Form 56 Instructions - It looks like i have to file two. After taking care of my elderly father, he passed away oct 2021 and i am now his fiduciary. The deceased only received $9,808 in. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? Level 3 to which address should form 56 be sent? Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. Form 56 and 1041 questions my wife and her brother are executor of an estate of their sibling.

It looks like i have to file two. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? After taking care of my elderly father, he passed away oct 2021 and i am now his fiduciary. The deceased only received $9,808 in. Form 56 and 1041 questions my wife and her brother are executor of an estate of their sibling. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. Level 3 to which address should form 56 be sent?

After taking care of my elderly father, he passed away oct 2021 and i am now his fiduciary. Level 3 to which address should form 56 be sent? Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? It looks like i have to file two. The deceased only received $9,808 in. Form 56 and 1041 questions my wife and her brother are executor of an estate of their sibling. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021.

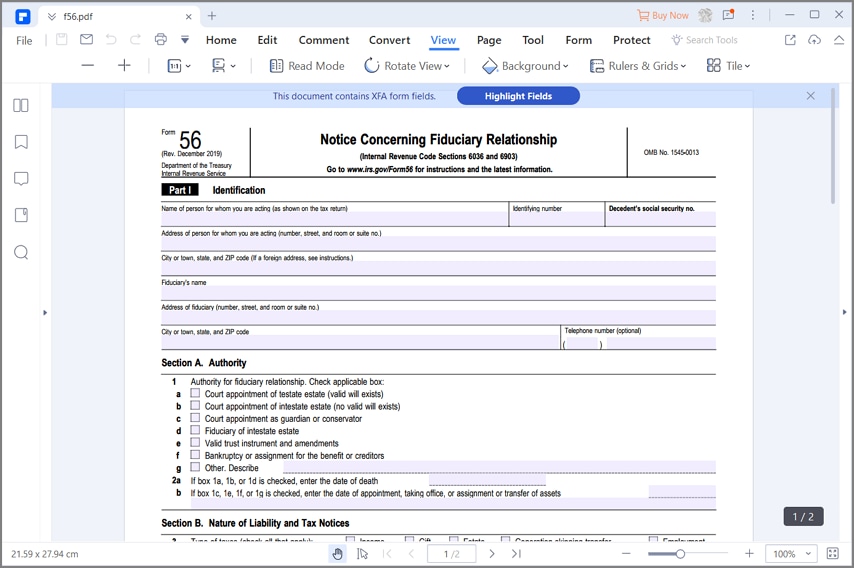

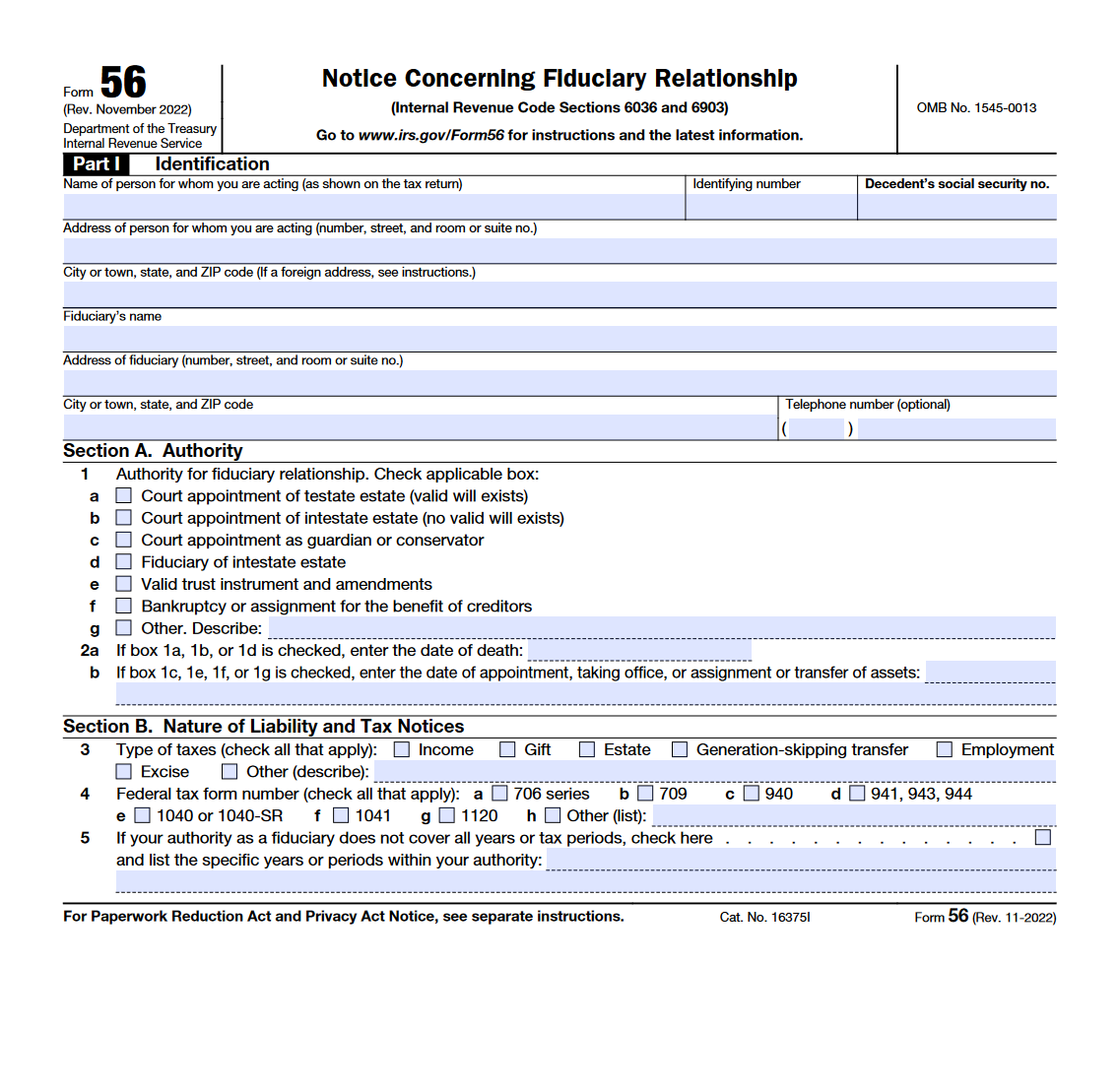

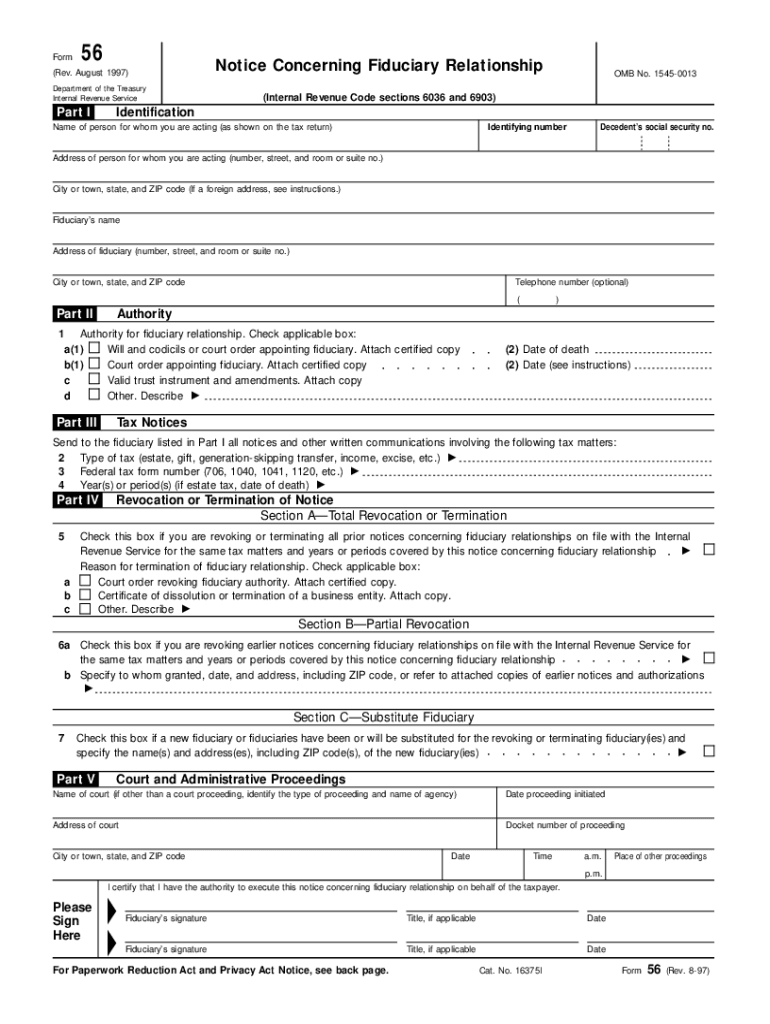

2022 Form IRS 56 Fill Online, Printable, Fillable, Blank pdfFiller

The deceased only received $9,808 in. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? It looks like i have to file two. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. Form 56 and.

IRS Form 56 Instructions IRS Notice of Fiduciary Relationship

Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. The deceased only received $9,808 in. After taking care of my elderly father, he passed away oct 2021 and i am now his fiduciary. Form 56 and 1041 questions my wife and her brother are executor of.

IRS Form 56 You can Fill it with the Best Form Filler

Form 56 and 1041 questions my wife and her brother are executor of an estate of their sibling. It looks like i have to file two. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. After taking care of my elderly father, he passed away oct.

IRS Form 56 Instructions IRS Notice of Fiduciary Relationship

Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? Form 56 and 1041 questions my wife and her brother are executor of an estate of their sibling. The deceased only received $9,808 in. Level 3 to which address should form 56 be sent? After taking care of my elderly.

