Form 8300 Is Required To Be Filed If - When you submit a free application. Access google forms with a personal google account or google workspace account (for business use). Easily create forms and surveys to gather data and gain insights from anywhere. See results in real time

Easily create forms and surveys to gather data and gain insights from anywhere. See results in real time Access google forms with a personal google account or google workspace account (for business use). When you submit a free application.

Easily create forms and surveys to gather data and gain insights from anywhere. See results in real time Access google forms with a personal google account or google workspace account (for business use). When you submit a free application.

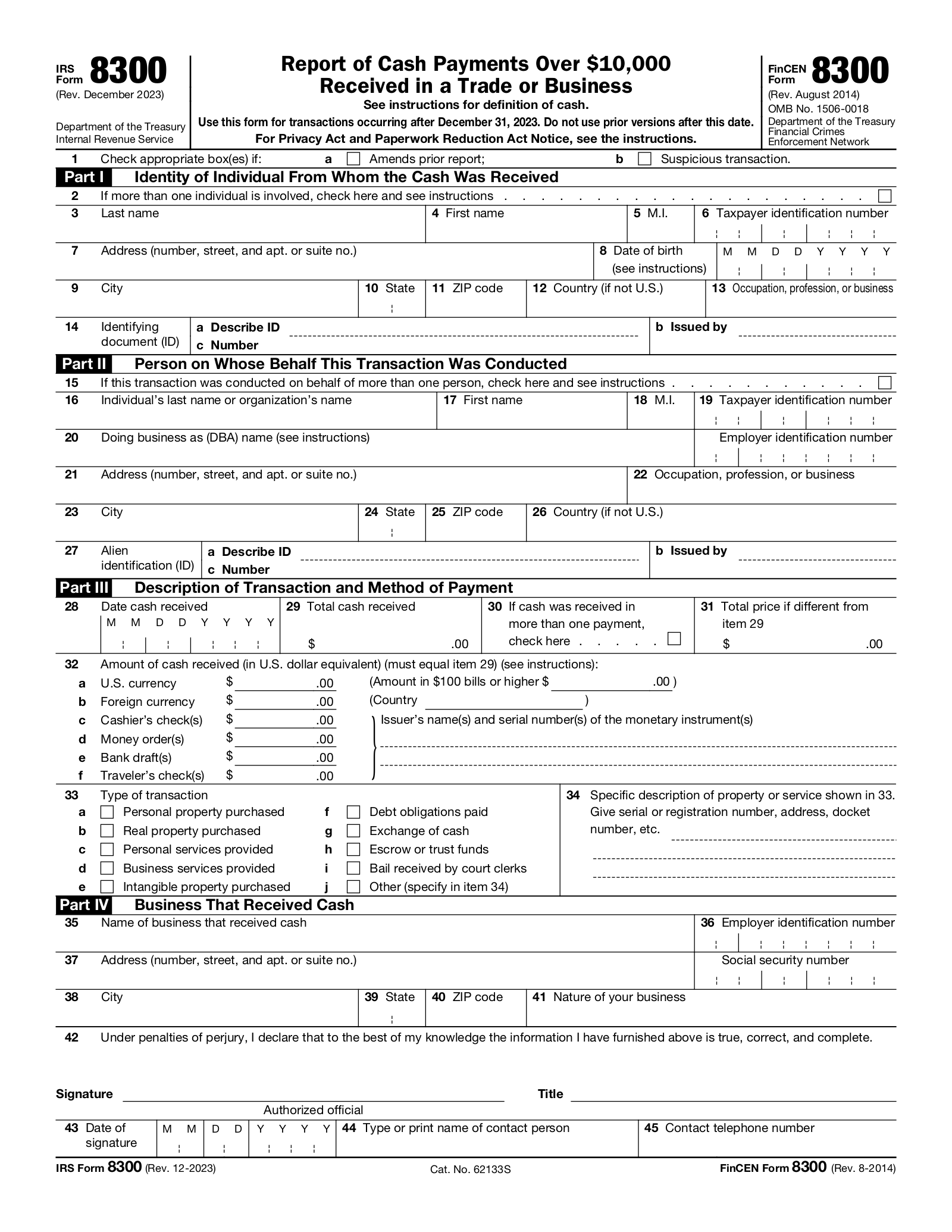

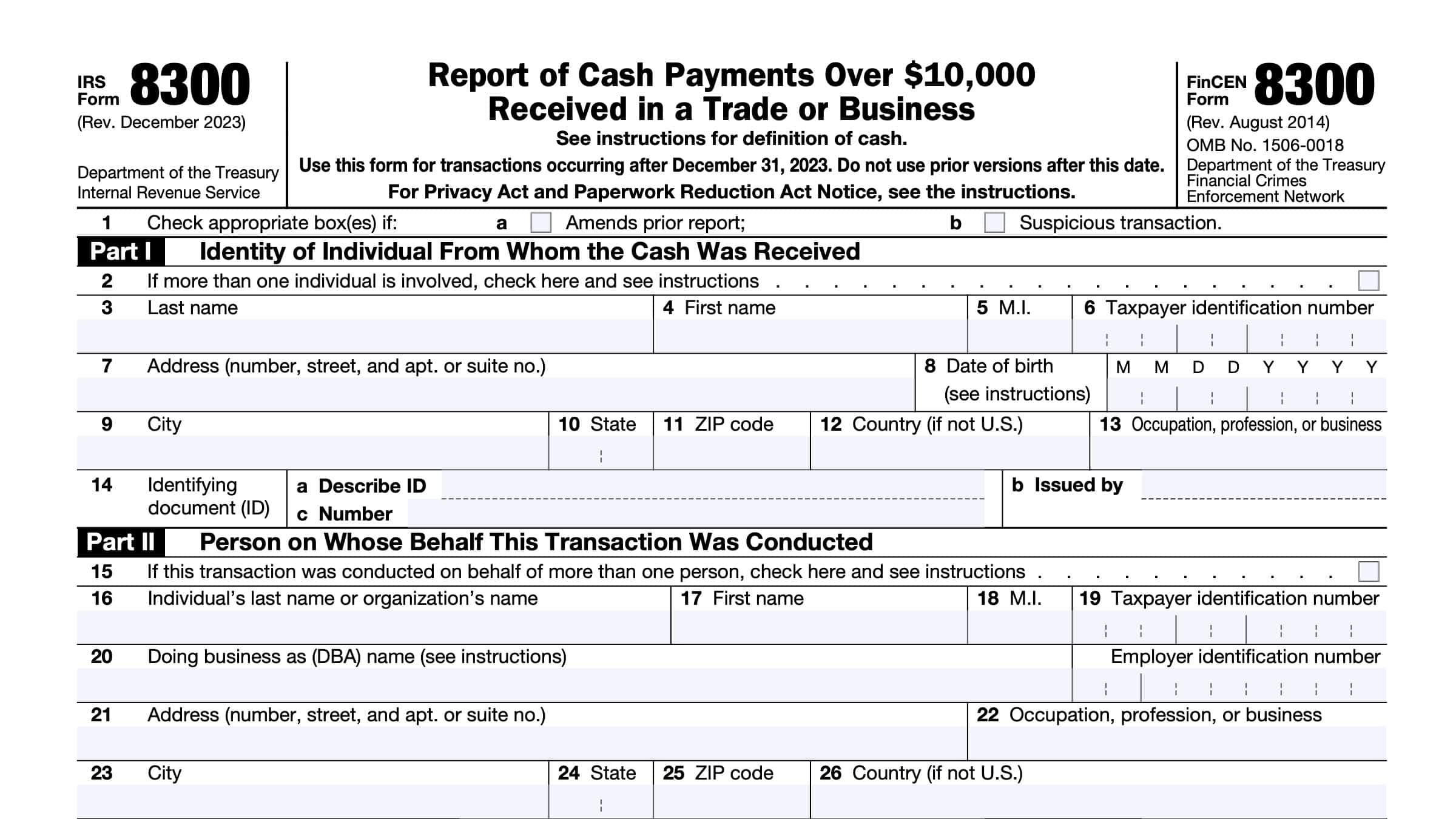

Understanding IRS Form 8300 Reporting Cash Payments

Easily create forms and surveys to gather data and gain insights from anywhere. When you submit a free application. Access google forms with a personal google account or google workspace account (for business use). See results in real time

IRS Form 8300 Fill it in a Smart Way

Easily create forms and surveys to gather data and gain insights from anywhere. When you submit a free application. Access google forms with a personal google account or google workspace account (for business use). See results in real time

IRS Announces New EFiling Requirements for Form 8300 ATA 2.0

See results in real time Access google forms with a personal google account or google workspace account (for business use). When you submit a free application. Easily create forms and surveys to gather data and gain insights from anywhere.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Easily create forms and surveys to gather data and gain insights from anywhere. See results in real time When you submit a free application. Access google forms with a personal google account or google workspace account (for business use).

