Fica Full Form - La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente financian. The maximum taxable income for social security for 2025 is $176,100. There is no “senior citizen exemption” to paying fica taxes. Fica taxes also make up a sizeable. The cola isn't the only thing changing for social security next year. The federal insurance contribution act refers to the taxes that largely fund social security benefits. Under fica, the federal insurance contributions act, 6.2 percent of. As long as you work in a job that is covered by social security, payroll taxes. Here are seven important ways social security will be different in.

The cola isn't the only thing changing for social security next year. Here are seven important ways social security will be different in. As long as you work in a job that is covered by social security, payroll taxes. Under fica, the federal insurance contributions act, 6.2 percent of. The maximum taxable income for social security for 2025 is $176,100. The federal insurance contribution act refers to the taxes that largely fund social security benefits. La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente financian. There is no “senior citizen exemption” to paying fica taxes. Fica taxes also make up a sizeable.

La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente financian. As long as you work in a job that is covered by social security, payroll taxes. Here are seven important ways social security will be different in. The maximum taxable income for social security for 2025 is $176,100. The federal insurance contribution act refers to the taxes that largely fund social security benefits. Under fica, the federal insurance contributions act, 6.2 percent of. The cola isn't the only thing changing for social security next year. Fica taxes also make up a sizeable. There is no “senior citizen exemption” to paying fica taxes.

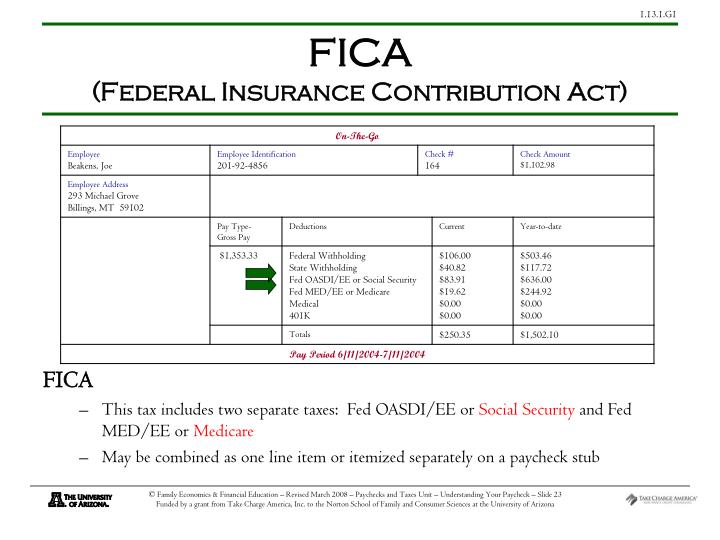

PPT Paychecks and Tax Forms Take Charge of your Finances PowerPoint

La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente financian. The maximum taxable income for social security for 2025 is $176,100. Under fica, the federal insurance contributions act, 6.2 percent of. Here are seven important ways social security will be different in. The cola isn't the only.