Irs Form 56 Fillable Pdf Printable Forms Free Online

Level 3 to which address should form 56 be sent? Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. After taking care of my elderly father, he passed away oct 2021 and i am now his fiduciary. Level 4 is a form 56 (notice concerning fiduciary.

IRS Form 56 Instructions IRS Notice of Fiduciary Relationship

Form 56 and 1041 questions my wife and her brother are executor of an estate of their sibling. It looks like i have to file two. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. The deceased only received $9,808 in. Level 3 to which address.

Form 56

The deceased only received $9,808 in. Form 56 and 1041 questions my wife and her brother are executor of an estate of their sibling. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? It looks like i have to file two. After taking care of my elderly father, he.

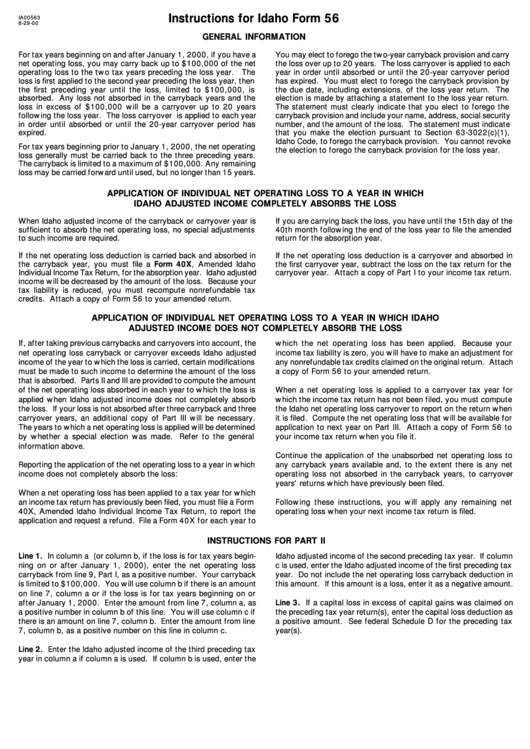

Instructions For Idaho Form 56 printable pdf download

The deceased only received $9,808 in. It looks like i have to file two. Form 56 and 1041 questions my wife and her brother are executor of an estate of their sibling. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. Level 4 is a form.