Maya (Marie) Cernotova, CPA on LinkedIn If your organization is

When you submit a free application. See results in real time Access google forms with a personal google account or google workspace account (for business use). Easily create forms and surveys to gather data and gain insights from anywhere.

Free IRS Form 8300 PDF eForms

Access google forms with a personal google account or google workspace account (for business use). See results in real time Easily create forms and surveys to gather data and gain insights from anywhere. When you submit a free application.

What Is Form 8300 and How Do You File It? Hourly, Inc.

See results in real time Access google forms with a personal google account or google workspace account (for business use). When you submit a free application. Easily create forms and surveys to gather data and gain insights from anywhere.

EFile 8300 File Form 8300 Online

When you submit a free application. Access google forms with a personal google account or google workspace account (for business use). See results in real time Easily create forms and surveys to gather data and gain insights from anywhere.

Irs Form 8300 Printable Printable Forms Free Online

Access google forms with a personal google account or google workspace account (for business use). Easily create forms and surveys to gather data and gain insights from anywhere. See results in real time When you submit a free application.

IRS Form 8300 Instructions Reporting Large Cash Transactions

Easily create forms and surveys to gather data and gain insights from anywhere. When you submit a free application. Access google forms with a personal google account or google workspace account (for business use). See results in real time

See Results In Real Time

When you submit a free application. Access google forms with a personal google account or google workspace account (for business use). Easily create forms and surveys to gather data and gain insights from anywhere.