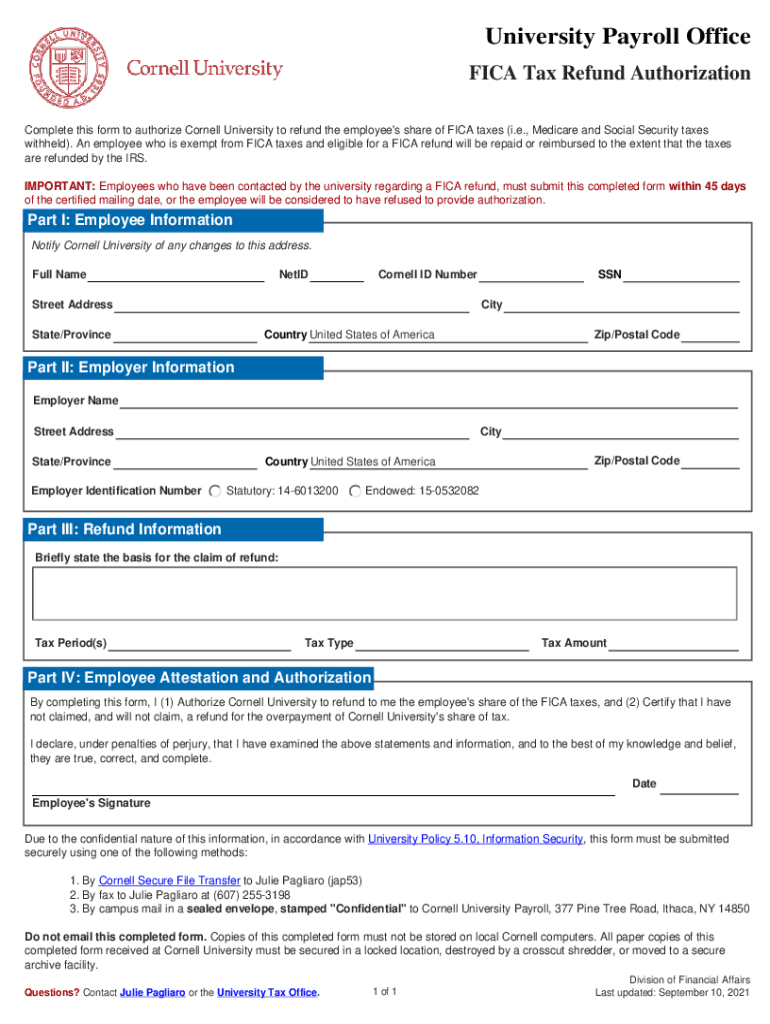

Fillable Online FICA Tax Refund Authorization Division of Financial

Fica taxes also make up a sizeable. The cola isn't the only thing changing for social security next year. There is no “senior citizen exemption” to paying fica taxes. The maximum taxable income for social security for 2025 is $176,100. Under fica, the federal insurance contributions act, 6.2 percent of.

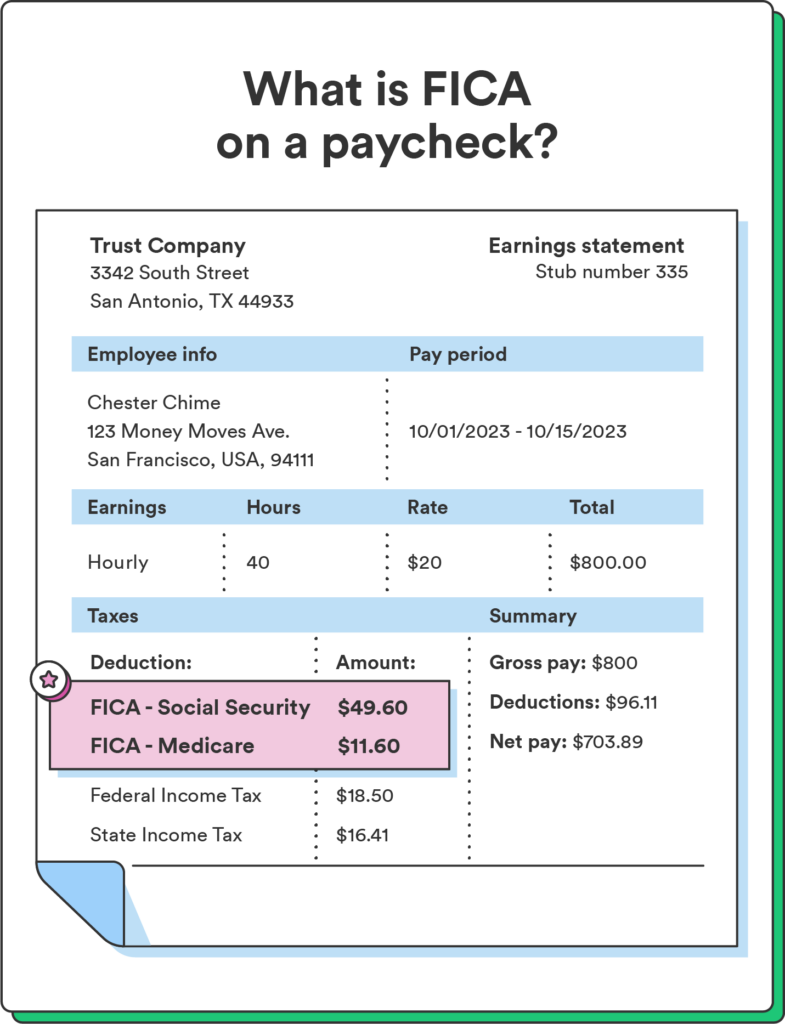

What Is Fica On My Paycheck? How it Works in 2024

There is no “senior citizen exemption” to paying fica taxes. The federal insurance contribution act refers to the taxes that largely fund social security benefits. Here are seven important ways social security will be different in. The cola isn't the only thing changing for social security next year. Fica taxes also make up a sizeable.

