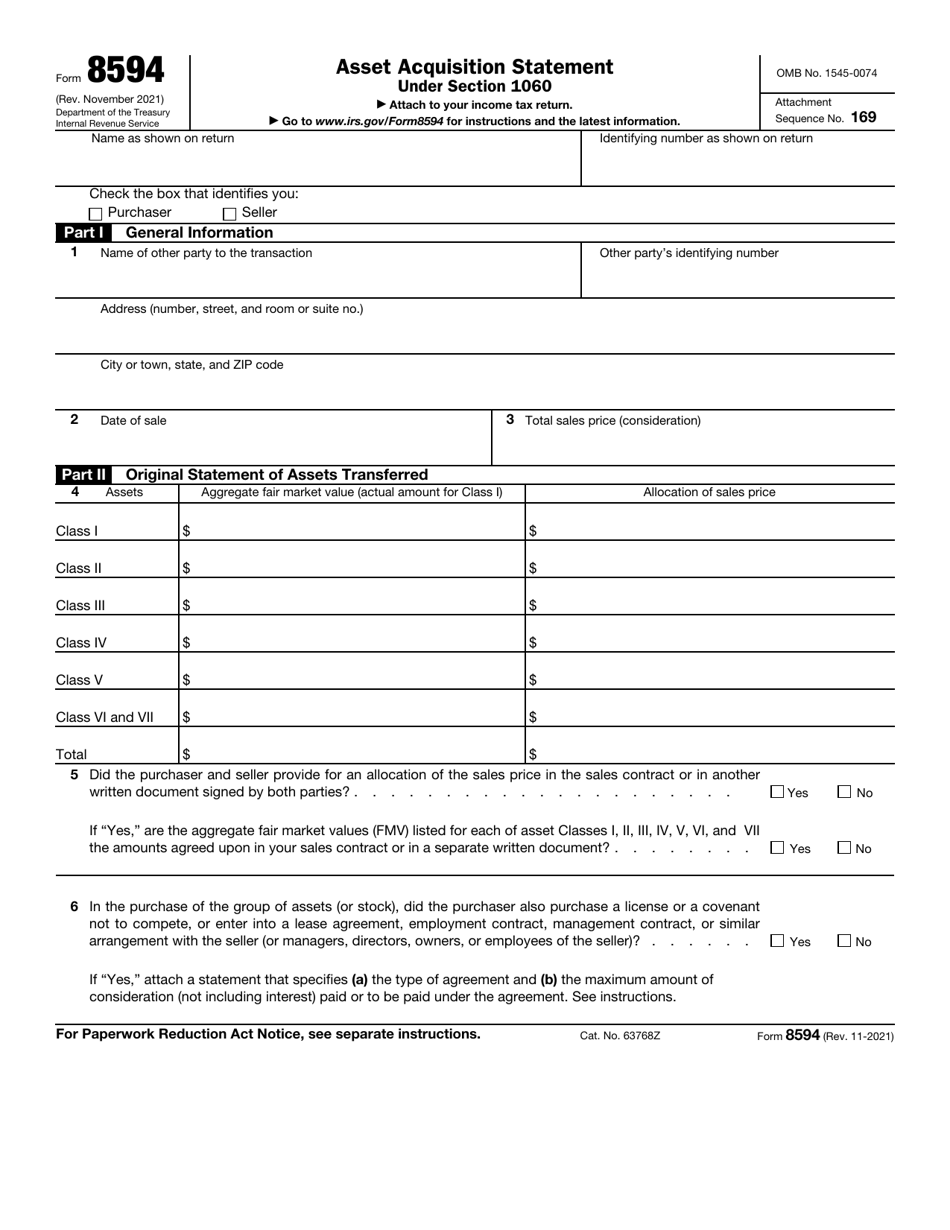

Form 8594 Pdf - Fill out the asset acquisition statement under section 1060 online. Download or print the 2024 federal form 8594 (asset acquisition statement under section 1060) for free from the federal internal revenue service. Form 8594 provides a standardized method for both parties to report this allocation, ensuring consistency and compliance with section 1060 of. A simple guide to completing irs form 8594 for asset acquisitions in business sales, ensuring both parties agree on the value for tax purposes. If “yes,” attach a statement that specifies (a) the type of agreement and (b) the maximum amount of consideration (not including interest) paid or to be.

Form 8594 provides a standardized method for both parties to report this allocation, ensuring consistency and compliance with section 1060 of. A simple guide to completing irs form 8594 for asset acquisitions in business sales, ensuring both parties agree on the value for tax purposes. If “yes,” attach a statement that specifies (a) the type of agreement and (b) the maximum amount of consideration (not including interest) paid or to be. Download or print the 2024 federal form 8594 (asset acquisition statement under section 1060) for free from the federal internal revenue service. Fill out the asset acquisition statement under section 1060 online.

