Form 5472 Filing Requirements - Discover filing essentials, avoid penalties, and ensure compliance with. De has no income tax return filing requirement, as a result of final regulations under section 6038a, it will now be. Learn how to file form 5472 correctly to avoid hefty irs penalties. In most scenarios, a form 5472 reporting requirement will arise in a situation in which foreign persons have 25% or more ownership in a u.s. This guide explains how u.s. Entity status, foreign ownership rules, and related party. Determine your form 5472 filing obligation.

Learn how to file form 5472 correctly to avoid hefty irs penalties. Determine your form 5472 filing obligation. Discover filing essentials, avoid penalties, and ensure compliance with. In most scenarios, a form 5472 reporting requirement will arise in a situation in which foreign persons have 25% or more ownership in a u.s. De has no income tax return filing requirement, as a result of final regulations under section 6038a, it will now be. Entity status, foreign ownership rules, and related party. This guide explains how u.s.

Learn how to file form 5472 correctly to avoid hefty irs penalties. Discover filing essentials, avoid penalties, and ensure compliance with. In most scenarios, a form 5472 reporting requirement will arise in a situation in which foreign persons have 25% or more ownership in a u.s. Entity status, foreign ownership rules, and related party. Determine your form 5472 filing obligation. This guide explains how u.s. De has no income tax return filing requirement, as a result of final regulations under section 6038a, it will now be.

