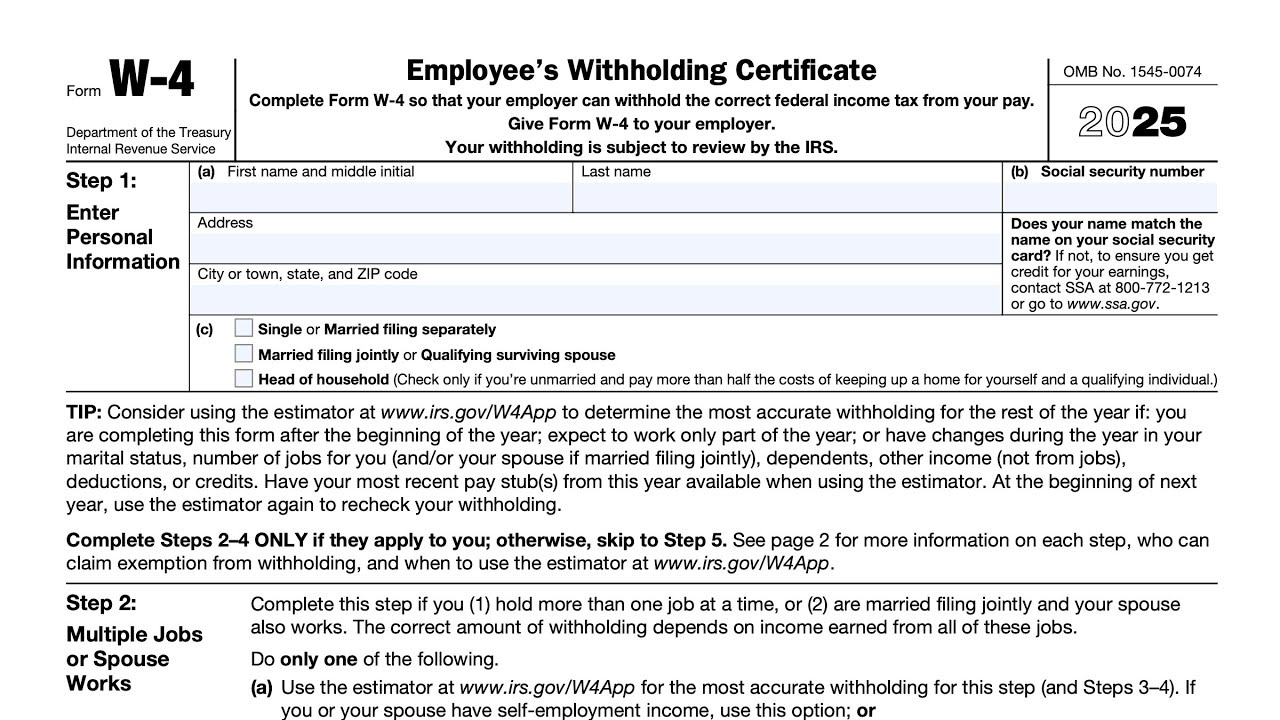

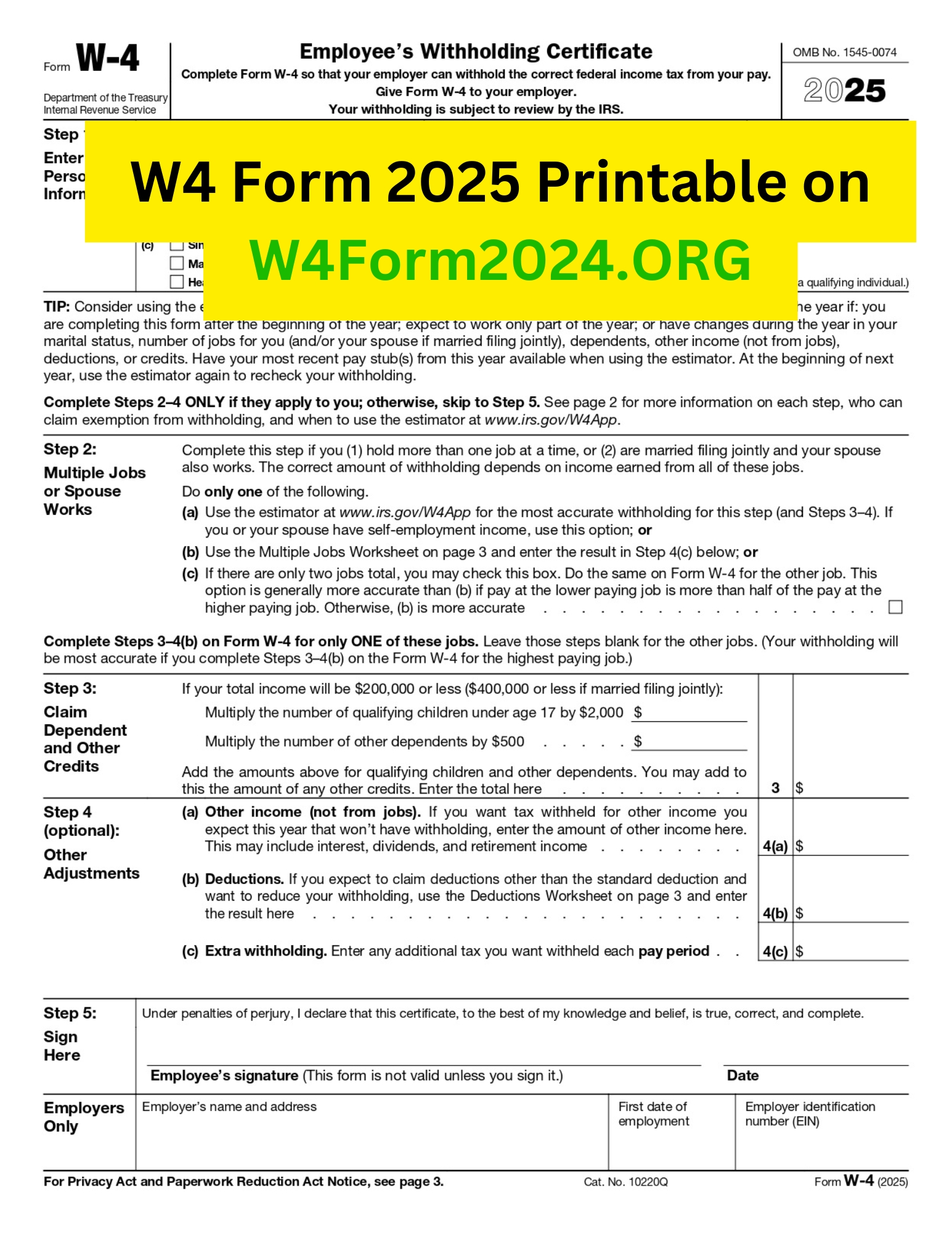

2025 Form W4 - Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. If too little is withheld, you will generally owe. Leave those steps blank for the other jobs. A tip was added that states employees. (your withholding will be most accurate if.

