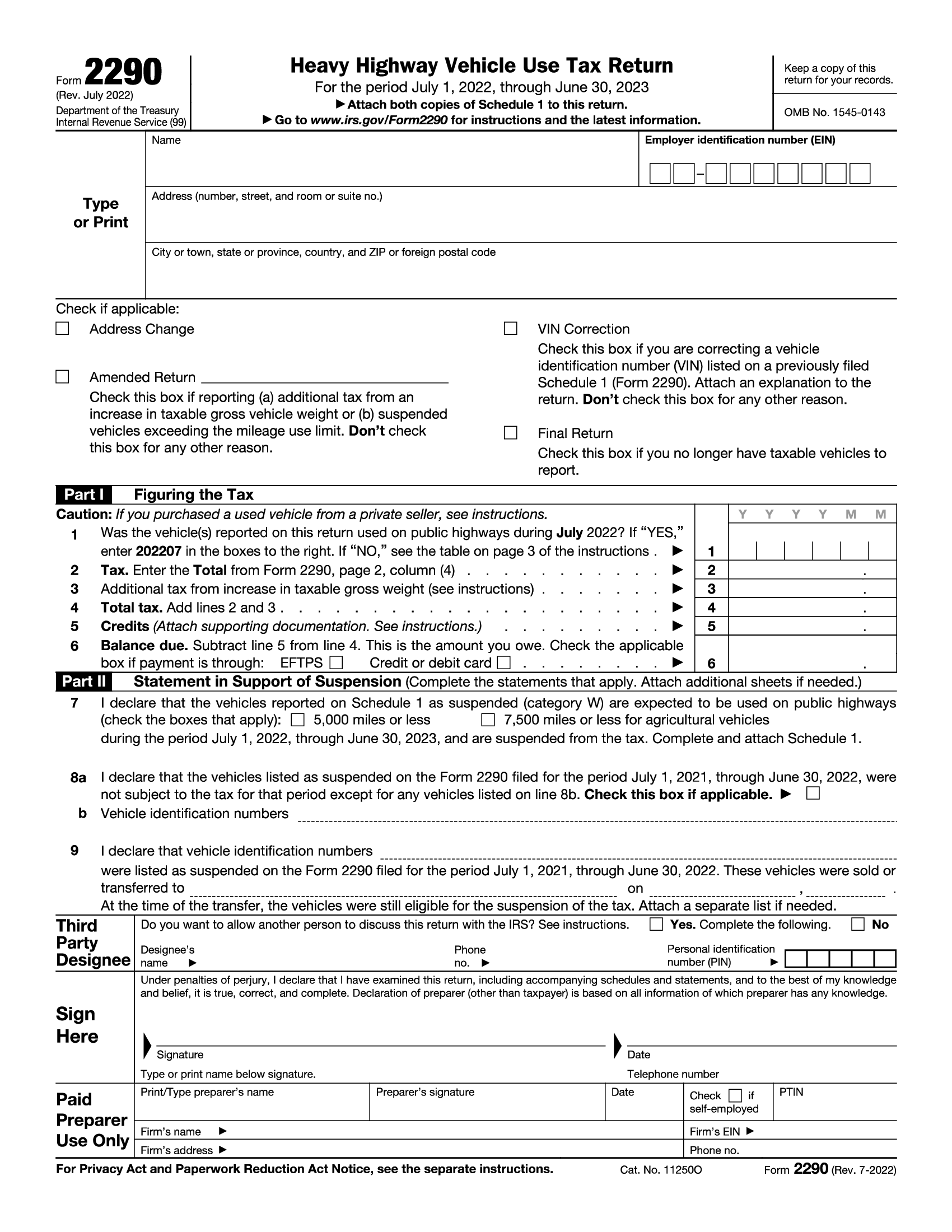

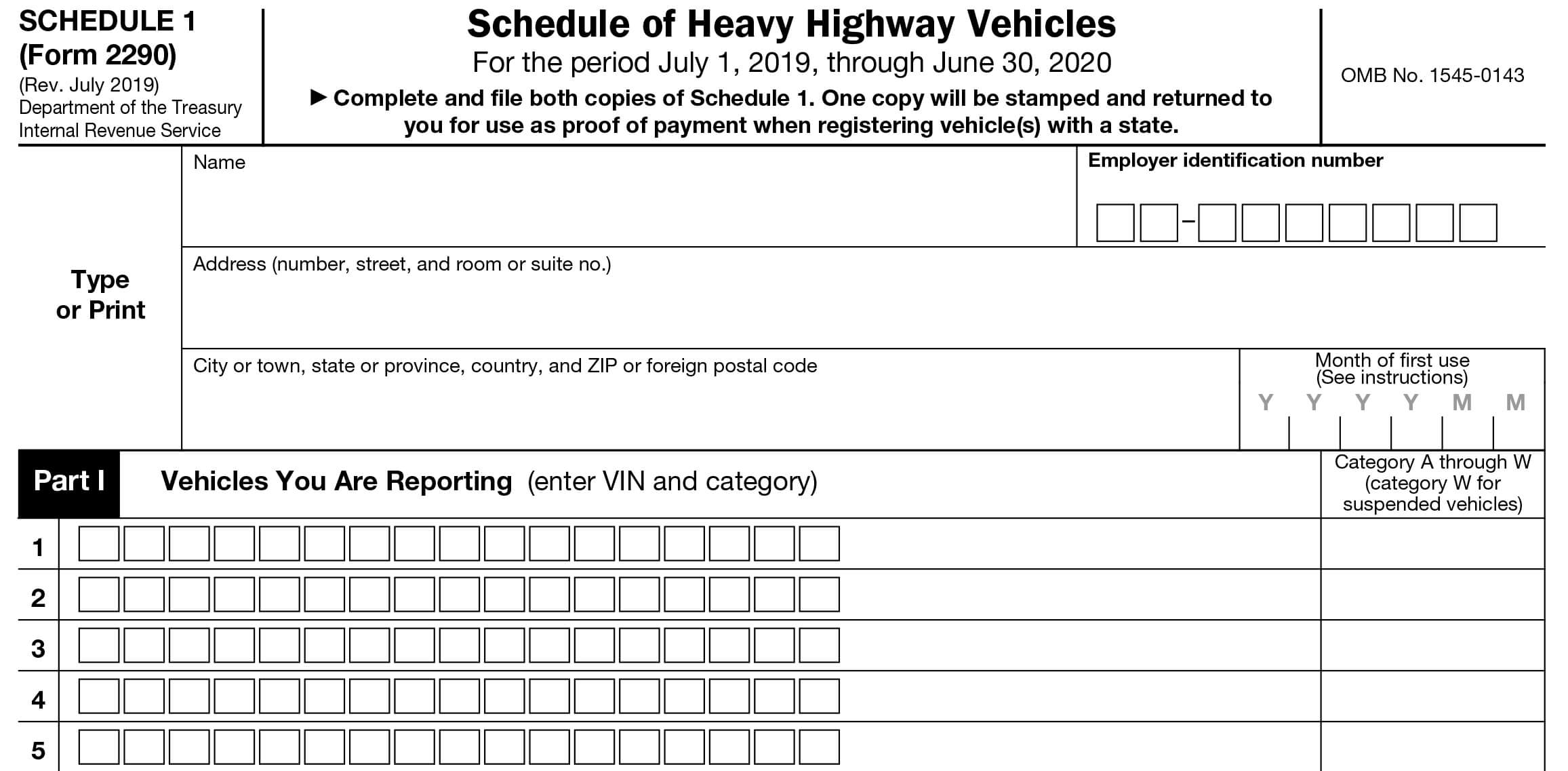

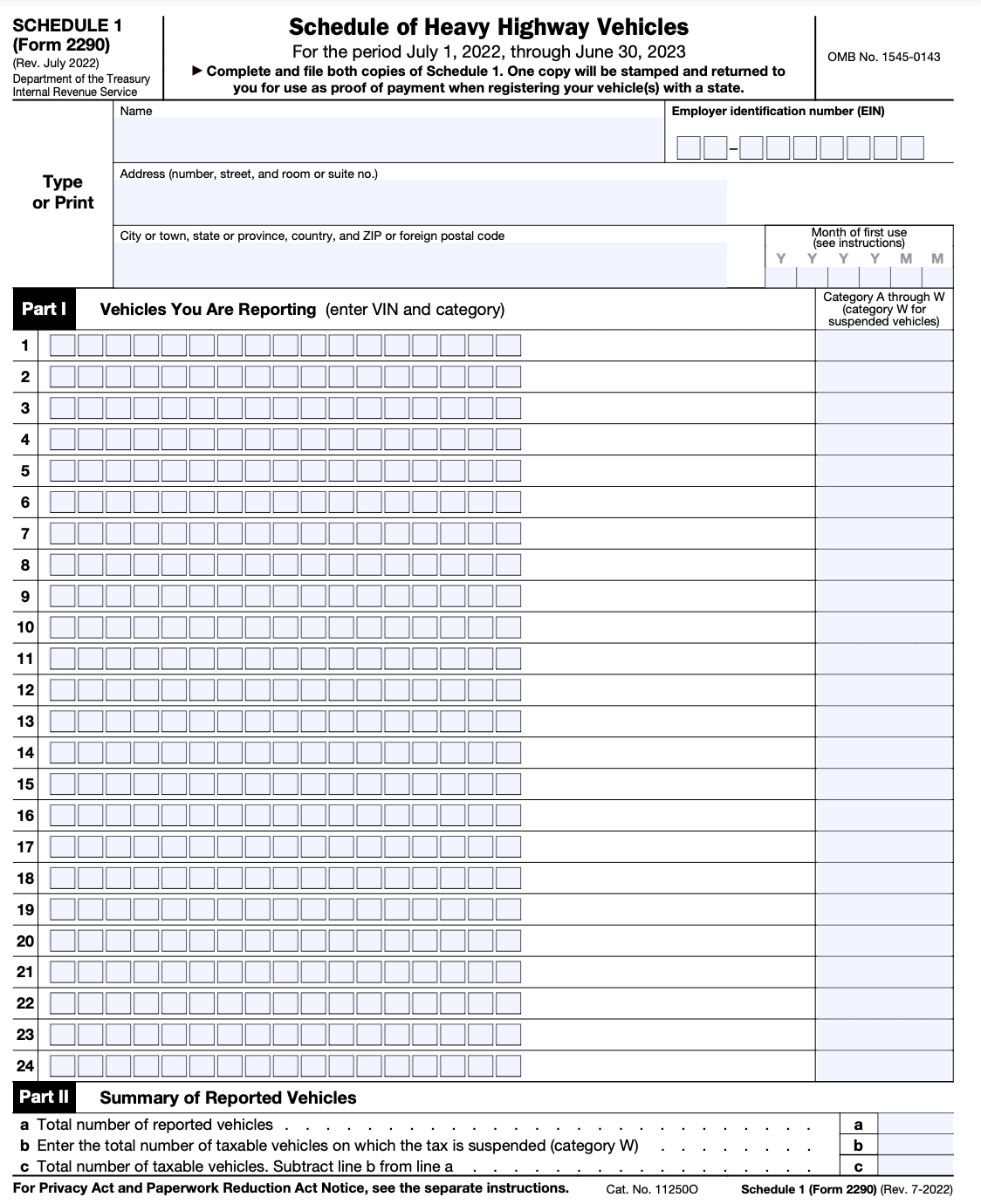

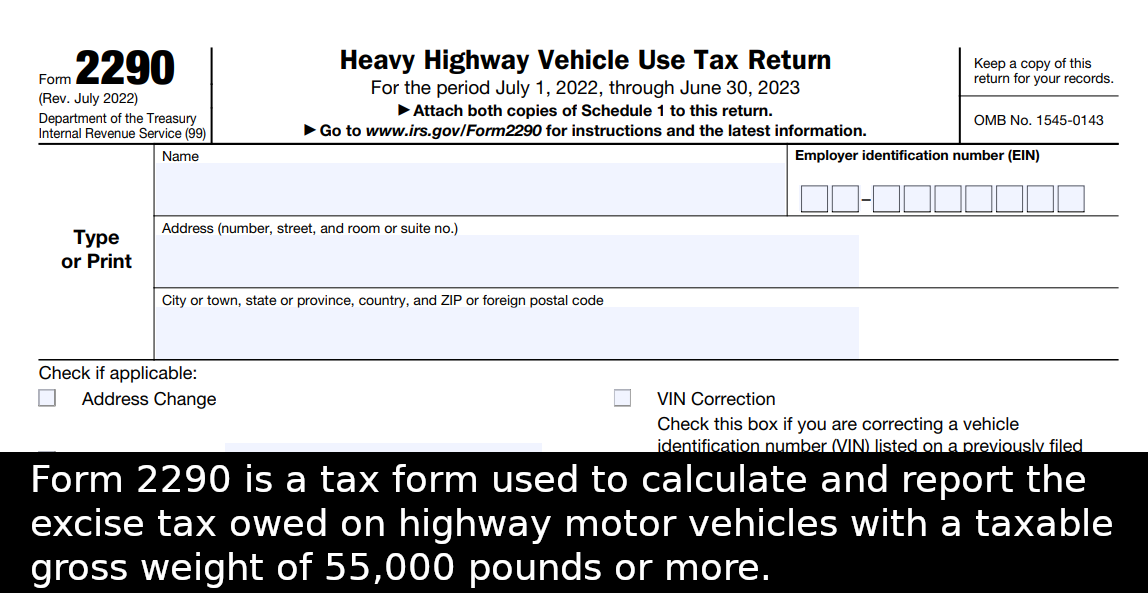

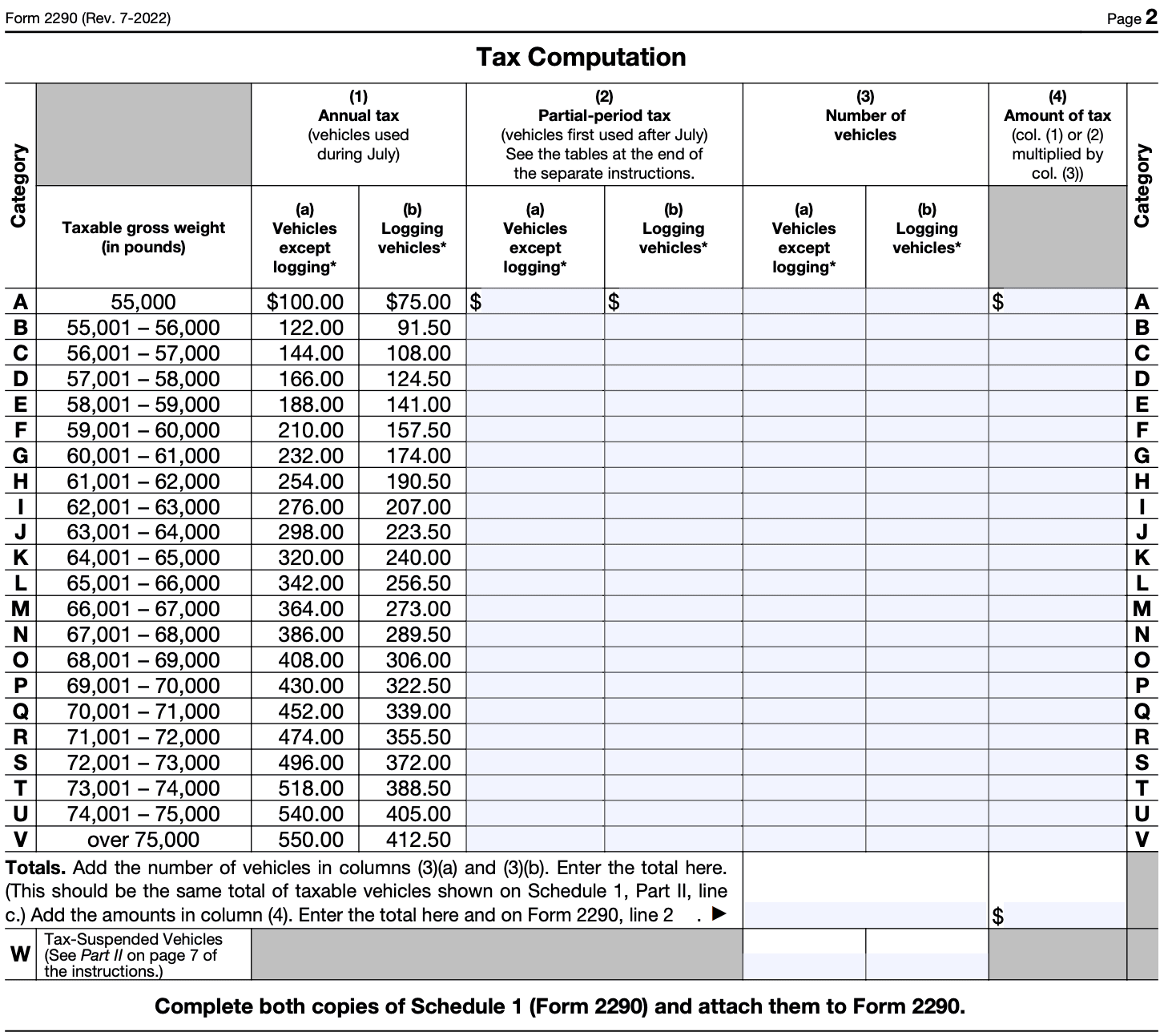

Form 2290 - The form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. If you have more than 25. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to. The purpose of the tax is to help fund. If you’re new to filing truck taxes or just looking to learn more about tax form 2290, you’ll find all the details you need here. You must file form 2290, if a taxable highway motor vehicle is registered, or required to be registered, in your name under state, district of columbia,.

If you have more than 25. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to. The form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. If you’re new to filing truck taxes or just looking to learn more about tax form 2290, you’ll find all the details you need here. You must file form 2290, if a