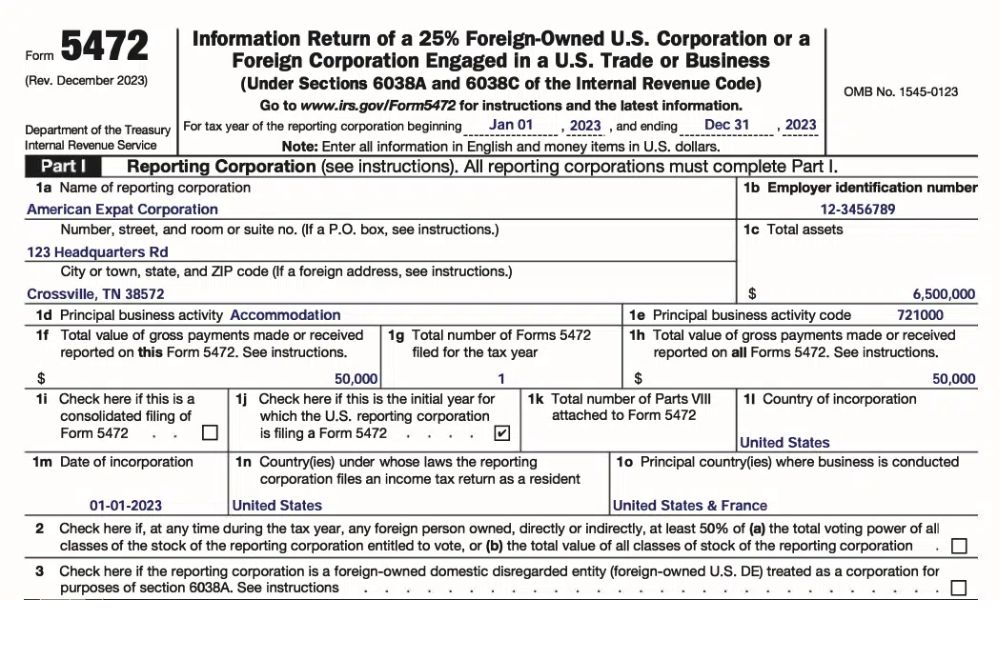

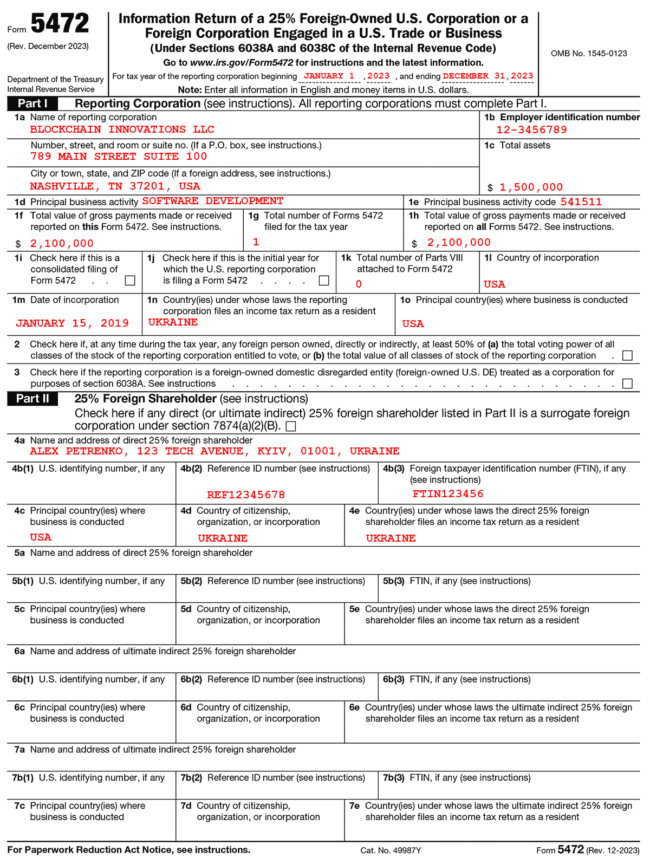

Comprehensive Guide to Filing Form 5472 for ForeignOwned U.S. Corporations

Determine your form 5472 filing obligation. In most scenarios, a form 5472 reporting requirement will arise in a situation in which foreign persons have 25% or more ownership in a u.s. Discover filing essentials, avoid penalties, and ensure compliance with. Learn how to file form 5472 correctly to avoid hefty irs penalties. Entity status, foreign ownership rules, and related party.

How To Fill Out Form 5472 StepbyStep Filing Guide CPA Tax

Determine your form 5472 filing obligation. De has no income tax return filing requirement, as a result of final regulations under section 6038a, it will now be. Learn how to file form 5472 correctly to avoid hefty irs penalties. This guide explains how u.s. In most scenarios, a form 5472 reporting requirement will arise in a situation in which foreign.

IRS Form 5472 Filing Requirements and Tips

Learn how to file form 5472 correctly to avoid hefty irs penalties. De has no income tax return filing requirement, as a result of final regulations under section 6038a, it will now be. Entity status, foreign ownership rules, and related party. Discover filing essentials, avoid penalties, and ensure compliance with. Determine your form 5472 filing obligation.

Guide to Filing Form 5472 for Corporations (Foreign Owned)

In most scenarios, a form 5472 reporting requirement will arise in a situation in which foreign persons have 25% or more ownership in a u.s. Learn how to file form 5472 correctly to avoid hefty irs penalties. This guide explains how u.s. Determine your form 5472 filing obligation. Discover filing essentials, avoid penalties, and ensure compliance with.

(PDF) Form 5472 Filing Requirements TaxCharts · This flowchart has

Entity status, foreign ownership rules, and related party. This guide explains how u.s. De has no income tax return filing requirement, as a result of final regulations under section 6038a, it will now be. Determine your form 5472 filing obligation. In most scenarios, a form 5472 reporting requirement will arise in a situation in which foreign persons have 25% or.

What’s New Foreignowned singlemember LLCs now must file Form 5472

In most scenarios, a form 5472 reporting requirement will arise in a situation in which foreign persons have 25% or more ownership in a u.s. Learn how to file form 5472 correctly to avoid hefty irs penalties. Discover filing essentials, avoid penalties, and ensure compliance with. De has no income tax return filing requirement, as a result of final regulations.

"Requirements of Form 5472"

Discover filing essentials, avoid penalties, and ensure compliance with. This guide explains how u.s. Determine your form 5472 filing obligation. In most scenarios, a form 5472 reporting requirement will arise in a situation in which foreign persons have 25% or more ownership in a u.s. Entity status, foreign ownership rules, and related party.

How To Fill Out Form 5472 StepbyStep Filing Guide CPA Tax

This guide explains how u.s. De has no income tax return filing requirement, as a result of final regulations under section 6038a, it will now be. Determine your form 5472 filing obligation. Learn how to file form 5472 correctly to avoid hefty irs penalties. Discover filing essentials, avoid penalties, and ensure compliance with.

Form 5472 Filing Requirements for ForeignOwned LLCs

Entity status, foreign ownership rules, and related party. De has no income tax return filing requirement, as a result of final regulations under section 6038a, it will now be. Determine your form 5472 filing obligation. This guide explains how u.s. Discover filing essentials, avoid penalties, and ensure compliance with.

What Is IRS Form 5472? Forming Today

This guide explains how u.s. Determine your form 5472 filing obligation. Discover filing essentials, avoid penalties, and ensure compliance with. In most scenarios, a form 5472 reporting requirement will arise in a situation in which foreign persons have 25% or more ownership in a u.s. Entity status, foreign ownership rules, and related party.

De Has No Income Tax Return Filing Requirement, As A Result Of Final Regulations Under Section 6038A, It Will Now Be.

Determine your form 5472 filing obligation. Discover filing essentials, avoid penalties, and ensure compliance with. Entity status, foreign ownership rules, and related party. In most scenarios, a form 5472 reporting requirement will arise in a situation in which foreign persons have 25% or more ownership in a u.s.

Learn How To File Form 5472 Correctly To Avoid Hefty Irs Penalties.

This guide explains how u.s.