Form 8821 Vs Form 2848 - Understanding form 2848 and form 8821 ahead of time — and filing the right one — can make life easier for everyone. Find out which form is right for your tax representation and authorized. Learn the key differences between irs form 8821 and irs form 2848. Understand the key difference between granting someone power to represent you before. Securely upload form 2848, power of attorney and declaration of. Learn the differences between them and how they can help you authorize someone to act on. Confused about irs form 8821 vs. Get details in form 2848 instructions or form 8821 instructions.

Understanding form 2848 and form 8821 ahead of time — and filing the right one — can make life easier for everyone. Get details in form 2848 instructions or form 8821 instructions. Understand the key difference between granting someone power to represent you before. Find out which form is right for your tax representation and authorized. Learn the key differences between irs form 8821 and irs form 2848. Securely upload form 2848, power of attorney and declaration of. Confused about irs form 8821 vs. Learn the differences between them and how they can help you authorize someone to act on.

Learn the key differences between irs form 8821 and irs form 2848. Find out which form is right for your tax representation and authorized. Securely upload form 2848, power of attorney and declaration of. Confused about irs form 8821 vs. Get details in form 2848 instructions or form 8821 instructions. Learn the differences between them and how they can help you authorize someone to act on. Understand the key difference between granting someone power to represent you before. Understanding form 2848 and form 8821 ahead of time — and filing the right one — can make life easier for everyone.

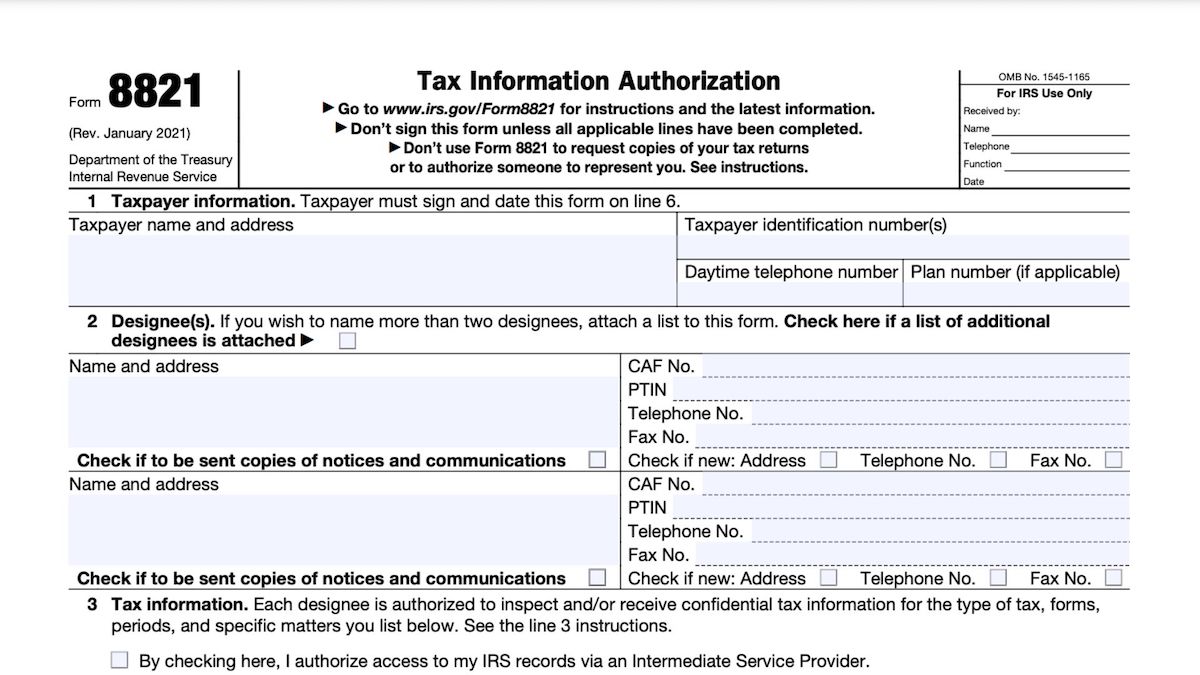

When Do You Need to File IRS Form 8821? Tax Relief Helpers

Get details in form 2848 instructions or form 8821 instructions. Understanding form 2848 and form 8821 ahead of time — and filing the right one — can make life easier for everyone. Learn the key differences between irs form 8821 and irs form 2848. Find out which form is right for your tax representation and authorized. Confused about irs form.

What is Form 8821 or Tax Guard Excel Capital Management

Get details in form 2848 instructions or form 8821 instructions. Securely upload form 2848, power of attorney and declaration of. Learn the key differences between irs form 8821 and irs form 2848. Learn the differences between them and how they can help you authorize someone to act on. Confused about irs form 8821 vs.

