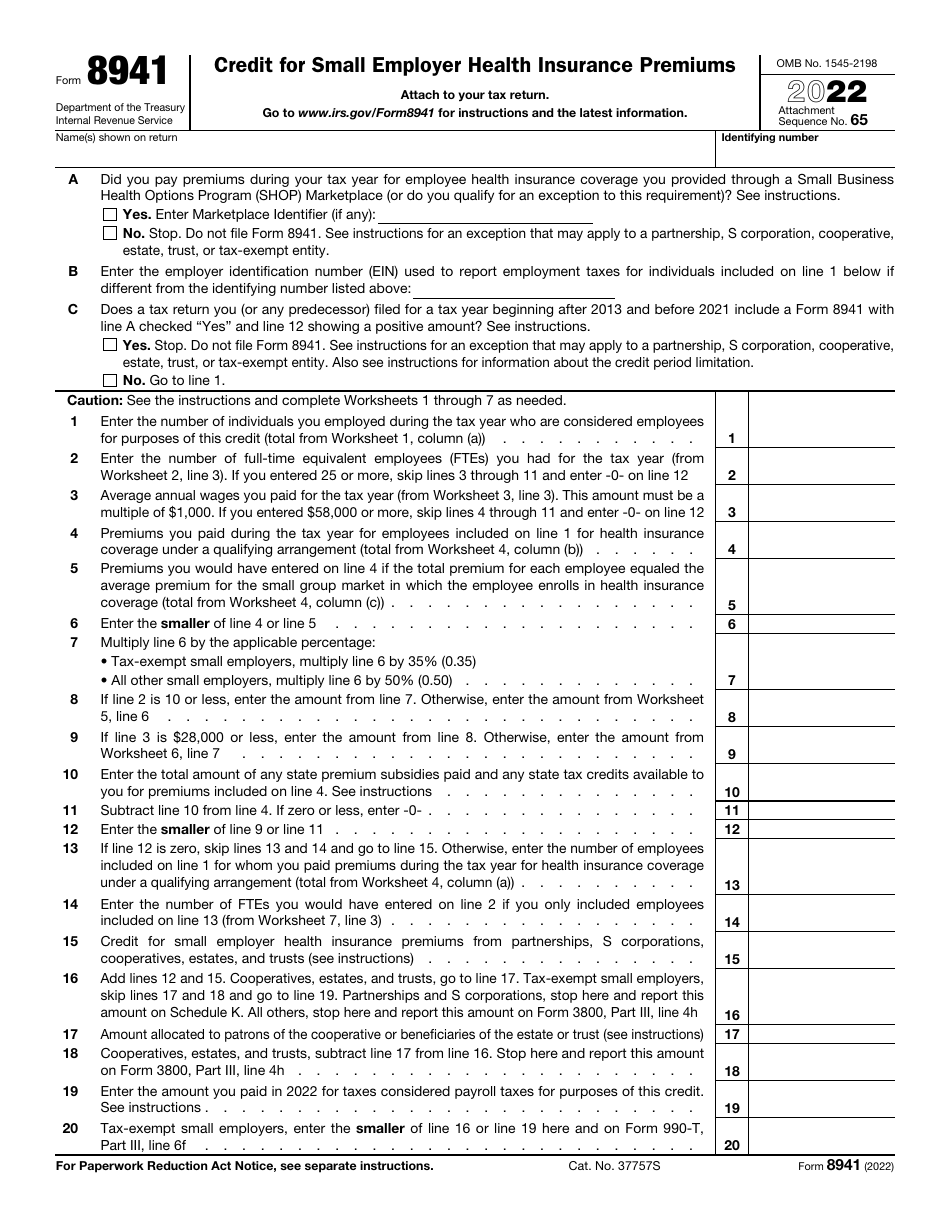

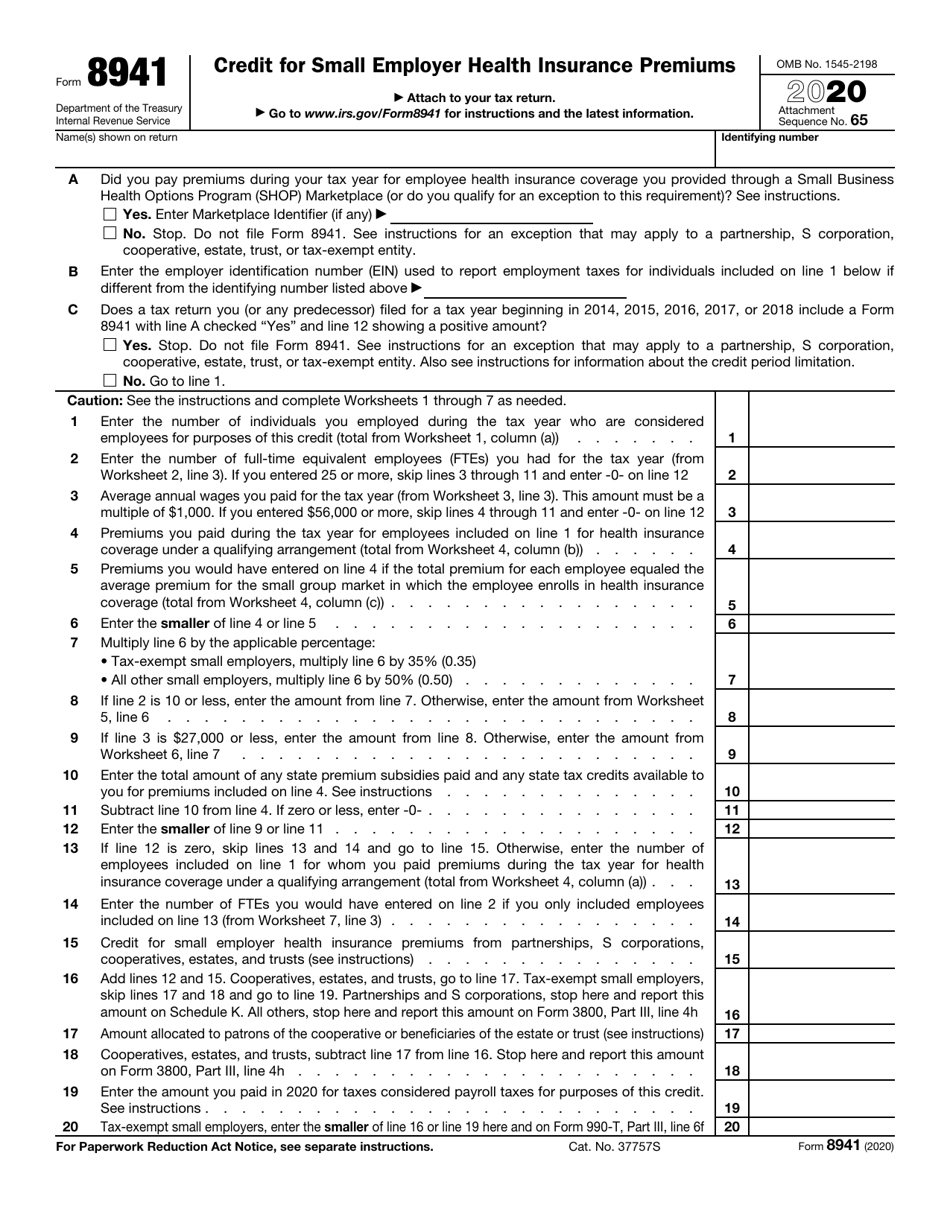

IRS Form 8941 Download Fillable PDF or Fill Online Credit for Small

Prior yr 8941 must be entered. And then a check box with py 8941 no box is. I am not a small business owner and don't have this form. Prior form 8941 must be entered question c does a tax return you (or any. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health.

IRS Form 8941 Download Fillable PDF or Fill Online Credit for Small

I am not a small business owner and don't have this form. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after. And then a check box with py 8941 no box is. Prior yr 8941 must be entered. Prior form 8941 must be entered question c.

Download Instructions for IRS Form 8941 Credit for Small Employer

And then a check box with py 8941 no box is. I am not a small business owner and don't have this form. Prior form 8941 must be entered question c does a tax return you (or any. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning.

Download Instructions for IRS Form 8941 Credit for Small Employer

And then a check box with py 8941 no box is. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after. Prior form 8941 must be entered question c does a tax return you (or any. I am not a small business owner and don't have this.

Download Instructions for IRS Form 8941 Credit for Small Employer

Prior yr 8941 must be entered. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after. Prior form 8941 must be entered question c does a tax return you (or any. I am not a small business owner and don't have this form. And then a check.

Download Instructions for IRS Form 8941 Credit for Small Employer

I am not a small business owner and don't have this form. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after. Prior yr 8941 must be entered. Prior form 8941 must be entered question c does a tax return you (or any. And then a check.

Fillable Form 8941 (2010) Credit For Small Employer Health Insurance

I am not a small business owner and don't have this form. And then a check box with py 8941 no box is. Prior form 8941 must be entered question c does a tax return you (or any. Prior yr 8941 must be entered. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health.

Form 8941 Credit for Small Employer Health Insurance Premiums (2014

I am not a small business owner and don't have this form. Prior yr 8941 must be entered. And then a check box with py 8941 no box is. Prior form 8941 must be entered question c does a tax return you (or any. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health.

And Then A Check Box With Py 8941 No Box Is.

Prior yr 8941 must be entered. Prior form 8941 must be entered question c does a tax return you (or any. I am not a small business owner and don't have this form. Eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after.