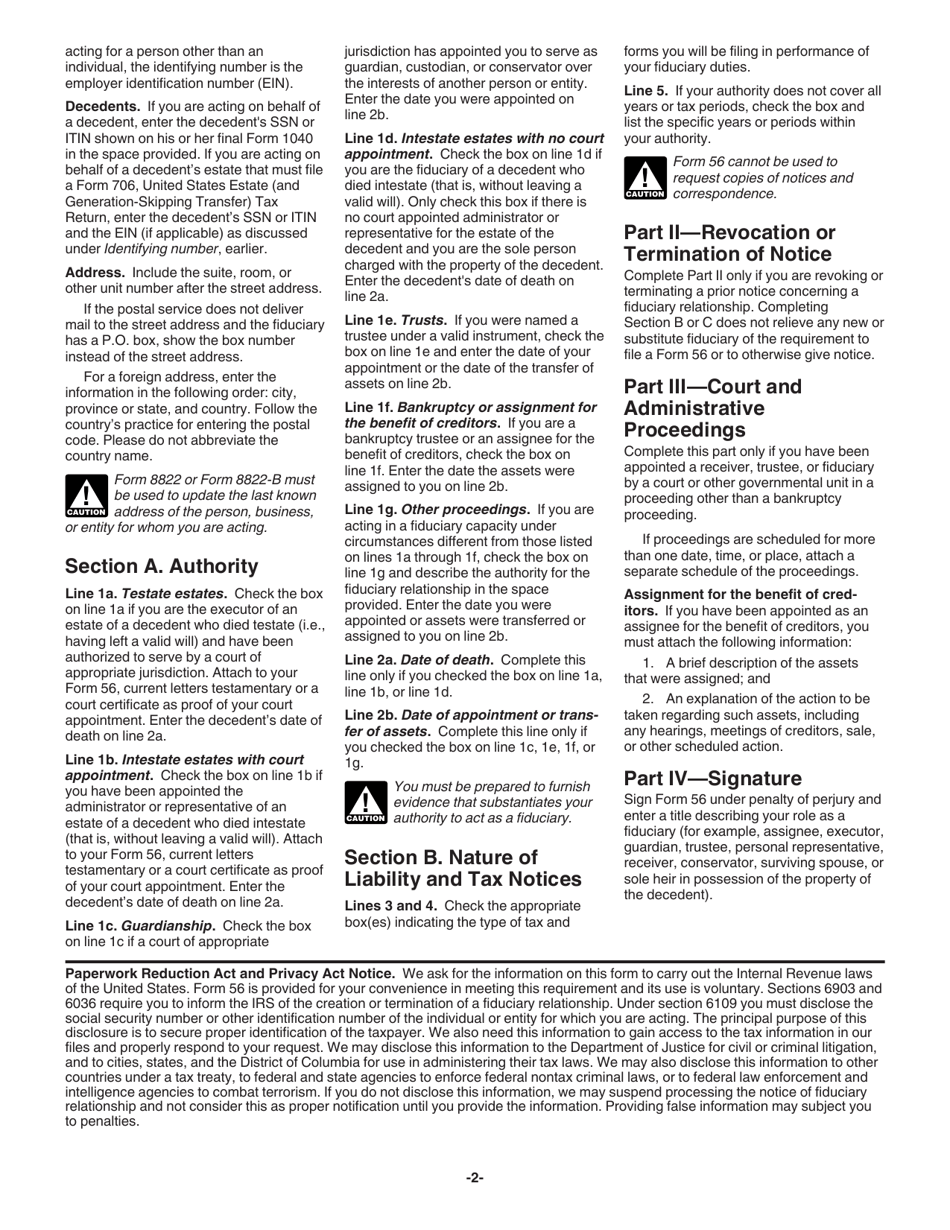

Download Instructions for IRS Form 56 Notice Concerning Fiduciary

Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. After taking care of my elderly father, he passed away oct 2021 and i am now his fiduciary. The deceased only received $9,808 in. It looks like i have to file two. Level 3 to which address.

AntiShyster IRS Instruction 56 Form Fill Online, Printable, Fillable

After taking care of my elderly father, he passed away oct 2021 and i am now his fiduciary. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? Form 56 and 1041 questions my wife and her brother are executor of an estate of their sibling. Form 56, authority for.

It Looks Like I Have To File Two.

Form 56 and 1041 questions my wife and her brother are executor of an estate of their sibling. After taking care of my elderly father, he passed away oct 2021 and i am now his fiduciary. The deceased only received $9,808 in. Level 3 to which address should form 56 be sent?

Level 4 Is A Form 56 (Notice Concerning Fiduciary Relationship) Required To Be Filed By A Trustee Of A Trust?

Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021.