Form 843 Penalty Abatement - Details & instructions on using this form. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. For the failure to file or pay penalty, taxpayers can request that the irs “abate” the penalties. One of the most common uses of form 843 is to request an abatement (cancellation or refund) of irs. Penalties and additions to tax: Abatement is simply removing the. This guide will walk you through the process, ensuring you. Taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain types of tax related charges. Accurately filling out form 843 is key to a successful penalty abatement request.

One of the most common uses of form 843 is to request an abatement (cancellation or refund) of irs. Details & instructions on using this form. This guide will walk you through the process, ensuring you. For the failure to file or pay penalty, taxpayers can request that the irs “abate” the penalties. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain types of tax related charges. Abatement is simply removing the. Accurately filling out form 843 is key to a successful penalty abatement request. Penalties and additions to tax:

One of the most common uses of form 843 is to request an abatement (cancellation or refund) of irs. Details & instructions on using this form. Penalties and additions to tax: This guide will walk you through the process, ensuring you. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Accurately filling out form 843 is key to a successful penalty abatement request. Abatement is simply removing the. Taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain types of tax related charges. For the failure to file or pay penalty, taxpayers can request that the irs “abate” the penalties.

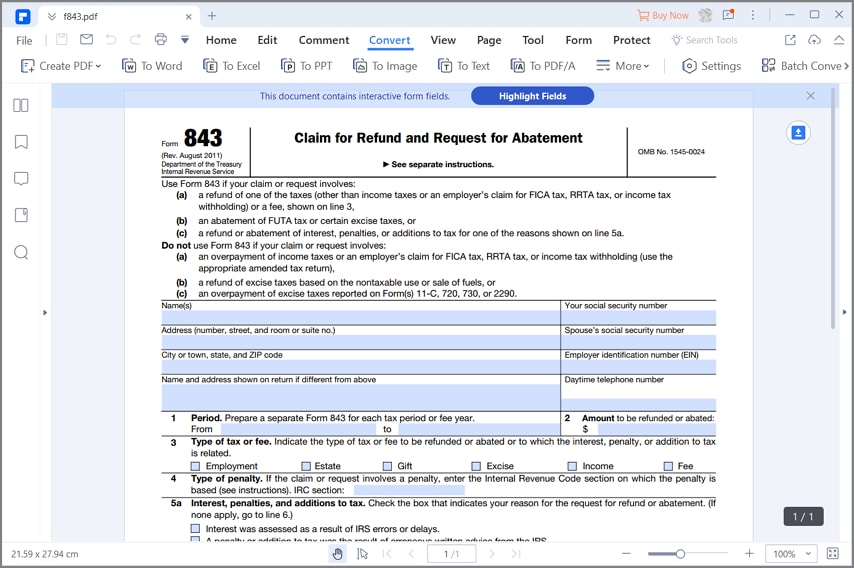

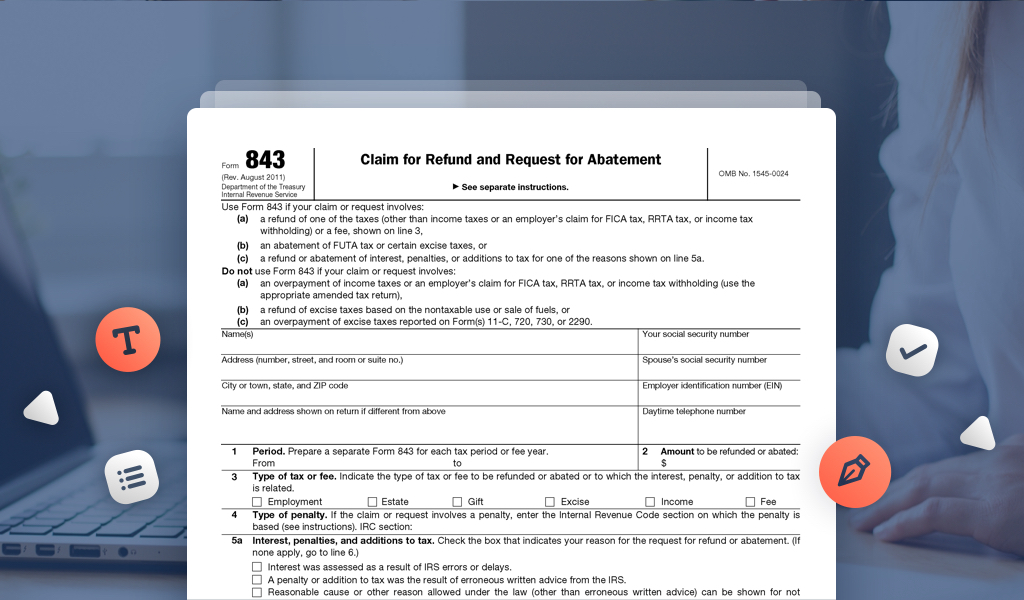

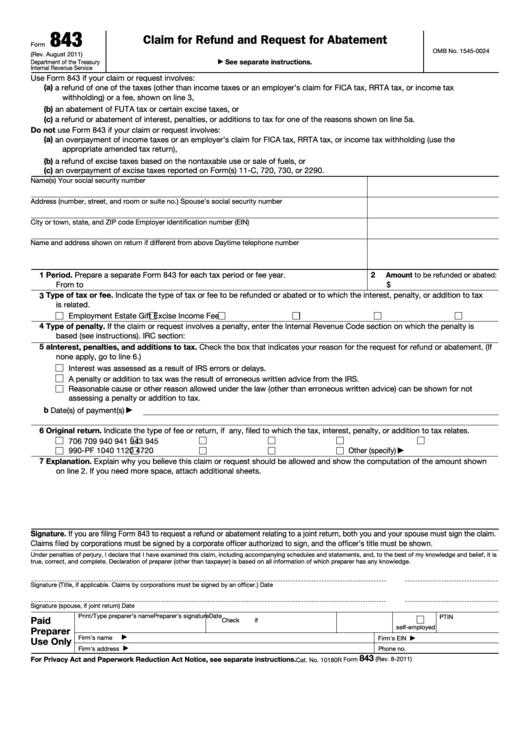

Fillable Form 843 Claim For Refund And Request For Abatement

Details & instructions on using this form. Accurately filling out form 843 is key to a successful penalty abatement request. Abatement is simply removing the. This guide will walk you through the process, ensuring you. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to.