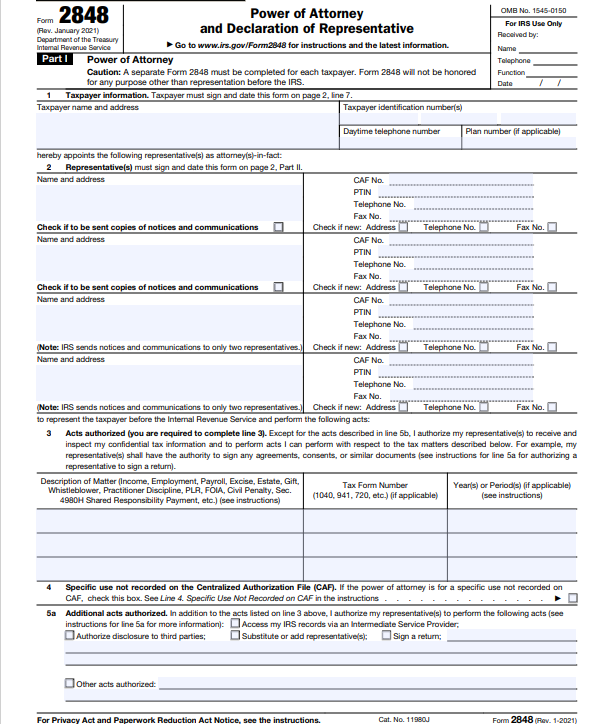

Form 2848 Power of Attorney and Declaration of Representative Definition

Understand the key difference between granting someone power to represent you before. Understanding form 2848 and form 8821 ahead of time — and filing the right one — can make life easier for everyone. Learn the differences between them and how they can help you authorize someone to act on. Confused about irs form 8821 vs. Securely upload form 2848,.

Tax Smack IRS Form 8821 & Form 2848 YouTube

Securely upload form 2848, power of attorney and declaration of. Understand the key difference between granting someone power to represent you before. Find out which form is right for your tax representation and authorized. Learn the key differences between irs form 8821 and irs form 2848. Confused about irs form 8821 vs.

Irs Faxnumber

Learn the key differences between irs form 8821 and irs form 2848. Get details in form 2848 instructions or form 8821 instructions. Find out which form is right for your tax representation and authorized. Confused about irs form 8821 vs. Understand the key difference between granting someone power to represent you before.

Doc

Get details in form 2848 instructions or form 8821 instructions. Learn the differences between them and how they can help you authorize someone to act on. Confused about irs form 8821 vs. Understand the key difference between granting someone power to represent you before. Find out which form is right for your tax representation and authorized.

The Tax Times IRS Has Updated Its Taxpayer And Third Party

Learn the key differences between irs form 8821 and irs form 2848. Get details in form 2848 instructions or form 8821 instructions. Understanding form 2848 and form 8821 ahead of time — and filing the right one — can make life easier for everyone. Confused about irs form 8821 vs. Learn the differences between them and how they can help.

8821 Form 2025 IRS Forms

Find out which form is right for your tax representation and authorized. Securely upload form 2848, power of attorney and declaration of. Learn the key differences between irs form 8821 and irs form 2848. Understand the key difference between granting someone power to represent you before. Confused about irs form 8821 vs.

Fill Out Form 2848 Power of Attorney to Authorize IRS Representation

Understand the key difference between granting someone power to represent you before. Confused about irs form 8821 vs. Get details in form 2848 instructions or form 8821 instructions. Securely upload form 2848, power of attorney and declaration of. Understanding form 2848 and form 8821 ahead of time — and filing the right one — can make life easier for everyone.

IRS Form 8821 vs. 2848 Which to Choose? Tax Relief Helpers

Securely upload form 2848, power of attorney and declaration of. Learn the key differences between irs form 8821 and irs form 2848. Understand the key difference between granting someone power to represent you before. Understanding form 2848 and form 8821 ahead of time — and filing the right one — can make life easier for everyone. Learn the differences between.

Find Out Which Form Is Right For Your Tax Representation And Authorized.

Securely upload form 2848, power of attorney and declaration of. Understand the key difference between granting someone power to represent you before. Learn the key differences between irs form 8821 and irs form 2848. Confused about irs form 8821 vs.

Learn The Differences Between Them And How They Can Help You Authorize Someone To Act On.

Understanding form 2848 and form 8821 ahead of time — and filing the right one — can make life easier for everyone. Get details in form 2848 instructions or form 8821 instructions.

:max_bytes(150000):strip_icc()/2848-f0c6a242a34340aa97b1dcfbe3a539d6.jpg)