Alabama Property Tax Exemption Form - Any owner of eligible property. Visit your local county office to apply for a homestead exemption. Must be eligible on october 1 and. This exemption allows for property to be assessed at less than market value when used only for the purposes specified. Homestead exemption 2 is for residents of alabama 65 years of age or older. Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled. Form may be mailed or brought to the revenue commissioner’s office.

Visit your local county office to apply for a homestead exemption. Must be eligible on october 1 and. Form may be mailed or brought to the revenue commissioner’s office. Any owner of eligible property. Homestead exemption 2 is for residents of alabama 65 years of age or older. Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled. This exemption allows for property to be assessed at less than market value when used only for the purposes specified.

Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled. Any owner of eligible property. Visit your local county office to apply for a homestead exemption. Must be eligible on october 1 and. Form may be mailed or brought to the revenue commissioner’s office. Homestead exemption 2 is for residents of alabama 65 years of age or older. This exemption allows for property to be assessed at less than market value when used only for the purposes specified.

Municipality Of Anchorage 2024 Residential Property Tax Exemption

Any owner of eligible property. Visit your local county office to apply for a homestead exemption. Homestead exemption 2 is for residents of alabama 65 years of age or older. Must be eligible on october 1 and. Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled.

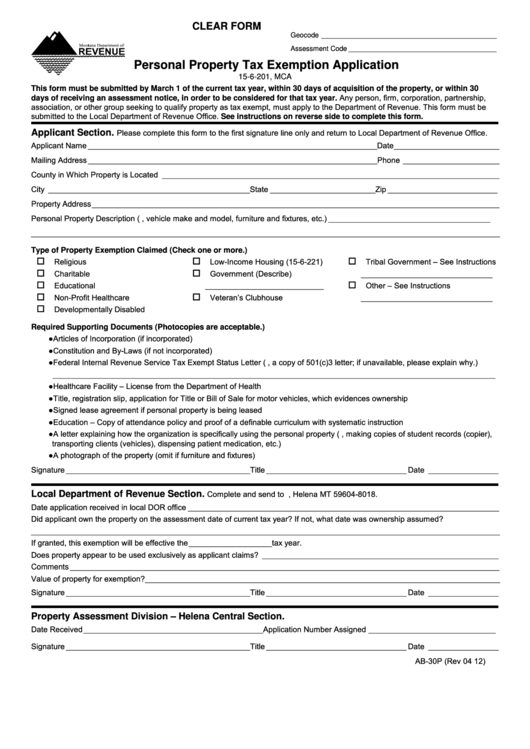

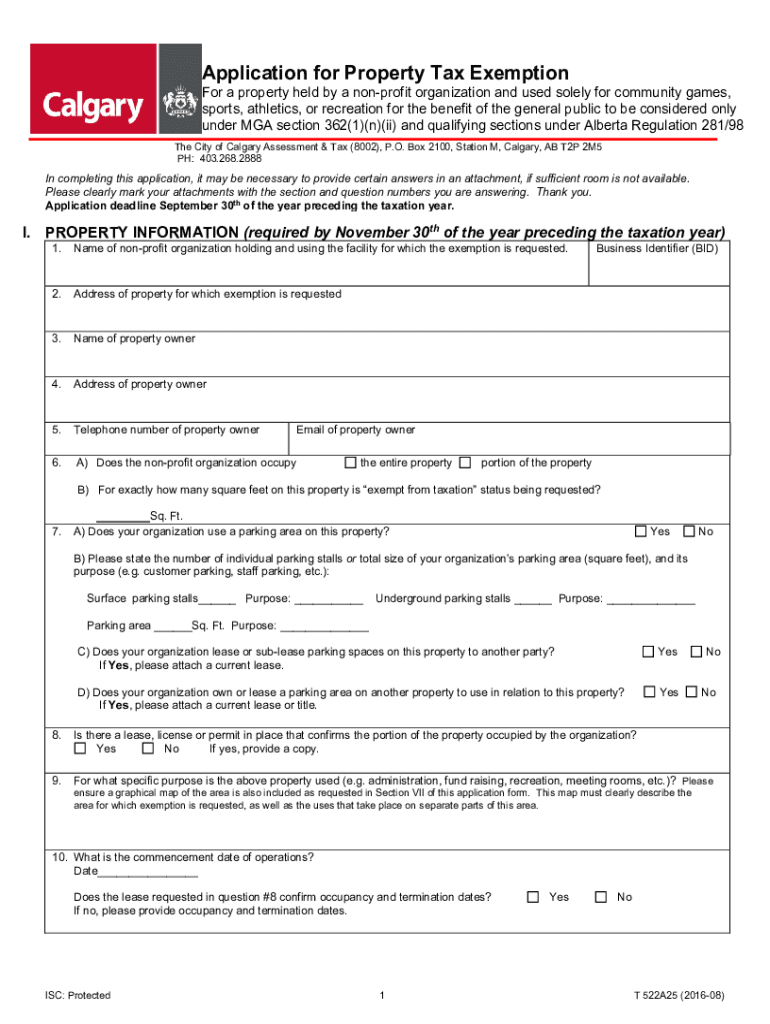

Fillable Online Organization Property Tax Exemption Regulation Fax

Any owner of eligible property. Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled. Visit your local county office to apply for a homestead exemption. Homestead exemption 2 is for residents of alabama 65 years of age or older. Must be eligible on october 1 and.

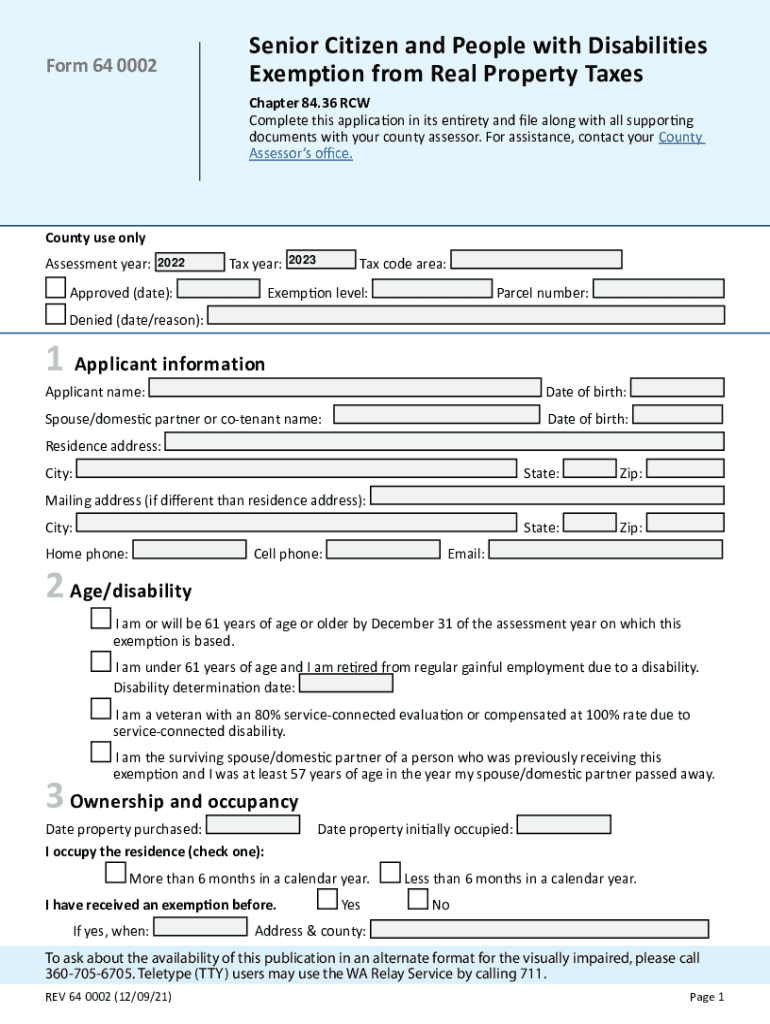

Fillable Online Senior Citizen and People with Disabilities Exemption

Homestead exemption 2 is for residents of alabama 65 years of age or older. This exemption allows for property to be assessed at less than market value when used only for the purposes specified. Any owner of eligible property. Visit your local county office to apply for a homestead exemption. Form may be mailed or brought to the revenue commissioner’s.

