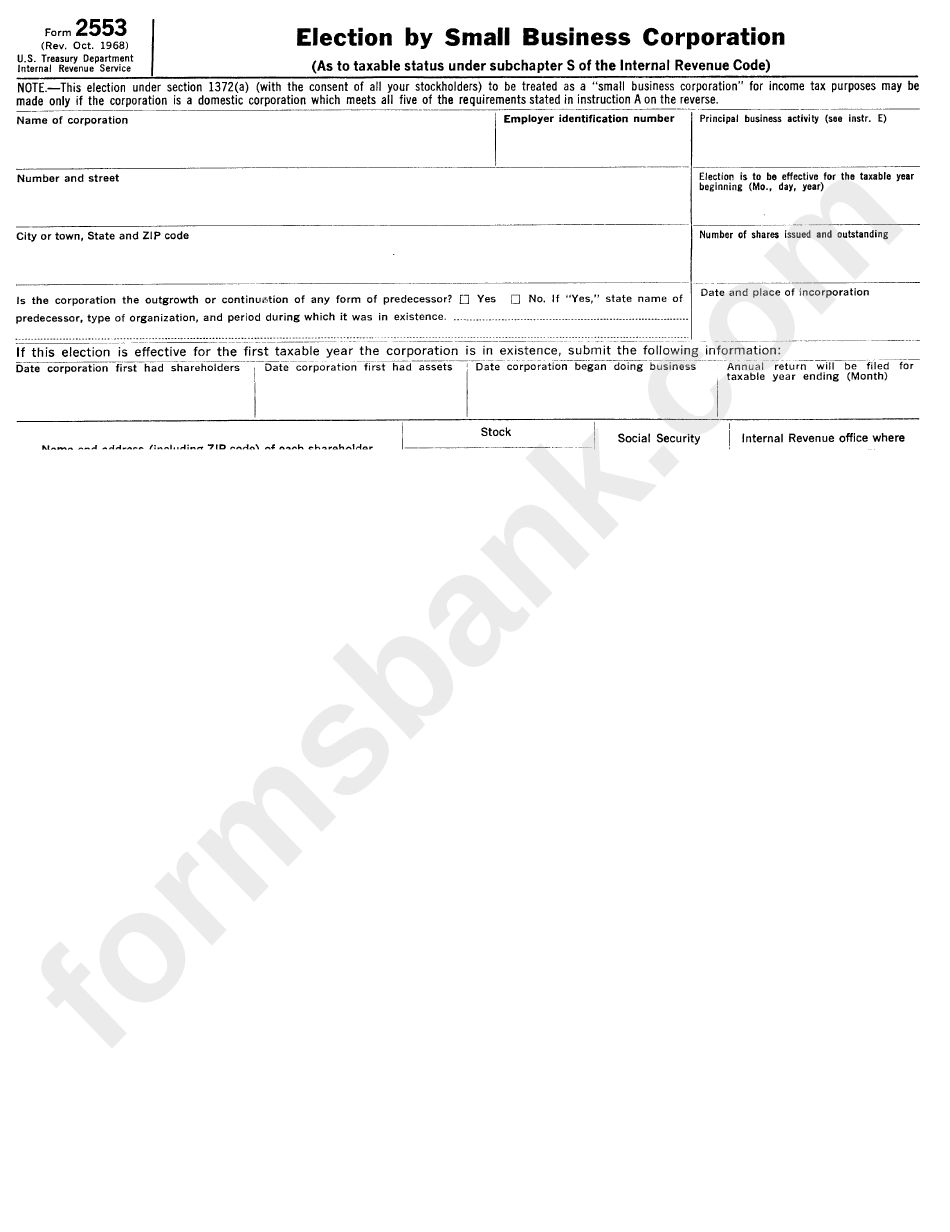

2253 Form - To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file. A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362 (a). If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to. A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec.

A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362 (a). Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to. To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file.

If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file. A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362 (a).