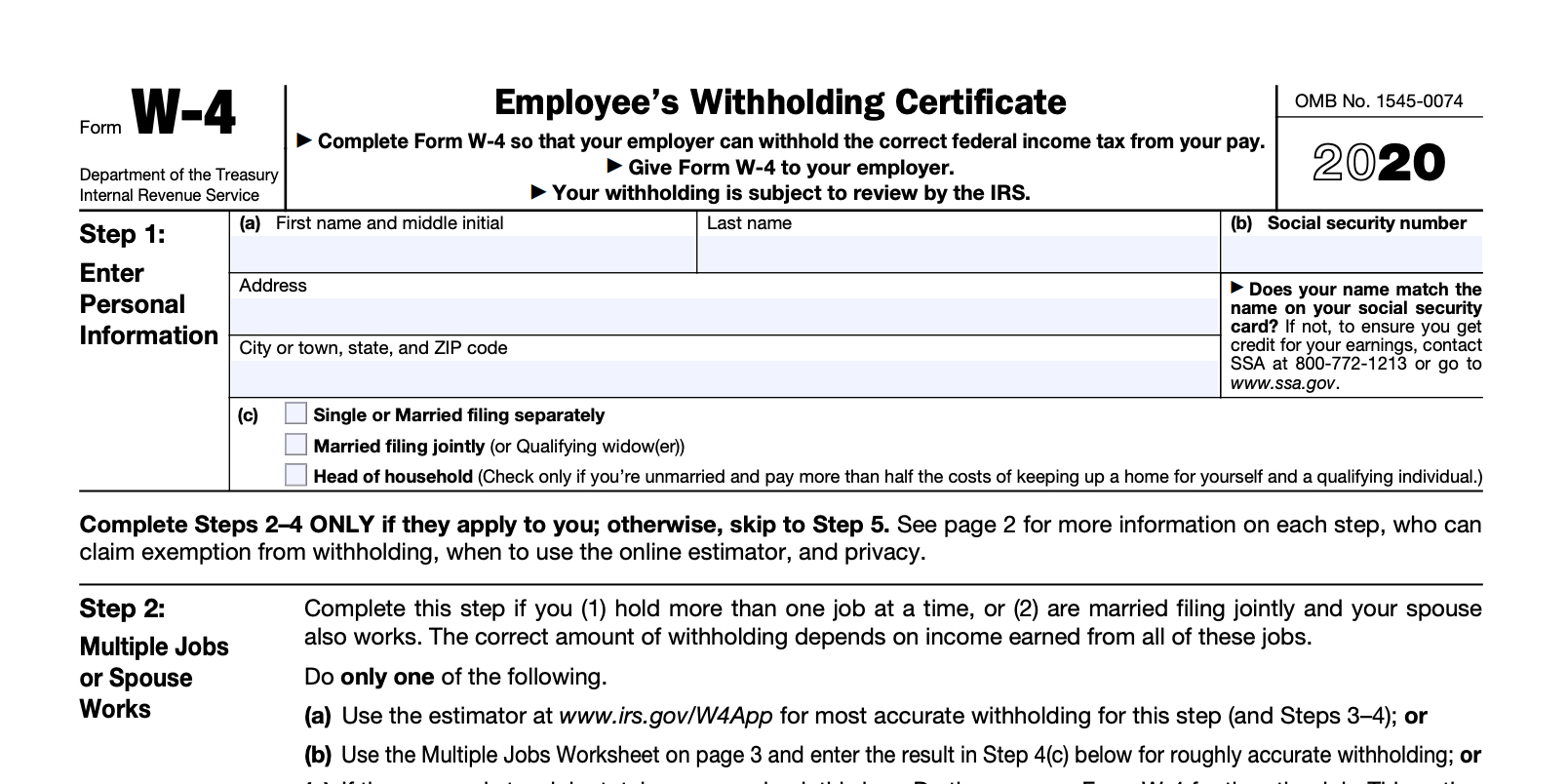

If too little is withheld, you will generally owe. A tip was added that states employees. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. (your withholding will be most accurate if. Leave those steps blank for the other jobs.

Leave those steps blank for the other jobs. A tip was added that states employees. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. (your withholding will be most accurate if. If too little is withheld, you will generally owe.

2025 W4 Form Printable W4 Form 2025

(your withholding will be most accurate if. Leave those steps blank for the other jobs. If too little is withheld, you will generally owe. A tip was added that states employees. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works.

Printable W4 Form 2025 Aiden S. Wunderly

Leave those steps blank for the other jobs. If too little is withheld, you will generally owe. A tip was added that states employees. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. (your withholding will be most accurate if.