Form 8594 provides a standardized method for both parties to report this allocation, ensuring consistency and compliance with section 1060 of. A simple guide to completing irs form 8594 for asset acquisitions in business sales, ensuring both parties agree on the value for tax purposes. If “yes,” attach a statement that specifies (a) the type of agreement and (b) the maximum amount of consideration (not including interest) paid or to be. Fill out the asset acquisition statement under section 1060 online. Download or print the 2024 federal form 8594 (asset acquisition statement under section 1060) for free from the federal internal revenue service.

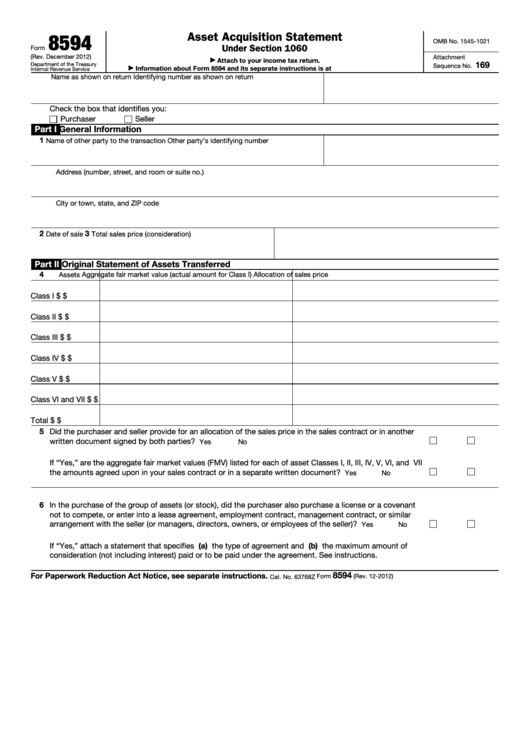

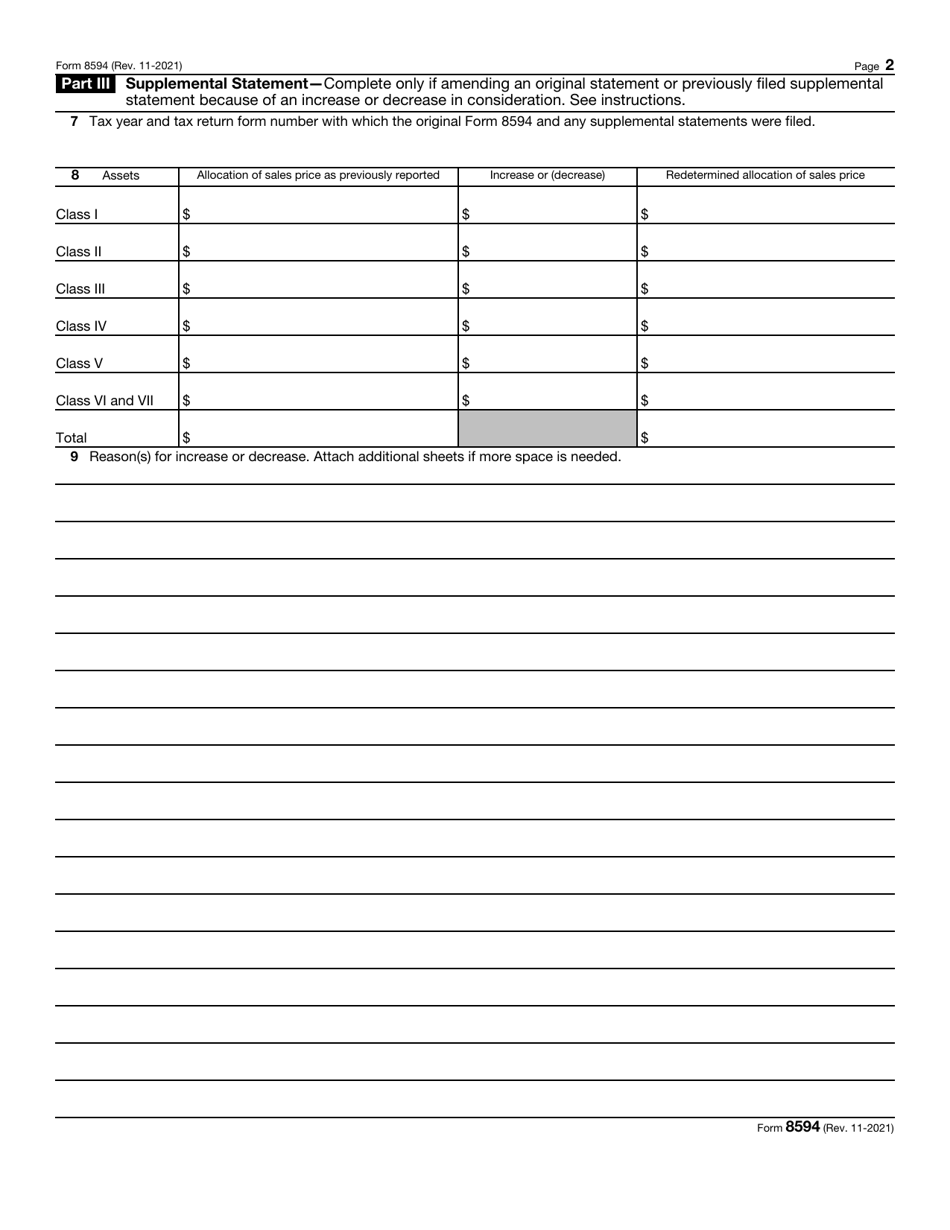

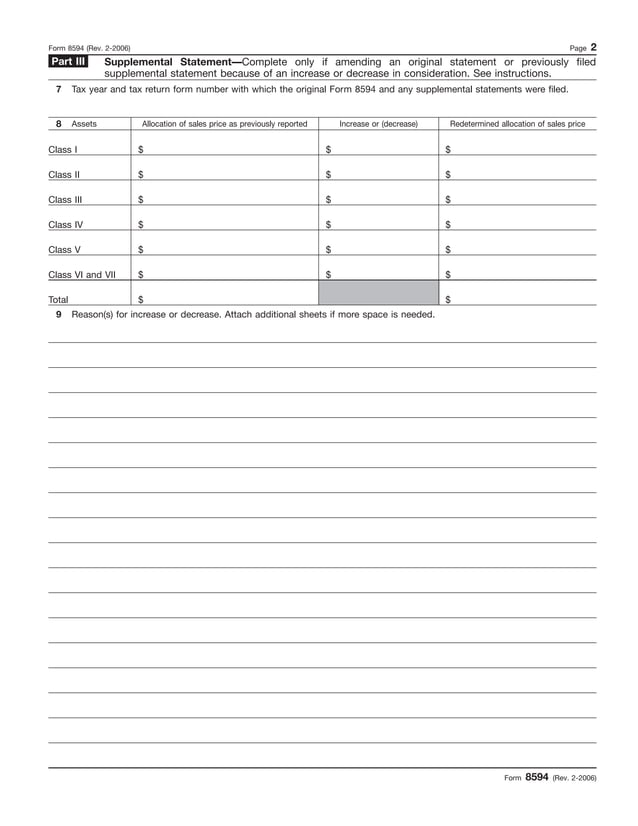

Fillable Form 8594 Asset Acquisition Statement printable pdf download

Form 8594 provides a standardized method for both parties to report this allocation, ensuring consistency and compliance with section 1060 of. Download or print the 2024 federal form 8594 (asset acquisition statement under section 1060) for free from the federal internal revenue service. A simple guide to completing irs form 8594 for asset acquisitions in business sales, ensuring both parties.

Fillable Online 8594 Asset Acquisition Statement Irs Tax Forms PDF

A simple guide to completing irs form 8594 for asset acquisitions in business sales, ensuring both parties agree on the value for tax purposes. If “yes,” attach a statement that specifies (a) the type of agreement and (b) the maximum amount of consideration (not including interest) paid or to be. Form 8594 provides a standardized method for both parties to.

Fillable Online Irs Form 8594 Asset Acquisition Statement Fax Email

If “yes,” attach a statement that specifies (a) the type of agreement and (b) the maximum amount of consideration (not including interest) paid or to be. A simple guide to completing irs form 8594 for asset acquisitions in business sales, ensuring both parties agree on the value for tax purposes. Download or print the 2024 federal form 8594 (asset acquisition.

