Form 1040 Schedule E - When do you file schedule e? A schedule is a form that collects information about specific types of taxable income and activities. If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an s corporation, you must check the box in. This blog post will walk. Schedule e can seem daunting, but with the right guidance, it becomes manageable. What is schedule e on form 1040 and how does it affect your taxes? Learn how schedule e on form 1040 reports supplemental income and.

A schedule is a form that collects information about specific types of taxable income and activities. If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an s corporation, you must check the box in. When do you file schedule e? Schedule e can seem daunting, but with the right guidance, it becomes manageable. Learn how schedule e on form 1040 reports supplemental income and. This blog post will walk. What is schedule e on form 1040 and how does it affect your taxes?

What is schedule e on form 1040 and how does it affect your taxes? This blog post will walk. Schedule e can seem daunting, but with the right guidance, it becomes manageable. Learn how schedule e on form 1040 reports supplemental income and. When do you file schedule e? If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an s corporation, you must check the box in. A schedule is a form that collects information about specific types of taxable income and activities.

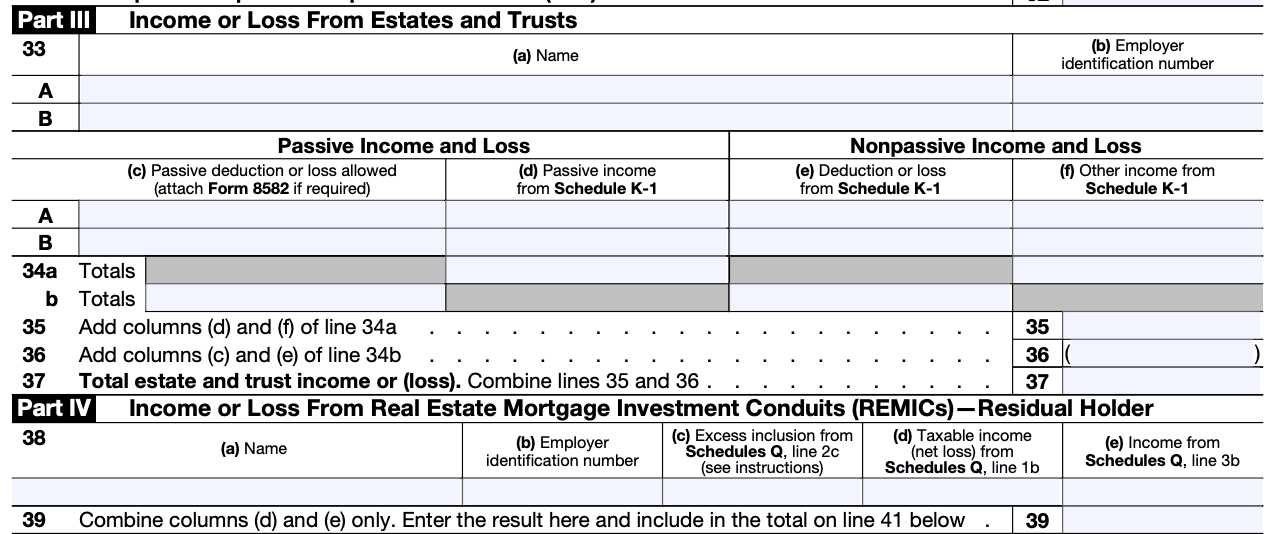

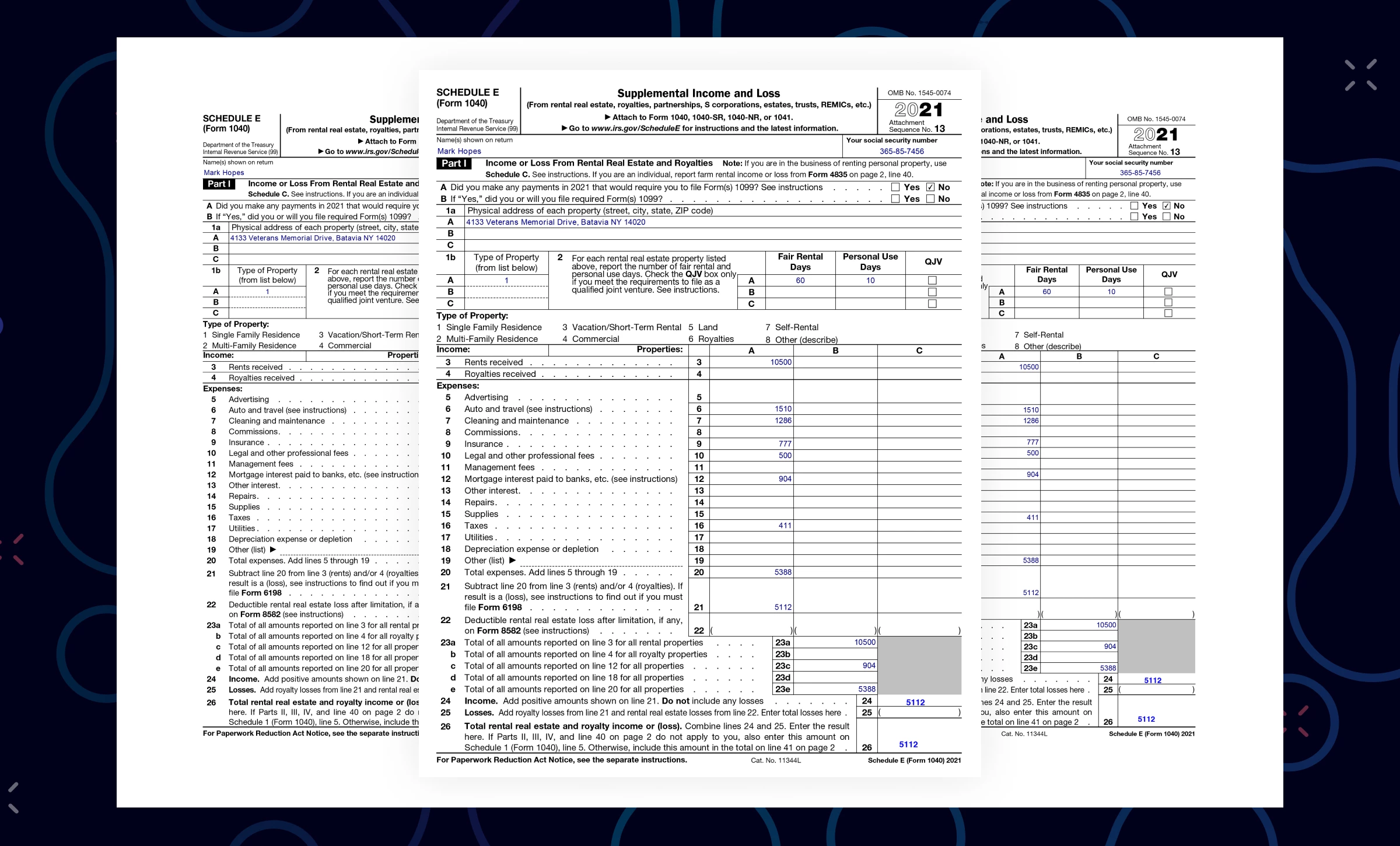

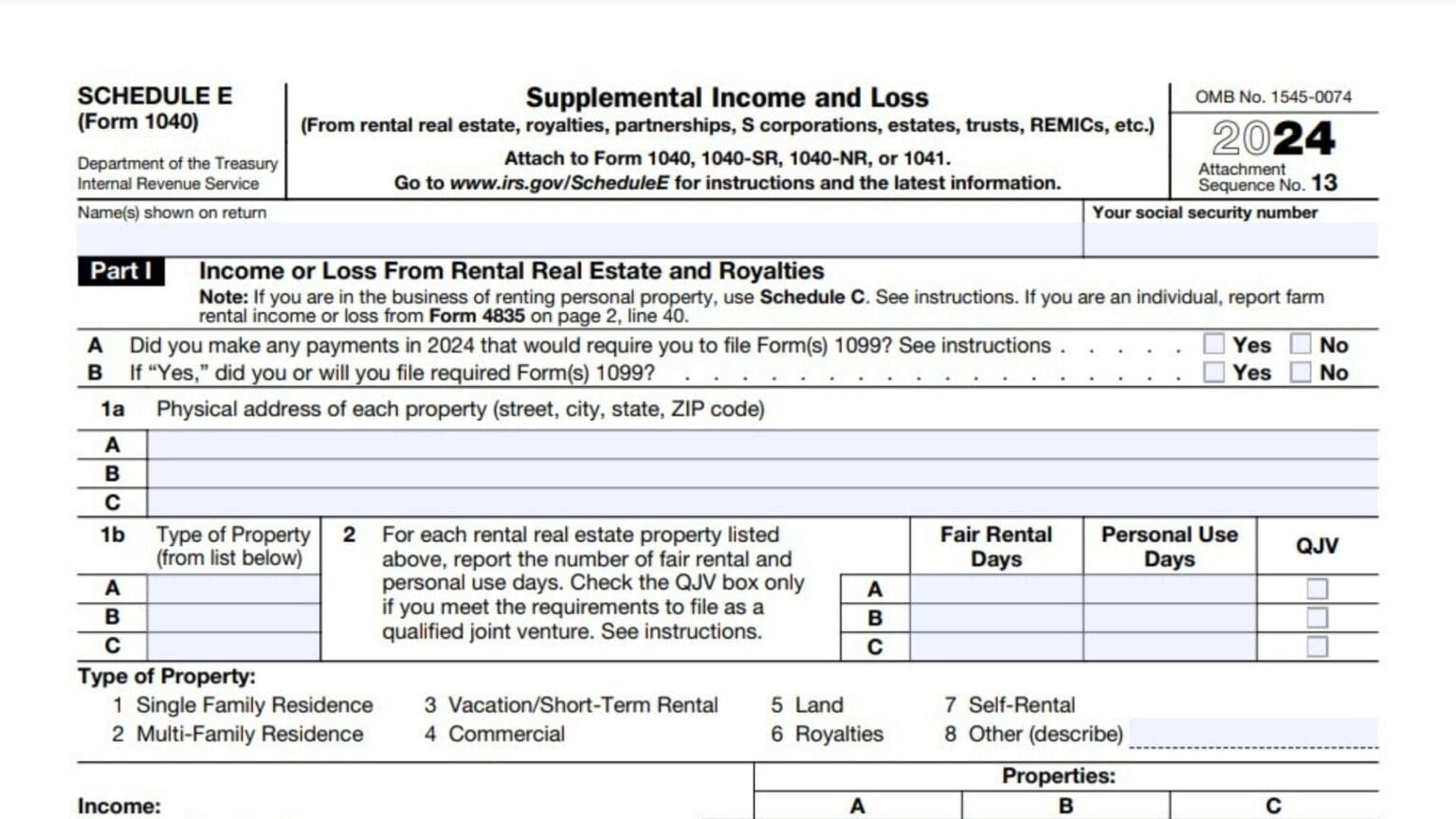

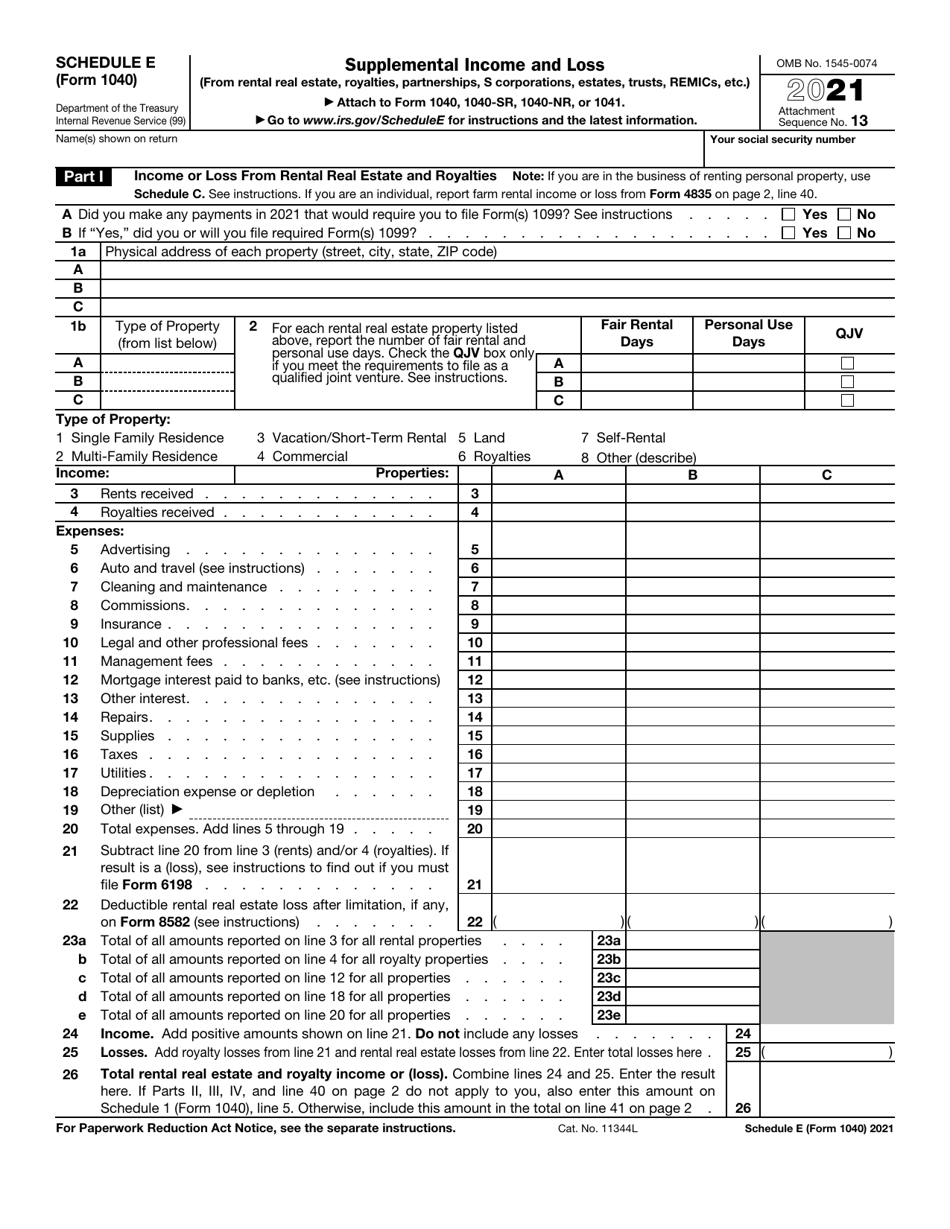

Schedule E (Form 1040) Supplemental and Loss

Schedule e can seem daunting, but with the right guidance, it becomes manageable. A schedule is a form that collects information about specific types of taxable income and activities. What is schedule e on form 1040 and how does it affect your taxes? If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from.

IRS Form 1040 Schedule B 2021 Document Processing

When do you file schedule e? Schedule e can seem daunting, but with the right guidance, it becomes manageable. Learn how schedule e on form 1040 reports supplemental income and. What is schedule e on form 1040 and how does it affect your taxes? This blog post will walk.