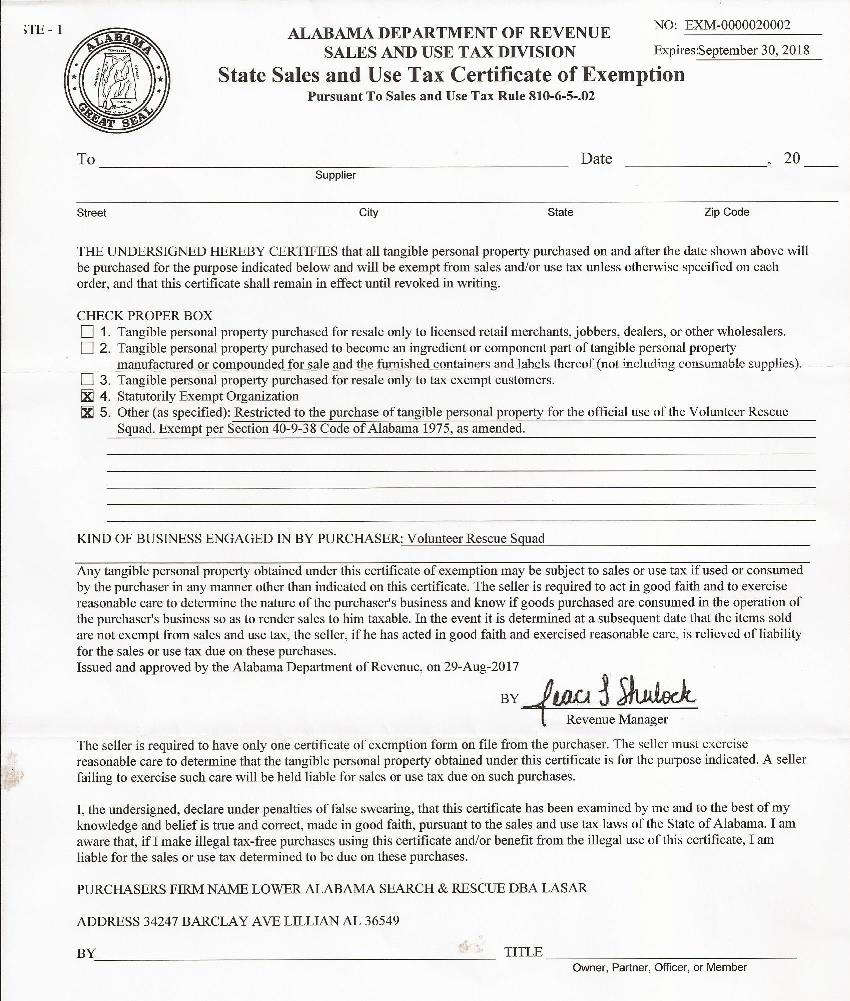

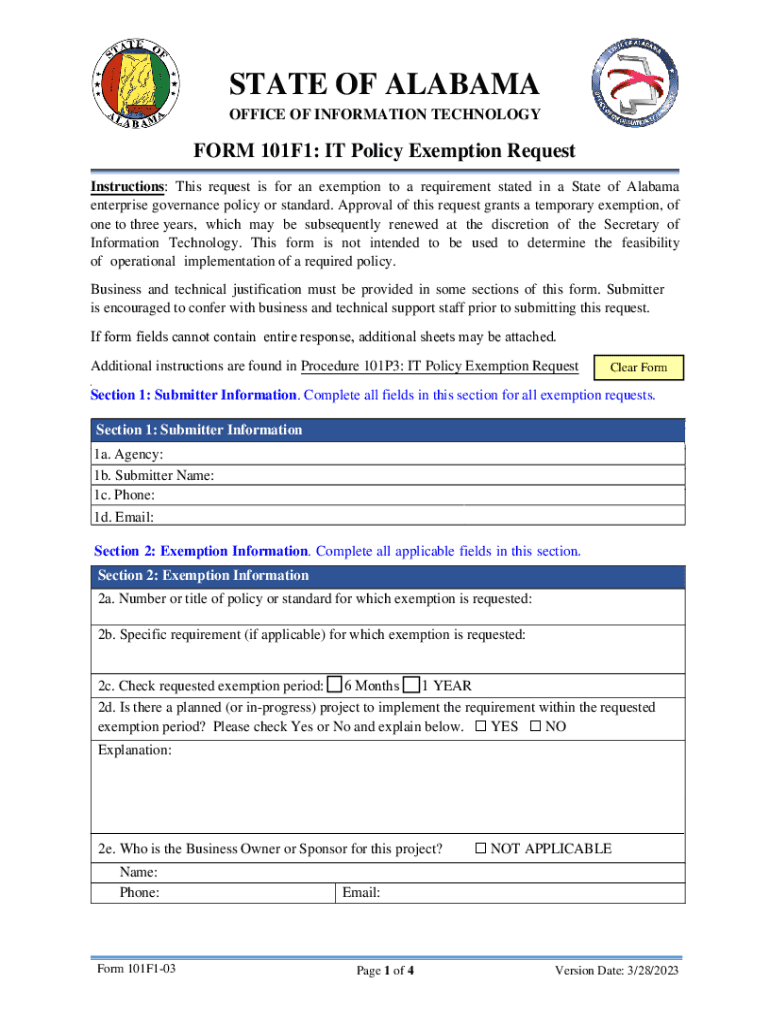

Application for Sales Tax Certificate of Exemption Alabama

This exemption allows for property to be assessed at less than market value when used only for the purposes specified. Must be eligible on october 1 and. Visit your local county office to apply for a homestead exemption. Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled. Homestead exemption 2 is for residents.

Fillable Online Long Form Property Tax Exemption for Seniors Fax

This exemption allows for property to be assessed at less than market value when used only for the purposes specified. Form may be mailed or brought to the revenue commissioner’s office. Homestead exemption 2 is for residents of alabama 65 years of age or older. Visit your local county office to apply for a homestead exemption. Must be eligible on.

How Do I Claim Exempt From Alabama State Taxes at Julius Scudder blog

Homestead exemption 2 is for residents of alabama 65 years of age or older. This exemption allows for property to be assessed at less than market value when used only for the purposes specified. Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled. Must be eligible on october 1 and. Any owner of.

Alabama Withholding Tax Exemption Certificate Form A4 dev

Any owner of eligible property. Visit your local county office to apply for a homestead exemption. Homestead exemption 2 is for residents of alabama 65 years of age or older. Must be eligible on october 1 and. Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled.