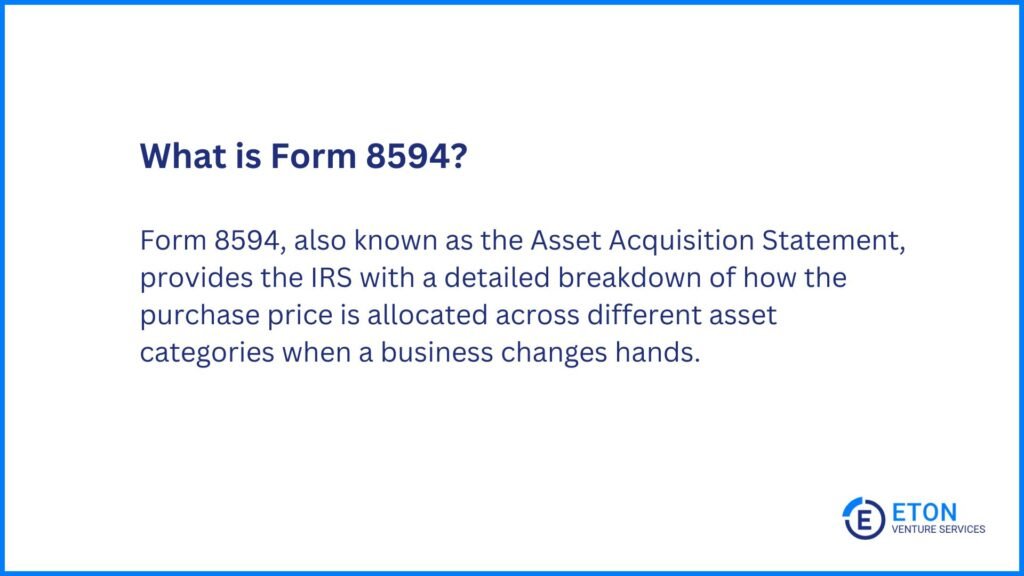

Form 8594 Explained The Purchase Price Allocation Form

Form 8594 provides a standardized method for both parties to report this allocation, ensuring consistency and compliance with section 1060 of. A simple guide to completing irs form 8594 for asset acquisitions in business sales, ensuring both parties agree on the value for tax purposes. Fill out the asset acquisition statement under section 1060 online. If “yes,” attach a statement.

Fillable Online Irs Form 8594 Instructions 2012 Fax Email Print pdfFiller

A simple guide to completing irs form 8594 for asset acquisitions in business sales, ensuring both parties agree on the value for tax purposes. If “yes,” attach a statement that specifies (a) the type of agreement and (b) the maximum amount of consideration (not including interest) paid or to be. Form 8594 provides a standardized method for both parties to.

Fillable Online About Form 8594, Asset Acquisition Statement Under

Download or print the 2024 federal form 8594 (asset acquisition statement under section 1060) for free from the federal internal revenue service. A simple guide to completing irs form 8594 for asset acquisitions in business sales, ensuring both parties agree on the value for tax purposes. Form 8594 provides a standardized method for both parties to report this allocation, ensuring.

IRS Form 8594 Download Fillable PDF or Fill Online Asset Acquisition

Form 8594 provides a standardized method for both parties to report this allocation, ensuring consistency and compliance with section 1060 of. If “yes,” attach a statement that specifies (a) the type of agreement and (b) the maximum amount of consideration (not including interest) paid or to be. Download or print the 2024 federal form 8594 (asset acquisition statement under section.

Form 8594

A simple guide to completing irs form 8594 for asset acquisitions in business sales, ensuring both parties agree on the value for tax purposes. Download or print the 2024 federal form 8594 (asset acquisition statement under section 1060) for free from the federal internal revenue service. If “yes,” attach a statement that specifies (a) the type of agreement and (b).

IRS Form 8594 Download Fillable PDF or Fill Online Asset Acquisition

Fill out the asset acquisition statement under section 1060 online. Form 8594 provides a standardized method for both parties to report this allocation, ensuring consistency and compliance with section 1060 of. A simple guide to completing irs form 8594 for asset acquisitions in business sales, ensuring both parties agree on the value for tax purposes. Download or print the 2024.

Form 8594Asset Acquisition Statement PDF

Download or print the 2024 federal form 8594 (asset acquisition statement under section 1060) for free from the federal internal revenue service. If “yes,” attach a statement that specifies (a) the type of agreement and (b) the maximum amount of consideration (not including interest) paid or to be. Fill out the asset acquisition statement under section 1060 online. A simple.

Fill Out The Asset Acquisition Statement Under Section 1060 Online.

Form 8594 provides a standardized method for both parties to report this allocation, ensuring consistency and compliance with section 1060 of. Download or print the 2024 federal form 8594 (asset acquisition statement under section 1060) for free from the federal internal revenue service. If “yes,” attach a statement that specifies (a) the type of agreement and (b) the maximum amount of consideration (not including interest) paid or to be. A simple guide to completing irs form 8594 for asset acquisitions in business sales, ensuring both parties agree on the value for tax purposes.