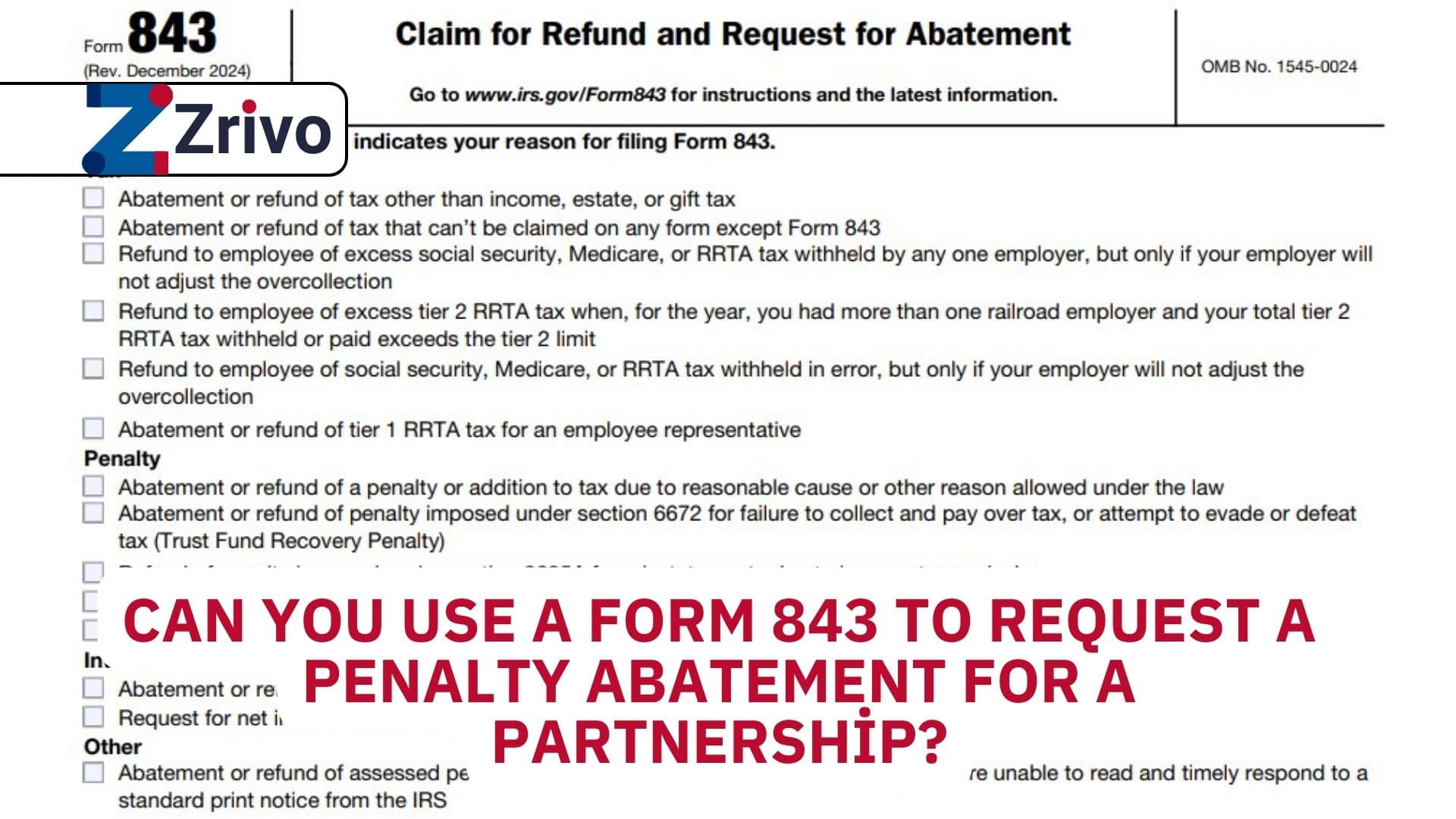

Can You Use a Form 843 to Request a Penalty Abatement for a Partnership?

This guide will walk you through the process, ensuring you. Taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain types of tax related charges. Details & instructions on using this form. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to..

Form 843 Claim for Refund and Request for Abatement How to File

Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. For the failure to file or pay penalty, taxpayers can request that the irs “abate” the penalties. Accurately filling out form 843 is key to a successful penalty abatement request. One of the most common uses of form 843.

Form 843 2024 2025

Taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain types of tax related charges. Details & instructions on using this form. Accurately filling out form 843 is key to a successful penalty abatement request. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions.

How to file form 843 for IRS Penalty Abatement YouTube

For the failure to file or pay penalty, taxpayers can request that the irs “abate” the penalties. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Abatement is simply removing the. Taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain.

IRS Form 843. Claim for Refund and Request for Abatement Forms Docs

Taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain types of tax related charges. This guide will walk you through the process, ensuring you. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Accurately filling out form 843 is key.

Guide to Using IRS Form 843 to Request Penalty Abatement

For the failure to file or pay penalty, taxpayers can request that the irs “abate” the penalties. Penalties and additions to tax: Details & instructions on using this form. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Taxpayers can use irs form 843 to claim a refund.

Irs Form 843 Fillable Pdf Printable Forms Free Online

Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Details & instructions on using this form. Accurately filling out form 843 is key to a successful penalty abatement request. For the failure to file or pay penalty, taxpayers can request that the irs “abate” the penalties. This guide.

EASILY Waive IRS Tax Penalties With The IRS Form 843 (IRS Penalty

Taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain types of tax related charges. Penalties and additions to tax: Details & instructions on using this form. One of the most common uses of form 843 is to request an abatement (cancellation or refund) of irs. For the failure to file or pay.

Form 843 pdfFiller Blog

Taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain types of tax related charges. Abatement is simply removing the. Accurately filling out form 843 is key to a successful penalty abatement request. Penalties and additions to tax: This guide will walk you through the process, ensuring you.

Details & Instructions On Using This Form.

Taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain types of tax related charges. One of the most common uses of form 843 is to request an abatement (cancellation or refund) of irs. For the failure to file or pay penalty, taxpayers can request that the irs “abate” the penalties. This guide will walk you through the process, ensuring you.

Penalties And Additions To Tax:

Accurately filling out form 843 is key to a successful penalty abatement request. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Abatement is simply removing the.

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)