taxable highway motor vehicle is registered, or required to be registered, in your name under state, district of columbia,. The purpose of the tax is to help fund.

The form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. If you’re new to filing truck taxes or just looking to learn more about tax form 2290, you’ll find all the details you need here. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to. You must file form 2290, if a taxable highway motor vehicle is registered, or required to be registered, in your name under state, district of columbia,. The purpose of the tax is to help fund. If you have more than 25.

Irs Form 2290 Printable 2024

If you have more than 25. The purpose of the tax is to help fund. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to. You must file form 2290, if a taxable highway motor vehicle is registered, or required to be registered, in your name under state, district of.

Printable Irs Form 2290 2020 2021

If you have more than 25. The purpose of the tax is to help fund. If you’re new to filing truck taxes or just looking to learn more about tax form 2290, you’ll find all the details you need here. You must file form 2290, if a taxable highway motor vehicle is registered, or required to be registered, in your.

Irs 2290 Form 2025 Printable Gabriel B. Hagelthorn

The form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to. If you’re new to filing truck taxes or just looking to learn more about tax form 2290, you’ll find all.

Printable Irs Form 2290 2020 2021

Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to. If you have more than 25. The form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. You must file form 2290, if a taxable highway motor vehicle is registered, or.

Form 2290 Heavy Highway Vehicle Use Tax Return

You must file form 2290, if a taxable highway motor vehicle is registered, or required to be registered, in your name under state, district of columbia,. The form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. If you have more than 25. Information about form 2290, heavy highway vehicle use.