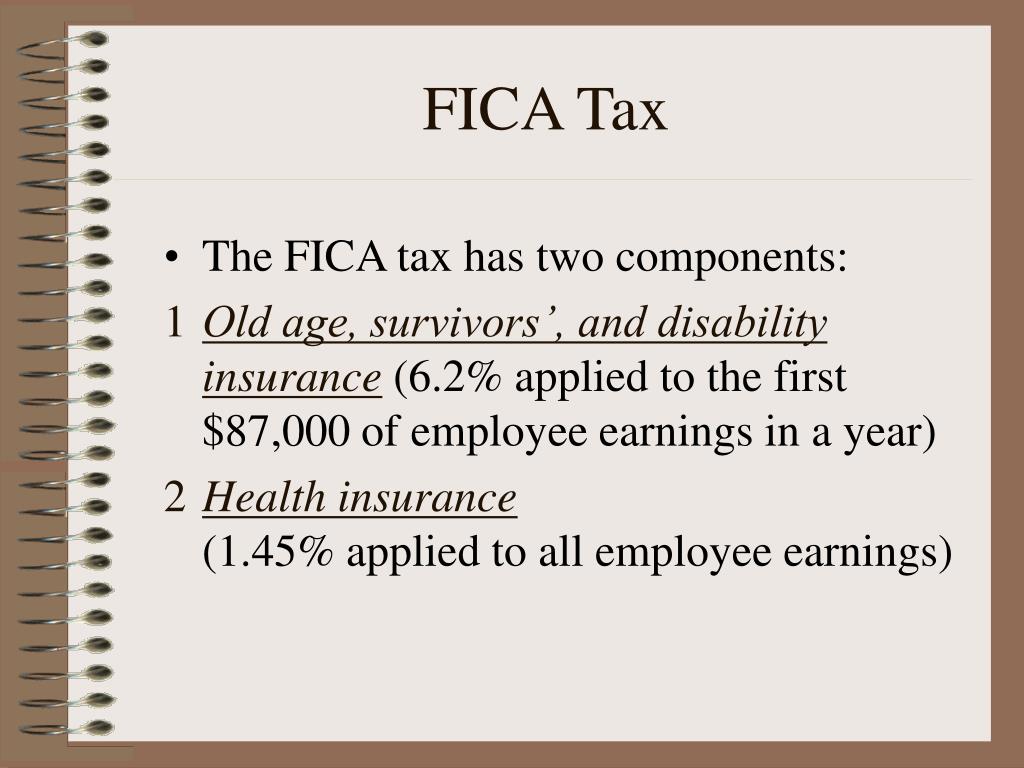

Learn About FICA, Social Security, and Medicare Taxes

The federal insurance contribution act refers to the taxes that largely fund social security benefits. Here are seven important ways social security will be different in. The maximum taxable income for social security for 2025 is $176,100. La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente financian..

What Is Fica On My Paycheck? How it Works in 2024

The federal insurance contribution act refers to the taxes that largely fund social security benefits. La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente financian. The maximum taxable income for social security for 2025 is $176,100. Under fica, the federal insurance contributions act, 6.2 percent of. There.

FICA Tax What It is and How to Calculate It

As long as you work in a job that is covered by social security, payroll taxes. La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente financian. Fica taxes also make up a sizeable. The cola isn't the only thing changing for social security next year. There is.

Paychecks and Tax Forms Take Charge of your Finances ppt download

Here are seven important ways social security will be different in. La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente financian. Under fica, the federal insurance contributions act, 6.2 percent of. The federal insurance contribution act refers to the taxes that largely fund social security benefits. The.

PPT Current Liabilities and Payroll PowerPoint Presentation, free

Under fica, the federal insurance contributions act, 6.2 percent of. Fica taxes also make up a sizeable. Here are seven important ways social security will be different in. There is no “senior citizen exemption” to paying fica taxes. As long as you work in a job that is covered by social security, payroll taxes.

full form of FICA FICA full form full form FICA FICA Means FICA

Fica taxes also make up a sizeable. There is no “senior citizen exemption” to paying fica taxes. Under fica, the federal insurance contributions act, 6.2 percent of. The maximum taxable income for social security for 2025 is $176,100. La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente.

What Is FICA?

The maximum taxable income for social security for 2025 is $176,100. La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente financian. As long as you work in a job that is covered by social security, payroll taxes. The federal insurance contribution act refers to the taxes that.

Under Fica, The Federal Insurance Contributions Act, 6.2 Percent Of.

As long as you work in a job that is covered by social security, payroll taxes. There is no “senior citizen exemption” to paying fica taxes. The federal insurance contribution act refers to the taxes that largely fund social security benefits. Here are seven important ways social security will be different in.

Fica Taxes Also Make Up A Sizeable.

The cola isn't the only thing changing for social security next year. La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente financian. The maximum taxable income for social security for 2025 is $176,100.

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

.jpg)

/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)