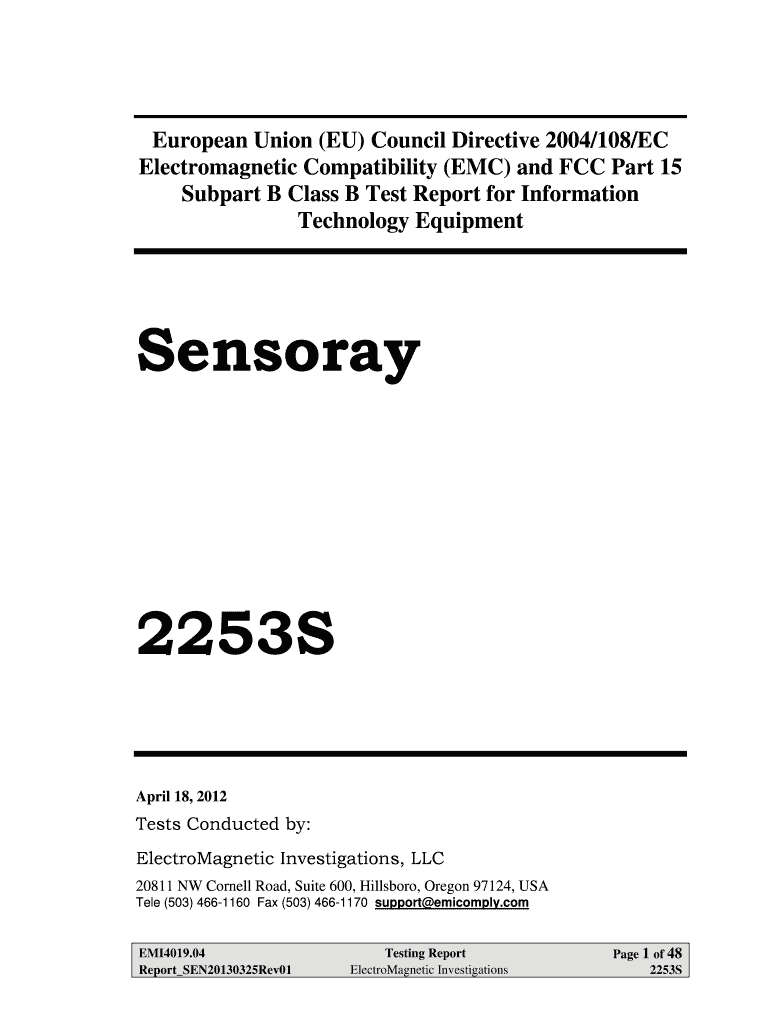

2253

A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362 (a). To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file. A complete guide to.