Irs Form 2290 Printable 2025

You must file form 2290, if a taxable highway motor vehicle is registered, or required to be registered, in your name under state, district of columbia,. If you have more than 25. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to. The form 2290 is a tax form used.

Fillable Online Form 2290EZ, heavy highway vehicle use tax return for

Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to. The form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. The purpose of the tax is to help fund. You must file form 2290, if a taxable highway motor vehicle.

Form 2290 Heavy Vehicle Use Tax

You must file form 2290, if a taxable highway motor vehicle is registered, or required to be registered, in your name under state, district of columbia,. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to. If you’re new to filing truck taxes or just looking to learn more about.

Irs Form 2290 Printable 2023 To 2024

The purpose of the tax is to help fund. If you have more than 25. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to. The form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. You must file form 2290,.

Form 2290 Heavy Highway Vehicle Use Tax Return

The purpose of the tax is to help fund. You must file form 2290, if a taxable highway motor vehicle is registered, or required to be registered, in your name under state, district of columbia,. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to. The form 2290 is a.

You Must File Form 2290, If A Taxable Highway Motor Vehicle Is Registered, Or Required To Be Registered, In Your Name Under State, District Of Columbia,.

The form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. If you have more than 25. The purpose of the tax is to help fund. If you’re new to filing truck taxes or just looking to learn more about tax form 2290, you’ll find all the details you need here.