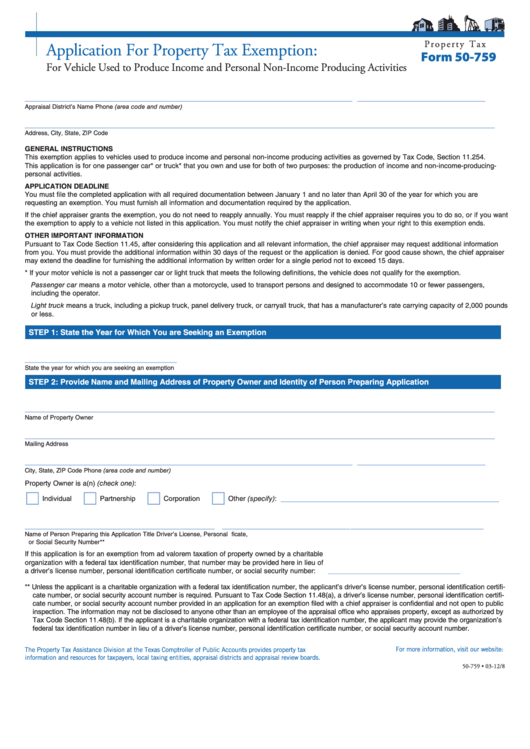

Form 50 114 Download Fillable PDF Or Fill Online Residence Homestead

This exemption allows for property to be assessed at less than market value when used only for the purposes specified. Visit your local county office to apply for a homestead exemption. Form may be mailed or brought to the revenue commissioner’s office. Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled. Any owner.

Alabama Tax Exemption Form

Visit your local county office to apply for a homestead exemption. Must be eligible on october 1 and. Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled. Homestead exemption 2 is for residents of alabama 65 years of age or older. Any owner of eligible property.

How Do I Claim Exempt From Alabama State Taxes at Julius Scudder blog

Must be eligible on october 1 and. Homestead exemption 2 is for residents of alabama 65 years of age or older. Form may be mailed or brought to the revenue commissioner’s office. Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled. Any owner of eligible property.

Must Be Eligible On October 1 And.

Homestead exemption 2 is for residents of alabama 65 years of age or older. This exemption allows for property to be assessed at less than market value when used only for the purposes specified. Visit your local county office to apply for a homestead exemption. Any owner of eligible property.

Form May Be Mailed Or Brought To The Revenue Commissioner’s Office.

Additional exemptions are available to homeowners over age 65 or who are totally and permanently disabled.