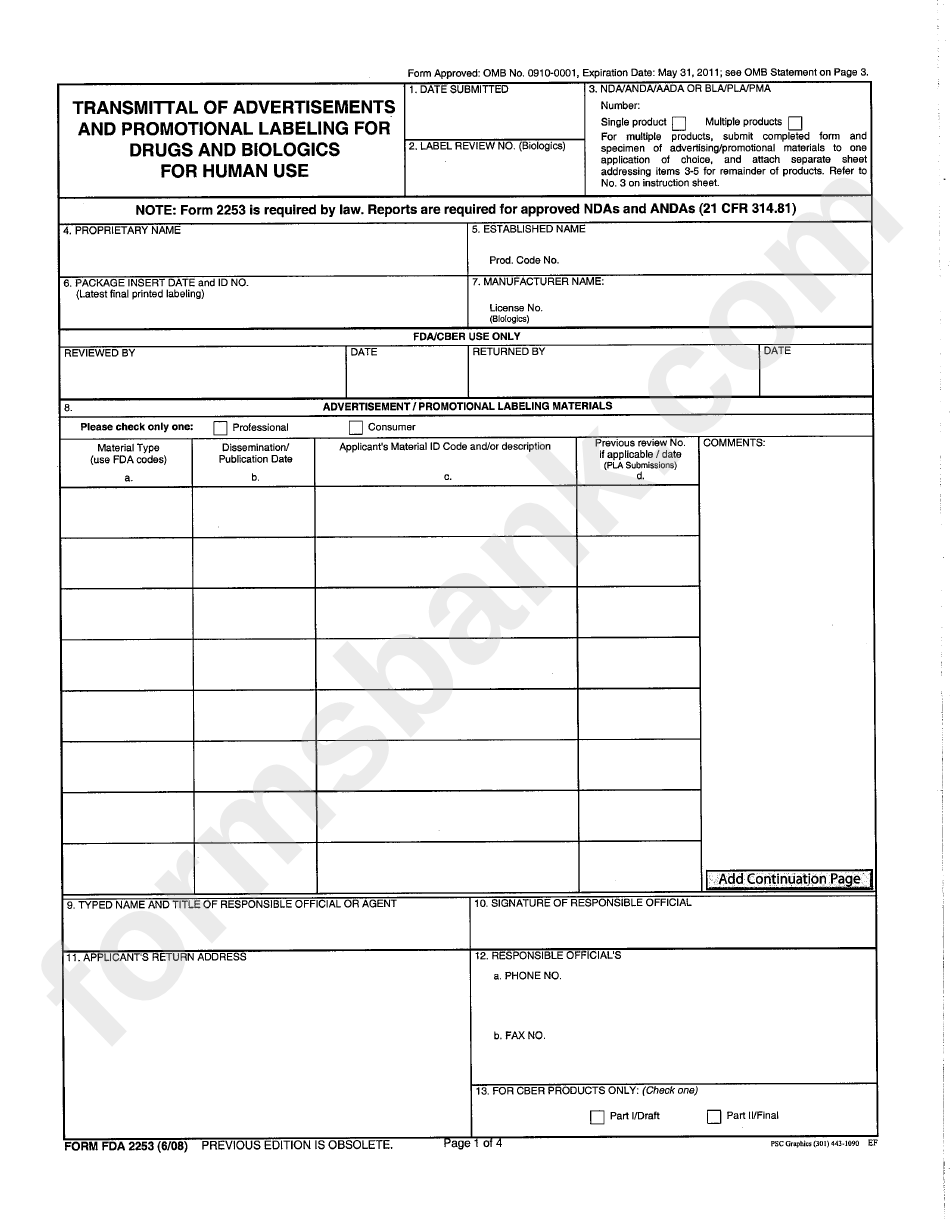

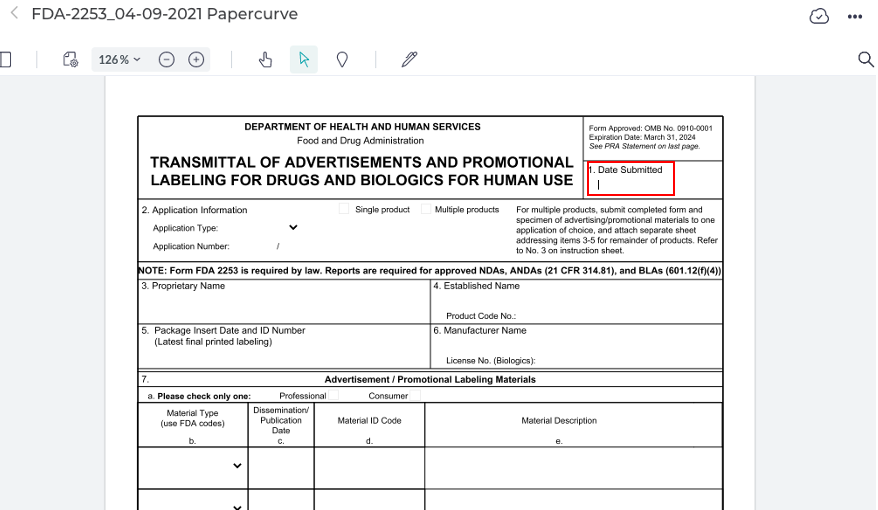

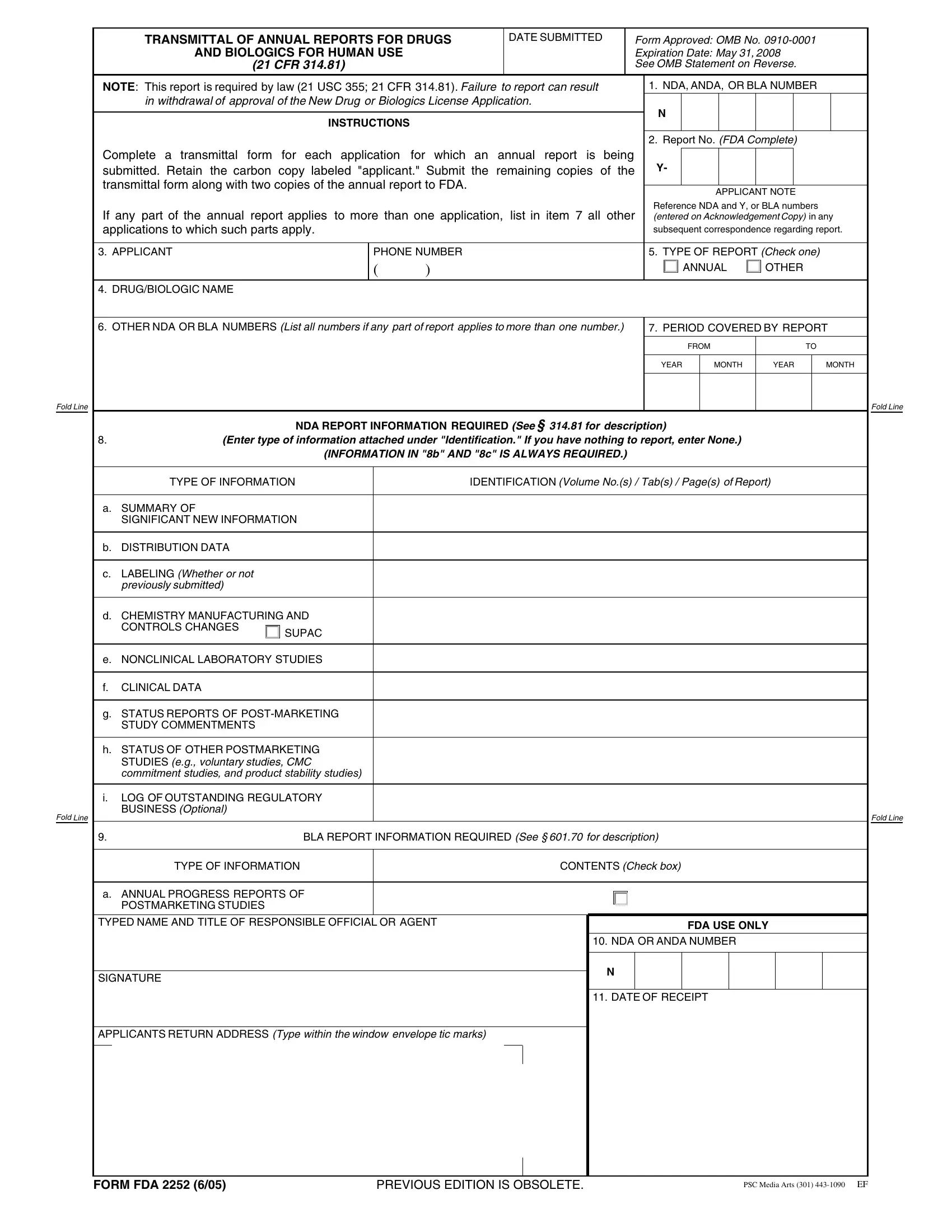

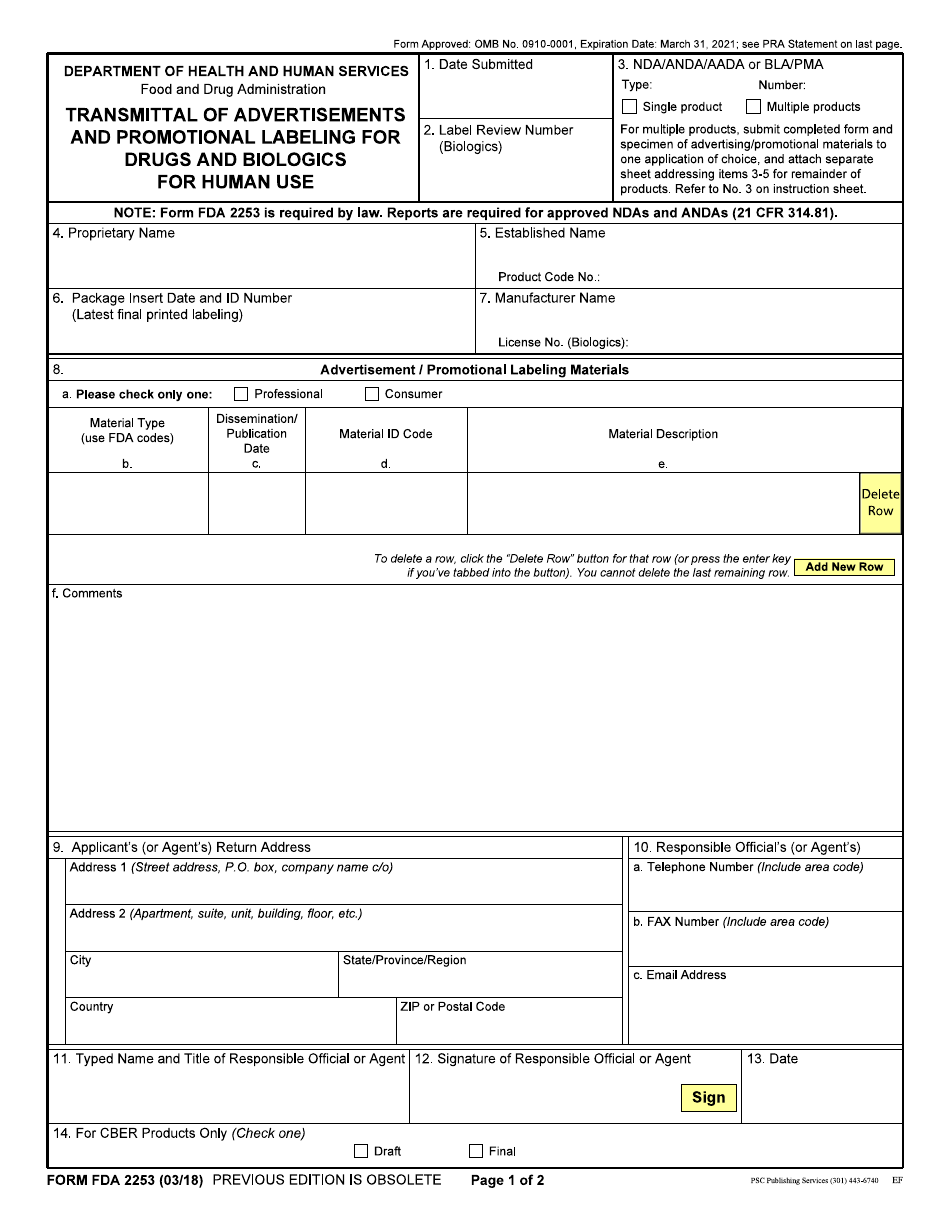

Images Of Fda Form

A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362 (a). To make the election, you must complete form 8716, election to have a tax year.

Form 2253 PDF

A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by.

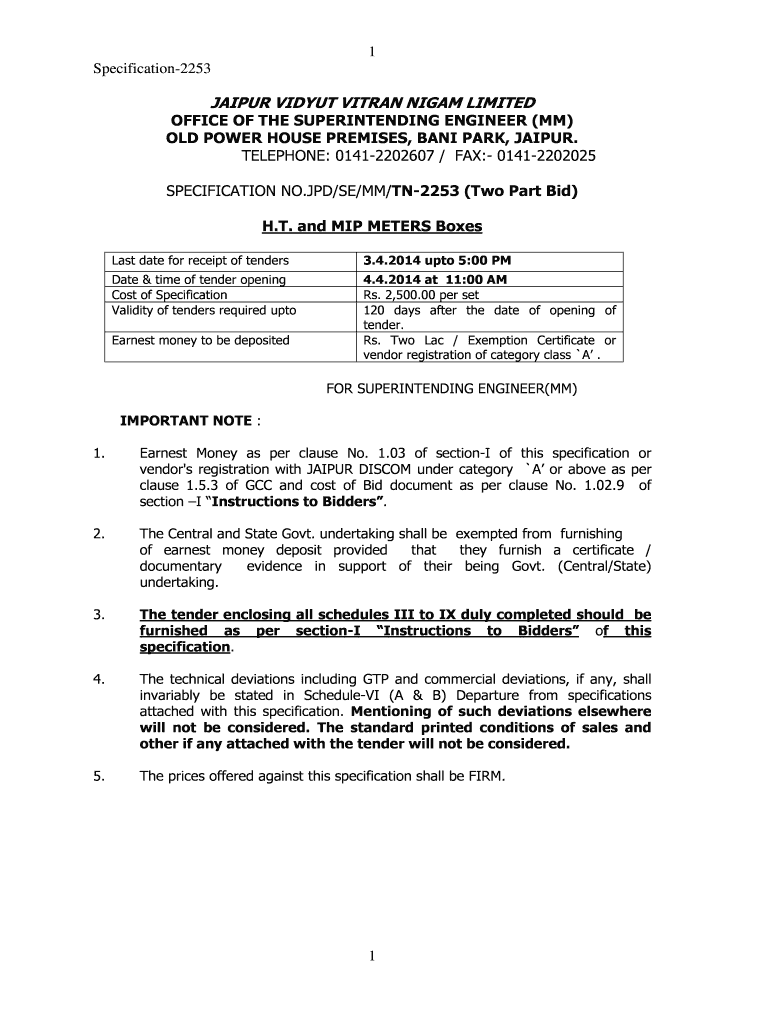

Fillable Online SPECIFICATION2253 Fax Email Print pdfFiller

To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to. A complete guide to irs form 2553, including.

2253 Form

To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A complete guide to irs form 2553, including eligibility requirements,.

Fillable Online CE Compliance Report, 2253 Sensoray Fax Email Print

A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362 (a). To make the election, you must complete form 8716, election to have a tax year.

Learn How to Fill the Form 2553 Election by a Small Business

To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file. A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362 (a). If this message is.

Form 2553 Election By Small Business Corporation printable pdf download

A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362 (a). Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. To make the election, you must complete form 8716, election to have a tax.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file. A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362 (a). Form 2553 is used.

Form FDA2253 Fill Out, Sign Online and Download Fillable PDF

A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to. To make the election, you must complete form 8716, election to have a tax year other than a required.

A Corporation Or Other Entity Eligible To Elect To Be Treated As A Corporation Must Use Form 2553 To Make An Election Under Section 1362 (A).

A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to. To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file.