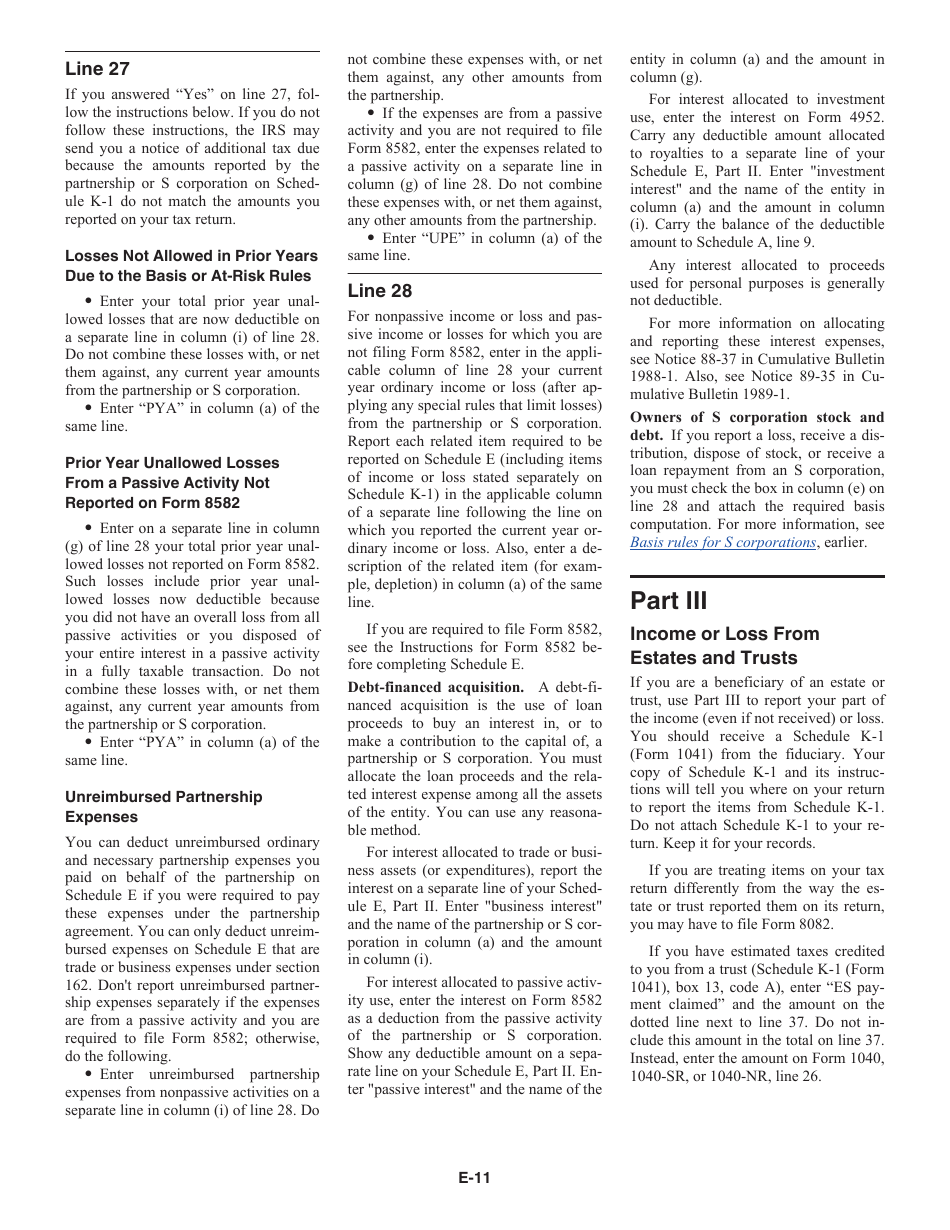

IRS Schedule E Instructions Supplemental and Loss

What is schedule e on form 1040 and how does it affect your taxes? A schedule is a form that collects information about specific types of taxable income and activities. When do you file schedule e? Schedule e can seem daunting, but with the right guidance, it becomes manageable. If you report a loss, receive a distribution, dispose of stock,.

Schedule E (Form 1040) Instructions 2025 2026

What is schedule e on form 1040 and how does it affect your taxes? If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an s corporation, you must check the box in. Schedule e can seem daunting, but with the right guidance, it becomes manageable. When do you file schedule e? A.

Download Instructions for IRS Form 1040 Schedule E Supplemental

Learn how schedule e on form 1040 reports supplemental income and. What is schedule e on form 1040 and how does it affect your taxes? If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an s corporation, you must check the box in. When do you file schedule e? This blog post.

Download Instructions for IRS Form 1040 Schedule E Supplemental

Schedule e can seem daunting, but with the right guidance, it becomes manageable. When do you file schedule e? If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an s corporation, you must check the box in. Learn how schedule e on form 1040 reports supplemental income and. A schedule is a.

Download Instructions for IRS Form 1040 Schedule E Supplemental

What is schedule e on form 1040 and how does it affect your taxes? This blog post will walk. Schedule e can seem daunting, but with the right guidance, it becomes manageable. If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an s corporation, you must check the box in. A schedule.

Schedule E "What", "Who", "When" and "How" The Usual Stuff

This blog post will walk. Schedule e can seem daunting, but with the right guidance, it becomes manageable. Learn how schedule e on form 1040 reports supplemental income and. A schedule is a form that collects information about specific types of taxable income and activities. When do you file schedule e?

All You Need to Know About Schedule E & Tax Form 1040 for IRS Rental

A schedule is a form that collects information about specific types of taxable income and activities. Learn how schedule e on form 1040 reports supplemental income and. Schedule e can seem daunting, but with the right guidance, it becomes manageable. What is schedule e on form 1040 and how does it affect your taxes? When do you file schedule e?

IRS Form 1040 Schedule E Download Fillable PDF or Fill Online

A schedule is a form that collects information about specific types of taxable income and activities. Learn how schedule e on form 1040 reports supplemental income and. What is schedule e on form 1040 and how does it affect your taxes? If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an s.

Learn How Schedule E On Form 1040 Reports Supplemental Income And.

This blog post will walk. A schedule is a form that collects information about specific types of taxable income and activities. If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an s corporation, you must check the box in. What is schedule e on form 1040 and how does it affect your taxes?

Schedule E Can Seem Daunting, But With The Right Guidance, It Becomes Manageable.

When do you file schedule e?