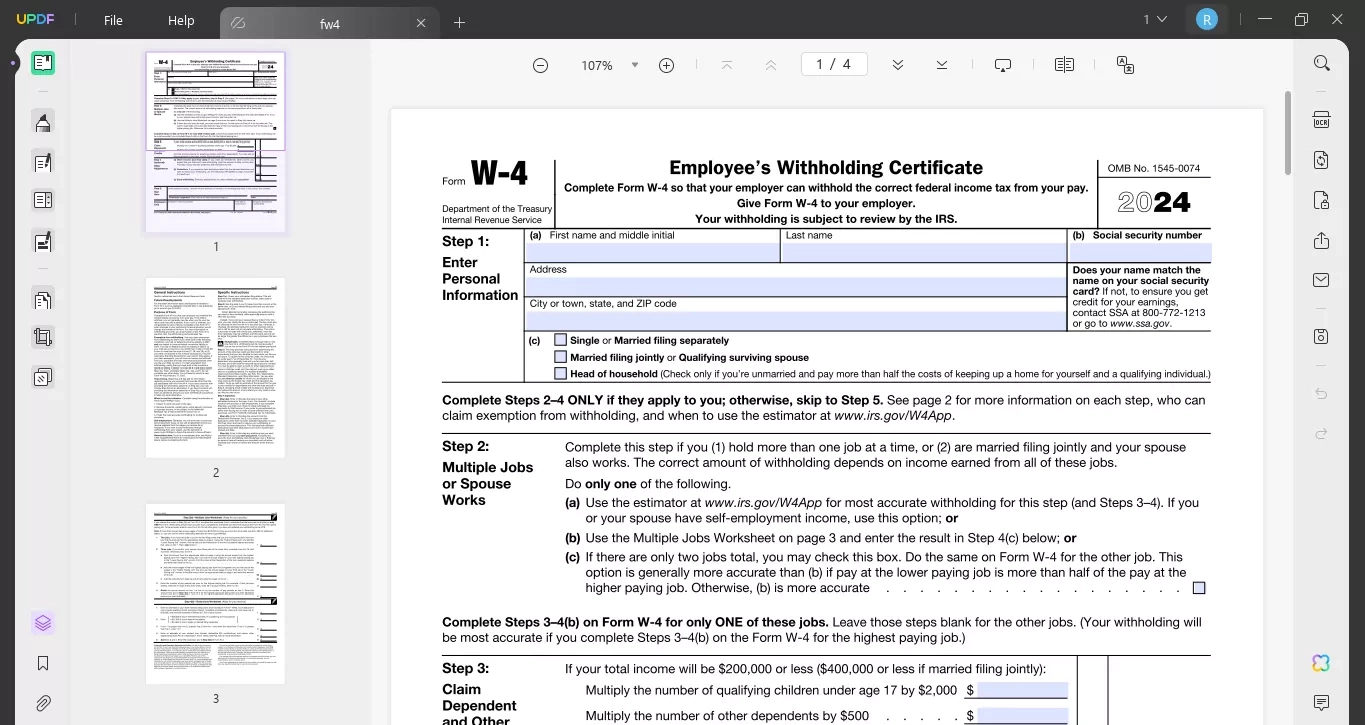

Irs W4 Form 2025 Daniel J. Thames

(your withholding will be most accurate if. A tip was added that states employees. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. Leave those steps blank for the other jobs. If too little is withheld, you will generally owe.

Irs Form W4 2025 Gelya Romona

Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. If too little is withheld, you will generally owe. (your withholding will be most accurate if. A tip was added that states employees. Leave those steps blank for the other jobs.

W4 Form 2025 Printable Employee’s Withholding Certificate IRS Tax

A tip was added that states employees. Leave those steps blank for the other jobs. (your withholding will be most accurate if. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. If too little is withheld, you will generally owe.

W4 Forms 2025 Printable Form 2025

Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. Leave those steps blank for the other jobs. If too little is withheld, you will generally owe. (your withholding will be most accurate if. A tip was added that states employees.

Federal 2025 W4 Form Printable Forms

A tip was added that states employees. Leave those steps blank for the other jobs. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. If too little is withheld, you will generally owe. (your withholding will be most accurate if.

2025 W4 Form Fillable Printable Form 2025

Leave those steps blank for the other jobs. A tip was added that states employees. (your withholding will be most accurate if. If too little is withheld, you will generally owe. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works.

Federal 2025 W4 Form Printable Forms

(your withholding will be most accurate if. Leave those steps blank for the other jobs. If too little is withheld, you will generally owe. A tip was added that states employees. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works.

W4 2025 Form Printable King Printables

A tip was added that states employees. If too little is withheld, you will generally owe. Leave those steps blank for the other jobs. (your withholding will be most accurate if. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works.

Complete This Step If You (1) Hold More Than One Job At A Time, Or (2) Are Married Filing Jointly And Your Spouse Also Works.

Leave those steps blank for the other jobs. If too little is withheld, you will generally owe. A tip was added that states employees. (your withholding will be most accurate if.